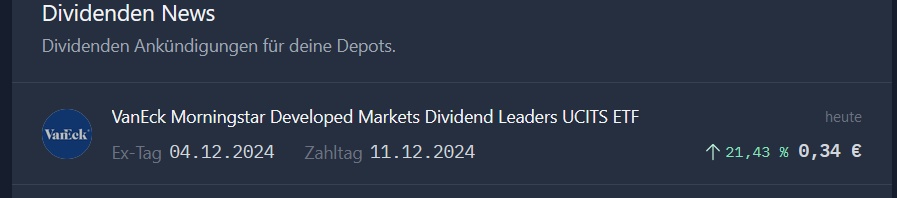

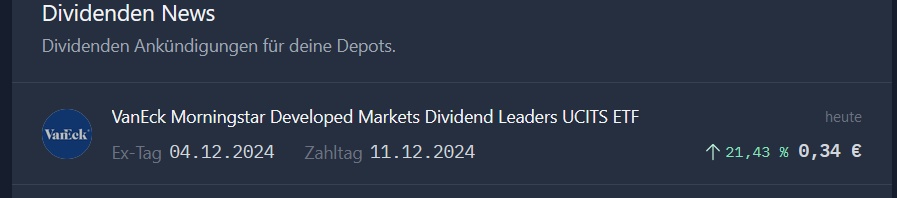

That's good news for once. Some have doubted whether he can maintain the dividend growth. At the moment it looks that way. It can go on like this.

That's good news for once. Some have doubted whether he can maintain the dividend growth. At the moment it looks that way. It can go on like this.