Hello Community,

thank you once again for your positive response to my last article "Climate change - rising temperatures, rising depot".

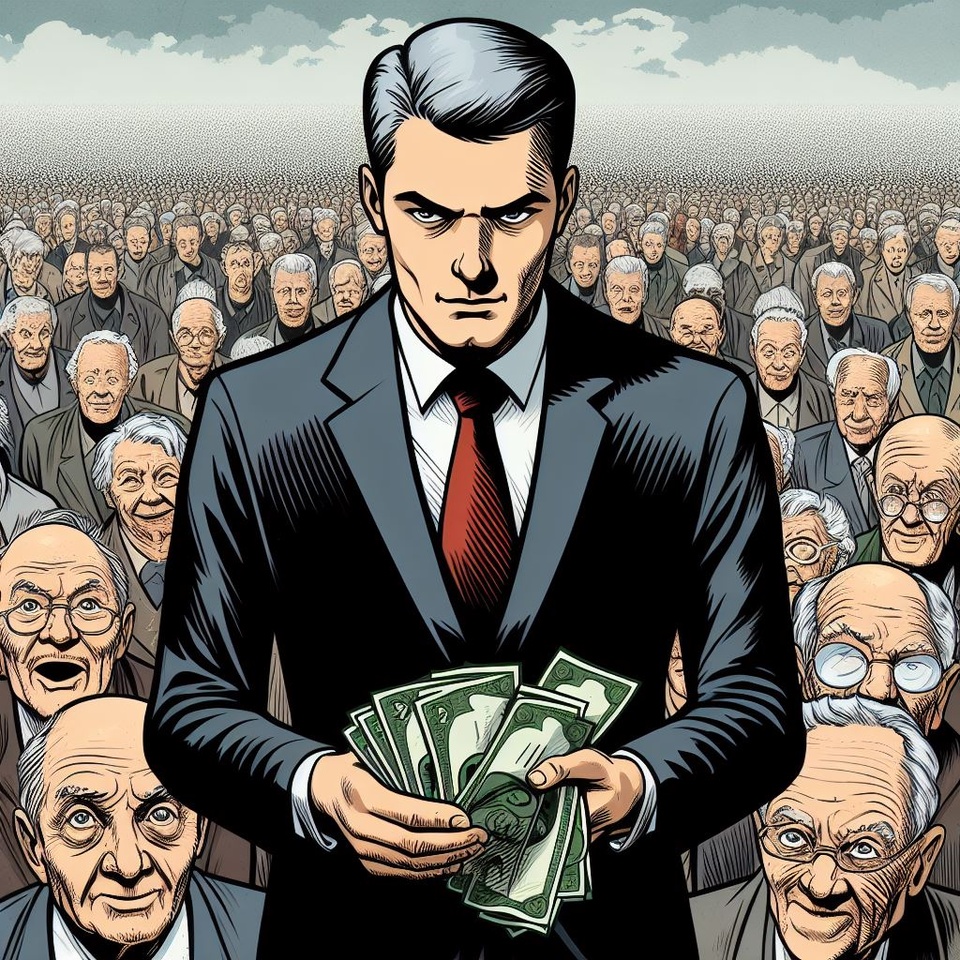

Today I have a no less relevant topic for you: The megatrend of an ageing society.

Boring. Everyone knows it. Not interesting. Or is it?

There are trends that are omnipresent: AI, climate change, the war in Ukraine, etc.. The trend of an ageing society, on the other hand, is hardly ever heard in everyday life.

Why is that? I suspect that the story of an ageing society was already told many years ago. Every year, the population ages a little more. The frog is sitting in water that is slowly heating up. Only when it is too late does he realize how hot it is getting.

That's why it's interesting for me to look at potential profiteers right now. The hype train hasn't started yet - and perhaps it won't due to the linear development of age cohorts. But hardly any other trend is so certain and predictable - and yet still under the radar.

One request in advance: let's remain objective. Ageing is a sensitive topic that can be emotionally charged. In my view, however, moral or political discussions have no added value here as long as no investments can be derived from them. There are other platforms for that.

Background

For anyone who has not yet heard of demographic change: The baby boomer generation (born between 1946 and 1964) are also known as the "baby boomers". These generations can be found in both the USA and Europe. And this age cohort is gradually retiring. In addition, the proportion of young people in the population is decreasing, as birth rates are steadily declining after the baby boomers.

So there will be more "old people". Which companies could benefit from this development?

To keep things interesting for you, I will focus on less obvious players. Nursing homes, Big Pharma and the like, you probably already know that.

I'm interested in profiteers at second glance. Here we go.

1. tourism

An ageing society does not mean care, immobility and illness. Today's older people are much fitter than they were 20 years ago, for example. Tourism can be one of the beneficiaries here. Where do senior citizens hang out? Presumably on cruise ships 😉

Actually less interesting for me because it's "asset heavy". But cruise companies have been heavily penalized since Corona. They are also not interesting for the ESG community because they are dirty. So maybe interesting after all?

The big players $RCL (+2,69 %) Royal Caribbean Cruises, Norwegian Cruise Line and $CCL (+4,78 %) Carnival are probably familiar to most people. Caribbean is now also back above the pre-corona rates - in contrast to the other two. It is possible that they will follow suit.

If that's too hot for you, you could take a closer look at $MAR (+0,19 %) take a closer look at Marriott. This is the largest hotel chain in the world. It can be classified in the premium segment - which is interesting, as senior citizens can look back on an entire working life. And if they invest their money wisely, they will certainly want to (and be able to) enjoy the last stage of their lives in comfort.

