Friedrich Vorwerk - Watchlist, investment or descending branch?

Dear Getquin'ers,

Due to new circumstances and information, I have changed my opinion on Friedrich Vorwerk contrary to the first post. However, I am still convinced that circumstances will turn around and lead the company to the success it deserves.

Furthermore, I have implemented the questions under the 1st post.

My topic today will be the Friedrich Vorwerk Group $VH2 will be. A medium-sized company that will have a decisive influence on the change.

First, a brief overview of the company's history:

No, this is not the household appliance manufacturer of the same name.

Founded in 1962 as "Lohnbaggerbetrieb Kleesch & Vorwerk" and renamed "Friedrich Vorwerk KG" in 1972, the focus at that time was already on underground infrastructure (natural gas and wastewater networks).

Since 2021, the "Friedrich Vorwerk Group" has been listed on the stock exchange in the Prime Standard.

Business segment/business activities:

In an umbrella term, it can be said that the Vorwerk Group is active in plant construction. However, it offers a sensational diversification with shareholdings in various sectors, including road construction (SKS), corrosion protection (Korupp) and many more. The company has a fully integrated and majority-owned value chain, which can offer any solution to the customer.

The business segments are officially declared on the basis of the area of use:

- Natural Gas

- Electricity

- Clean Hydrogen

- Adjacent Opportunities (complex, individual infrastructure projects)

But let us now turn to the most significant items of the business in each case:

1. turnkey solutions

- This includes the all-round package I mentioned for complex infrastructure projects. Friedrich Vorwerk takes on such projects from planning through execution and commissioning to maintenance.

2. engineering

- This area is extremely interesting for industry and utilities and mainly includes project support on behalf of the customer.

3. plant construction and service

- I deliberately combine this point, as it probably reflects the "classic" plant construction most closely. The focus is clearly on electricity, gas and liquid transport, including pump and compressor stations for onward transport, as well as transformers, electrolysers, heat generators, substations, and much more.

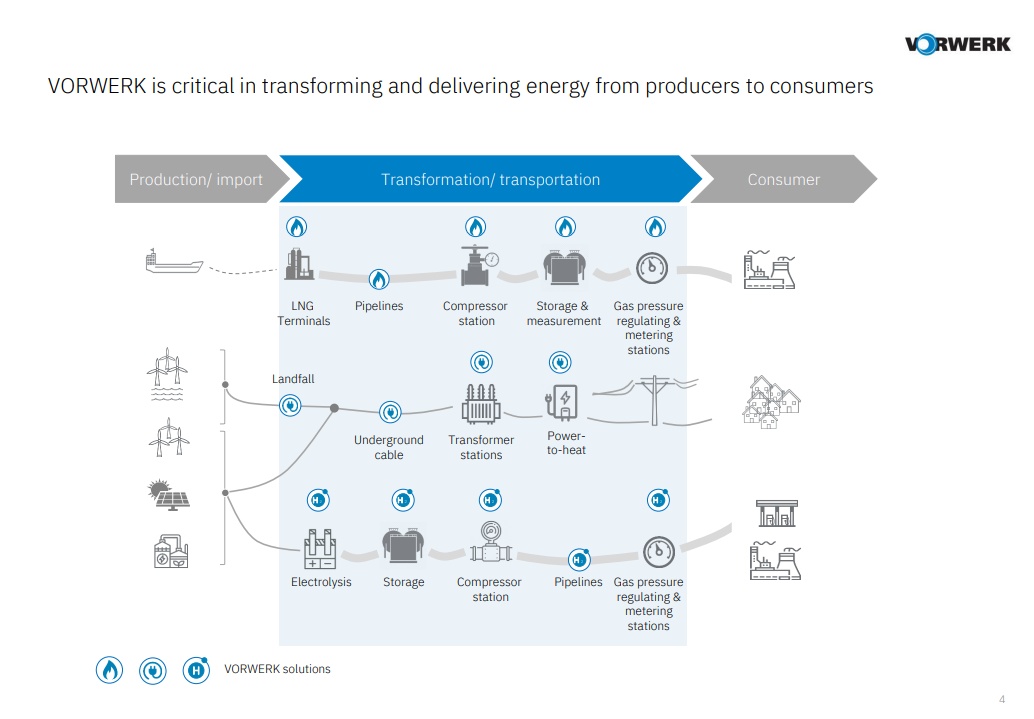

Friedrich Vorwerk's business thus covers the entire range of energy transport from the producer to the consumer. I enclose an internal overview. The entire business activity can of course be viewed individually on the website (https://www.friedrich-vorwerk.de/).

