$DIS (-0,71 %) - Disney Q3 Earnings:

- Adjusted earnings per share: USD 1.39 (estimated USD 1.19); increase of 35 % compared to the previous year

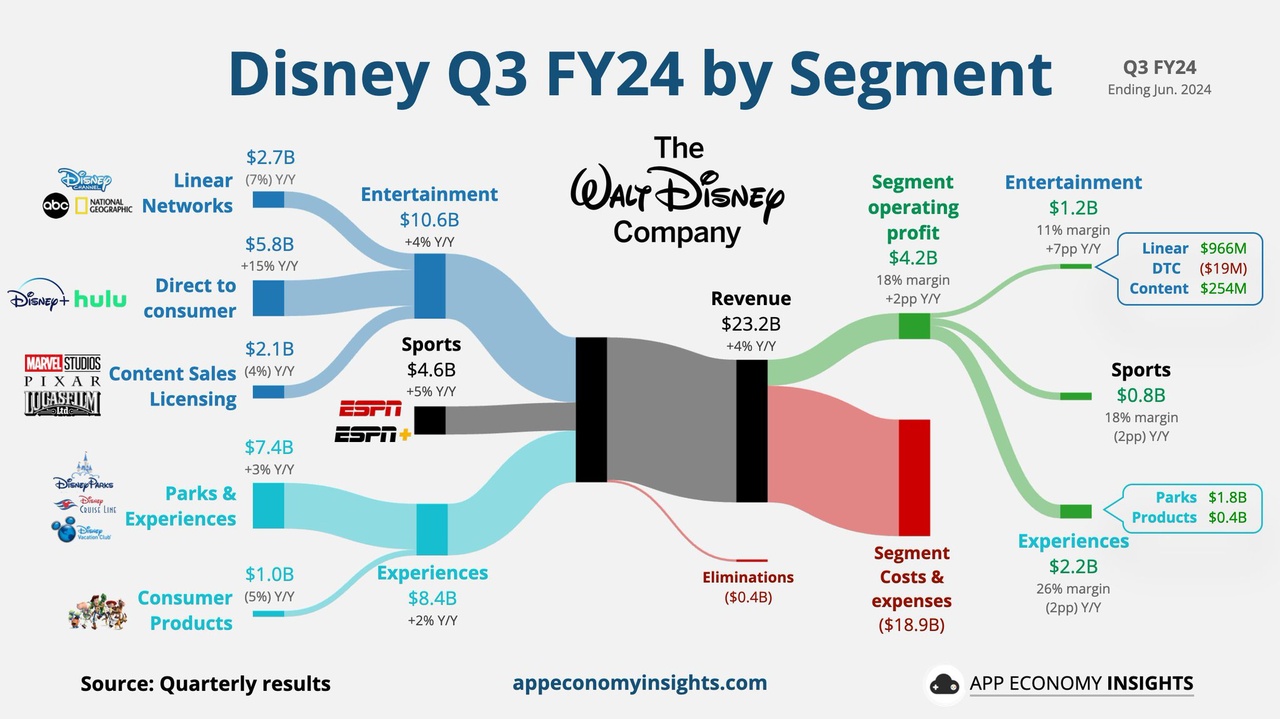

- Revenue: USD 23.16 billion (estimated USD 23.08 billion) ; increase of +3.7 % compared to the previous year

Outlook for the 4th quarter:

- A slight increase in Disney+ Core subscribers is expected.

- Operating income for the Experiences segment is expected to decline by a mid-single digit percentage year-over-year in the fourth quarter.

- Demand at Disney Cruise Line is expected to be strong, with upfront spending on Disney Adventure and Disney Treasure impacting fourth quarter results.

Forecast for the 2024 financial year:

- New adjusted EPS growth target: +30%

- The combined streaming businesses are expected to be profitable in the fourth quarter, with both Entertainment DTC and ESPN+ expected to be profitable.

Entertainment:

- Revenue: USD 10.58 billion (estimated USD 10.37 billion) ; +4.5% year-on-year increase

- Operating income: USD 1.20 billion (estimated USD 811.3 million); more than double the previous year's figure of USD 408 million

Direct to consumer:

- Sales: USD 5.81 billion (estimated USD 5.73 billion) ; increase of 15 % compared to the previous year

- Operating loss: USD 19 million (estimated loss USD 141 million) ; improvement of USD (505) million compared to the previous year

Sports:

- Sales: USD 4.56 billion (estimated USD 4.4 billion) ; increase of +5.1 % compared to the previous year

- Operating result: USD 802 million (estimated USD 757 million) ; decrease of -6.1 % compared to the previous year

Experiences:

- Sales: USD 8.39 billion (estimated USD 8.61 billion) ; increase of +2.3 % compared to the previous year

- Operating result: USD 2.22 billion (estimated USD 2.34 billion); decrease of -3.3 % compared to the previous year

Key figures:

- Total segment operating profit: USD 4.23 billion (estimated USD 3.84 billion); increase of 19% compared to the previous year

- Free cash flow: USD 1.24 billion; decrease of -24% compared to the previous year

Consumer metrics:

- Disney+ paid subscribers: 118.3 million; decrease of -7.7% year-over-year

- Total Hulu subscribers: 51.1m (estimated 50.44m); increase of +1.8% QoQ

- Disney+ ARPU: $7.22

- Hulu SVOD ARPU: $12.73 (estimated $12.47) ; up 7.5% QoQ

- Hulu Live TV + SVOD ARPU: $96.11 (estimated $95.05) ; up +1.2% QoQ

Comment from CEO Robert A. Iger:

- "Our performance in the third quarter demonstrates the progress we made on our four strategic priorities across our Creative Studios, Streaming, Sports and Experiences businesses. This was a strong quarter for Disney, driven by outstanding results in our Entertainment segment at both the box office and DTC, as we achieved profitability in our combined streaming businesses for the first time, exceeding our prior guidance by one quarter. Despite the weaker performance of our experiential segment in the third quarter, the Company's adjusted earnings per share increased 35% and with our complementary and balanced portfolio of businesses, we are confident in our ability to continue to deliver earnings growth through our collection of unique and high performing assets."

Further insights:

- The Entertainment segment saw significant improvements in direct-to-consumer and content sales/licensing.

- The success of "Inside Out 2" led to significant outperformance in content sales/licensing, including 1.3 million Disney+ sign-ups and over 100 million views globally.

- At ESPN, advertising revenues increased by 17% year-on-year and operating income by 4%, despite a decline in the sports segment due to lower results from Star India.