Topic: Warrant - general question pricing

I am currently familiarizing myself with warrants and am watching the OS HD2B7V on $RWE (+0,71 %)

The underlying has risen by around 1.3% since 09:00 today.

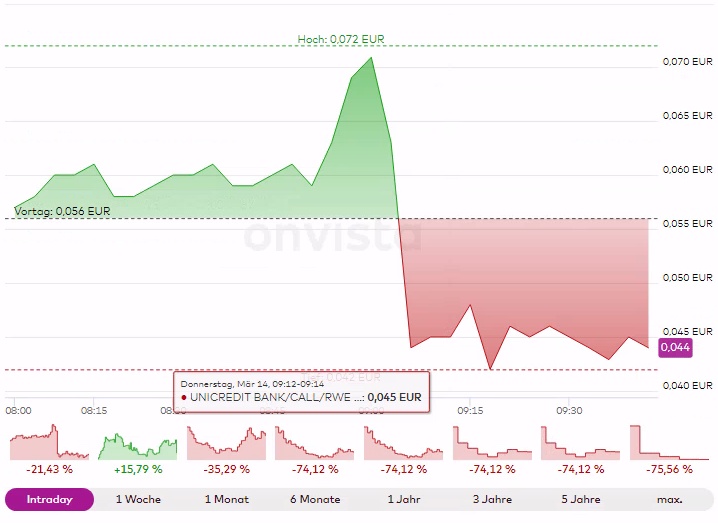

The OS has risen from €0.057 to €0.071 since 08:00. From 09:00 to 09:05 it lost 0.027€ to 0.044€.

How can this fall in the OS come about even though the underlying is rising?