Due to Corona, a look at the development of the key figures is a little distorted. Nevertheless, profits grew by around 13% p.a. over 5 years, while sales growth is estimated at 7.2% p.a..

In addition, there is a dividend yield of just under 1%, although there is still room for improvement with a payout ratio of just under 25% of free cash flow.

In my view, the stock is currently running a little too hot. Definitely something for the watch list if tourism should collapse - that happens regularly.

2. leisure & consumption

Brunswick Corporation

I had never heard of this company before my research. The company is active in the (sports) boat sector and is regarded as a leading manufacturer in this field. They sell boat electronics and drives as well as "finished" boats, from inflatable boats to large yachts.

Sales growth over 5 years: 9.4 % p.a.

Profit growth over 5 years: approx. 14 % p.a.

Plus a dividend yield of currently 2%.

Despite a cyclical industry, profit stability is 0.84.

That is strong. In addition, the share is currently trading at the level of 2022.

The leisure boat market is generally resilient and is also forecast to grow by around 5% p.a. Exciting niche value in my view.

Churchill Downs Incorporated (horse racing tracks)

$CHDN (+0,39 %) Churchill Downs operates horse racing tracks, casinos and betting facilities. They host the famous Kentucky Derby at their racetrack. In itself fun for young and old, although the cliché probably focuses more on the older customer. An exciting candidate that can also remain interesting for young customers due to its segments.

The figures are a real treat:

Sales growth over 5 years: approx. 16 % p.a.

Profit growth over 5 years: approx. 22 % p.a.

Despite strong price growth, the share is fundamentally fairly valued according to my research and still offers some potential due to the growth prospects.

If I wasn't already heavily invested in gambling, this would be a hot candidate for me.

Animal welfare is of course a critical point here. But please remember: This is supposed to be about shares and investments, not about moral debates.

Acushnet Holdings Corp

If horse racing is too exciting for you, you can take a look at Acushnet Holdings Corp. $GOLF (-0,37 %) . As the ticker says, it's all about golf (products). The company sells everything related to the sport.

And they have an impressive 14/15 points in the Traderfox quality check.

If you ask around in golf, you know how expensive the equipment can be. And the sport can be played well into old age.

Unfortunately, the candidate wasn't included in the share finder, so I haven't included that many key figures for you here. If you are interested, you can research the company in more detail (and perhaps share your findings here?).

3. medical care

Having dealt with two positive areas, we will now turn to the other side of the coin of ageing: the increased need for medical care. There is, of course, a wide range of companies here. I have brought along two candidates that I have repeatedly come across in my research:

Resmed

$RMD (+1,12 %) Resmed's main business lies in the treatment of sleeping disorders and respiratory diseases. However, a second - currently small - segment is very exciting for the trend discussed here: software solutions, which include remote monitoring tools to make patient care more efficient. There are not only more old people - there are also fewer young people. There will certainly be resource bottlenecks (shortage of specialists) when it comes to covering the increasing treatment requirements. Efficiency-enhancing options are important here.

Resmed's main business is developing magnificently. Another strong branch could be established with Software Solutions. A very exciting candidate for me.

The figures:

Sales growth over 5 years: 12.6 % p.a.

Profit growth over 5 years: 21 % p.a.

Was still very cheap six months ago. Will be on my watch list. I will get in if there is a setback.

Stryker

I have been looking for alternatives to $SYK (+1,48 %) Stryker for a long time, as Stryker is probably not one of the "second glance" profiteers. They are simply too well known for that. But there's no getting around the company. Even when I was specifically looking for specialists in hip and joint implants, no other company could come close to matching the quality of Stryker's figures. In the event of a setback, I would consider getting in. Or do you know of any alternatives?

4. nursing & patient care

Let's move on to the last category: care. Sooner or later, you will need care in old age. Care is not only provided on an inpatient basis, but also on an outpatient basis. You will no doubt have seen various small cars from outpatient care services in cities. There are no monopolistic structures here; there are many small providers on the market. So how can you benefit from care? I looked around for "shovel manufacturers":

Nexus AG

$NXU (+1,53 %) Nexus AG is a company for software systems for hospitals, care centers and medical practices. They optimize processes there and aim to improve patient care. In my view, this is more exciting than, for example, a player from its US counterpart ($MCK (-0,52 %) ), as Europe is more affected by demographic change than the USA. And Nexus AG has not yet performed as strongly as McKesson recently.

Estimated sales growth of just under 13% p.a., estimated earnings growth of 26% p.a.

For me, it is on the watch list alongside McKesson.

Cintas

The company $CTAS (+0,17 %) specializes in workwear and textiles. As boring as it sounds, the figures are impressive, as is the performance. Congratulations to all those who got in early.

In my view, the company is interesting because everyone involved and the (care) added value requires suitable (clean) workwear. And with blue-collar jobs like these, there is probably little risk that AI will make them obsolete in the next few years. After all, the company is not only active in the care textile industry.

However, despite its high quality, the company is far too expensive in my view. A P/E ratio of 44 with sales growth of <10% p.a. is high.

But: The company is also subject to a certain cyclicality. I will definitely put it on my watchlist - I will get in if there is a significant setback.

That was it, my ride through the demographic stocks.

Now it's your turn:

- Which companies do you think will benefit from demographic change?

- What effects do you see?

If you don't have an opinion, I would be delighted to receive any feedback on my article:

- Was it too short? Too long?

- Did you miss something?

- How could I make my posts more interesting overall?

I'm looking forward to your comments.

Your Money Man