Note: The structure on my part does not correspond to the internal structure according to Vorwerk's own company presentation!

Fundamental data:

Here, I orient myself on the basis of the given data up to Q4/22. An overview is attached/edited for publication.

In fact, this is a point to be viewed critically from the current situation. The financials are intrinsically sound and the business is profitable. However, ongoing inflationary pressures and severe supply difficulties are squeezing margins considerably (after Q4/22). Sales of Electricity, Clean Hydrogen and Adj. Opp. divisions are steadily increasing (especially the latter), with the Gas Transmission division stagnating, due to the "green" transformation.

A solid market position is increasingly emerging, particularly in the German market, which will be able to meet the challenges of the future and should benefit strongly from this should.

The order situation continues to be sensational. In fiscal 2022, the number of orders received increased by 146%. The approximate total volume of these orders is in the range of €850 million to €1.1 billion. (as of September 2022). However, further order intakes have already been officially announced.

NEW JAN. 31, 2023:

Following the announcement of the preliminary figures for the full year 2022, the company can still be expected to grow very strongly.

Sales increased by +56% in Q4/22 alone. For the full year, at €368 million, forecasts of €320 million were far exceeded. The margin, on the other hand, is shockingly low. Only 2.6% was generated in Q4/22. Nevertheless, a moderate margin of 9.2% was achieved for the year as a whole.

But how can that be? In revenue-driving projects, a lack of personnel led to deadline pressure. As a result, orders had to be completed with the help of contractors (partner contractors).

Furthermore, the restructuring of the Puhlmann Group is continuing and the defense against a cyberattack led to profitability and visibility problems.

The outlook also leaves much to be desired. For 2023, a lower sales level is already expected in advance. In 2024, on the other hand, there should be a decent boost from projects in the electricity sector.

It remains to be seen.

Share:

Following the announcement of the preliminary figures, we are trending at around €12 per share. A hard correction, but appropriate. MBB sold just under 16% of its shares, 31.01, and now owns just under 36% of the shares. Other well-known investors here are Amundi and Fidelity. Only just under 46% of the shares are now in free circulation.

KGV 22: ~13 KGV 23: ~11 KGV 24: ~9

FCF:

For many members of our community, the free cash flow is sometimes a decisive criterion for an investment.

In 2022, the FCF of € 3.55 million is still very low and thus probably rather deterrent. As early as 2023, however, FCF is expected to rise to over €20 million and continue to increase.

Margin:

A net margin of 9% is the target for the next few years.

Dividend:

0.2€/share was paid in July 2022.

Personal opinion:

Friedrich Vorwerk is a promising beneficiary of the energy transition and has a first-class position in the transport solutions segment. The order situation is good, the finances appear relatively solid with cutbacks in some places. Potential customers here are not only companies but also the public sector, especially within the EU. The pipeline network should offer great order opportunities as the economy restructures (gas/hydrogen). This should have become particularly noticeable after a joint Norway/Germany cooperation in the course of the last visit of our Federal Minister of Economics.

The next big order point will be energy transport solutions for offshore/onshore transport. The expansion of offshore capacity alone to 40 GW by 2040 will generate huge orders to transfer electricity onshore.

My personal target for the stock by the end of 2023 is around €15/share. An entry on my part was made today. (Stop: 8€). Nevertheless, the management should now urgently take care of the known problems of lacking human resources without generating further internal cost pressures themselves. The answer to the question of the headline now therefore: Watchlist.

In the last contribution the question of @TomTurboInvest whether there are not better investment opportunities in this respect. I fully share this view and appreciate at this point once again the profundity of the question. However, if one attaches great importance to diversification, one should certainly keep an eye on Friedrich Vorwerk in the infrastructure sector. I consider a "buy & hold forever" strategy to be less sensible here. The zenith of growth should be priced into the share price between 2030 and 2035. Beyond that, you'll want to settle into the dividend payer portfolio for the long term.

I also see the following as intra-European competitors in the segment: Hochtief $HOT , Strabag $STR , Vinci $DG and Ferrovial $FER . Under certain circumstances, Bilfinger could also be included in this segment. $GBF

Conclusion:

I thank you very much for your attention to this point and I hope to have kept a certain simplicity, which could be elaborated if necessary. Please do not hesitate to correct or question me, because this is the only way to get into a discourse.

Thank you very much.

Sources:

https://www.friedrich-vorwerk.de/

Friedrich Vorwerk: Q3/22 quarterly statement + preliminary figures Q4/22.

Chart image: https://www.wallstreet-online.de/