In my opinion, the investment in Action alone justifies the current valuation

The 3i Group is a private equity investment company listed on the London Stock Exchange and specializes in building long-term corporate value. With a market capitalization of several billion pounds, it is part of the FTSE 100.

3i invests in various sectors, including consumer goods, technology and sustainable infrastructure. Its best-known investments are probably companies such as Action and Valorem.

Leading global investment firm 3i Group focuses on two main sectors: Infrastructure and Private Equity. The company was founded in 1945 and focuses on investing in mid-market companies in North America and Europe.

Private Equity:

3i primarily uses its own funds to invest in companies with a market value between 100 and 500 million euros. Their approach focuses on promoting growth as a means of long-term wealth generation. They invest heavily in sectors such as software, industrial technology, consumer services, healthcare and consumer goods. A prominent example of this is Action, a rapidly expanding European discount retailer, which makes up a significant part of their portfolio and has been a key driver of their recent returns.

Infrastructure:

3i oversees a portfolio of infrastructure holdings and focuses on sectors such as healthcare, communications and energy. Its investments in this area are designed to generate both capital appreciation and high returns from fund management fees.

3i's portfolio was valued at £6.7 billion for infrastructure and £21.6 billion for private equity in March 2024.

Action:

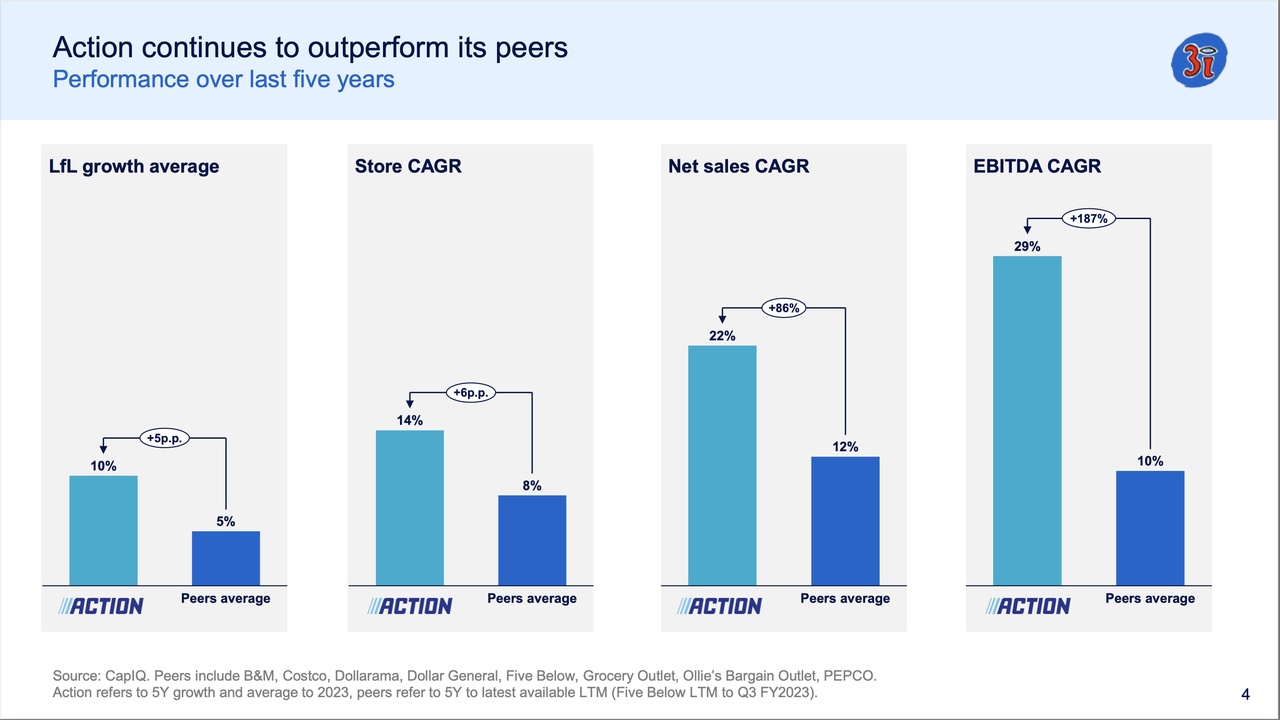

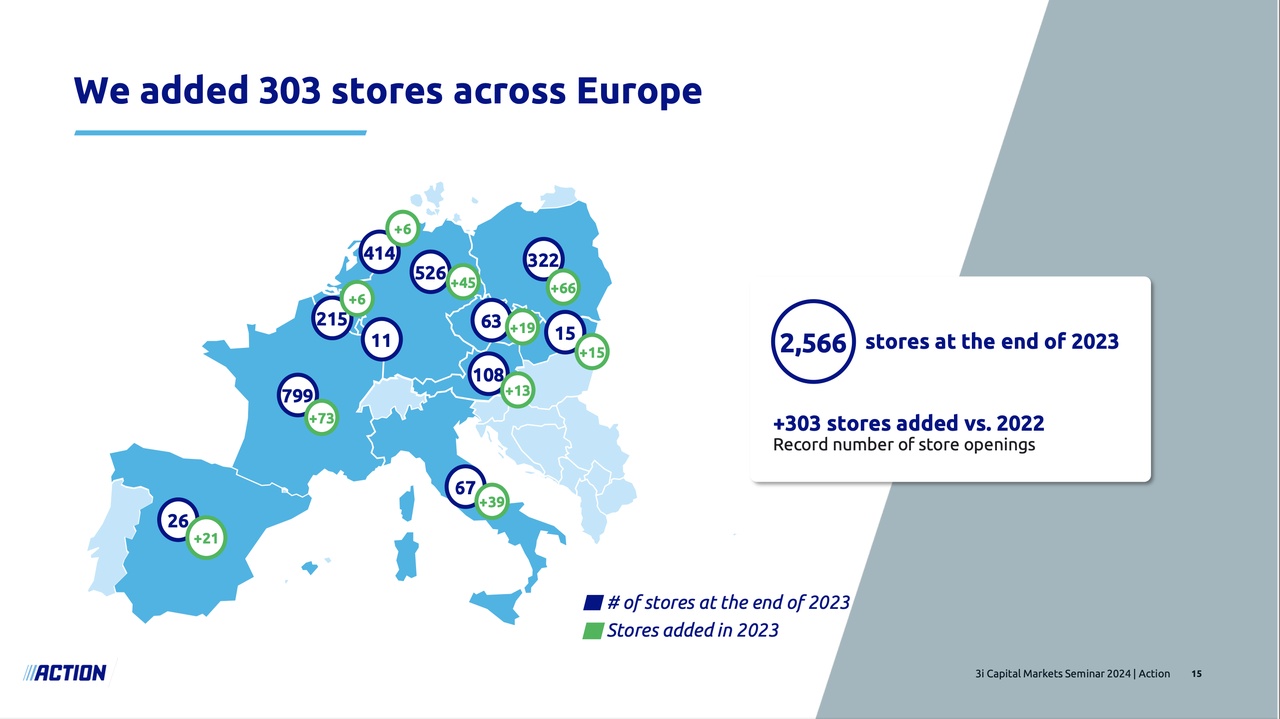

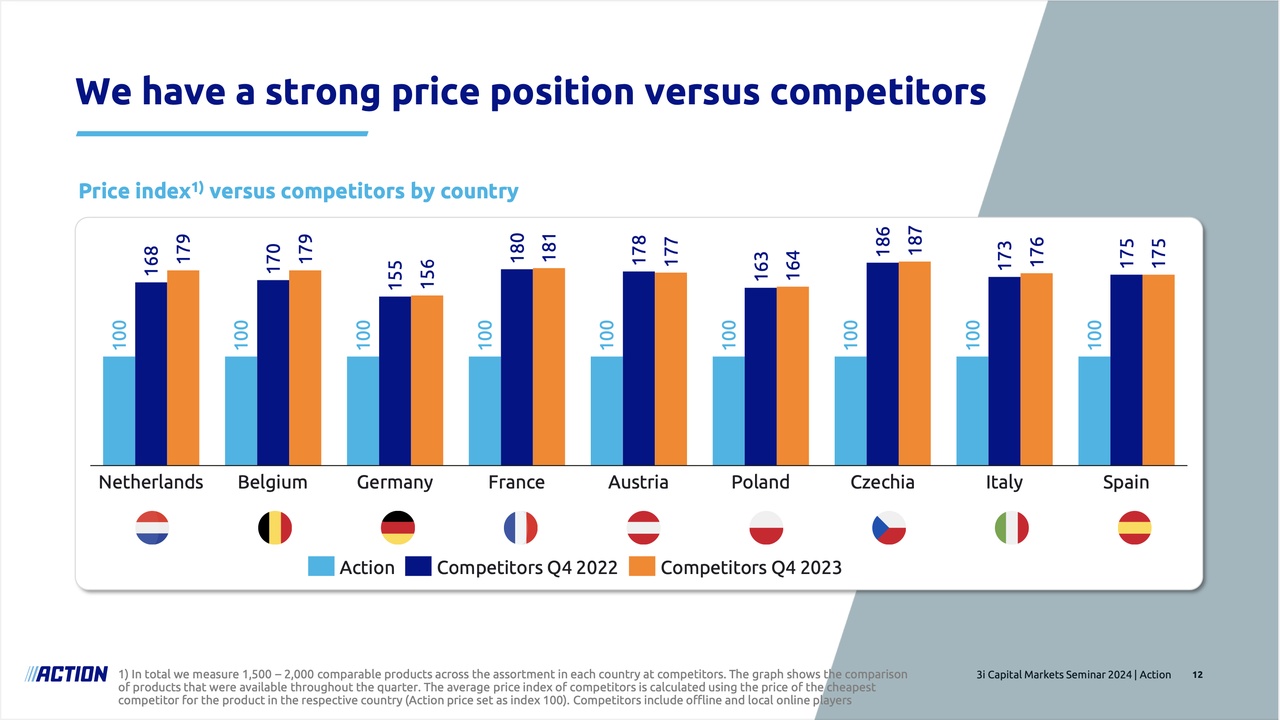

The fast-growing cheap non-food business Action currently occupies around 72% of 3i's portfolio. The company was founded in the Netherlands in 1993 and is now the fastest growing bargain chain in Europe with more than 2,300 locations in 12 countries, including the Netherlands, France, Germany, Austria and Spain. The core of Action's business strategy is to offer consumers a regularly curated selection of great value goods across 14 different categories including toys, fashion, personal care and homeware. Action is a popular option for those looking for the best deals due to its effective sourcing and extensive sourcing that guarantees high quality items at the lowest cost.

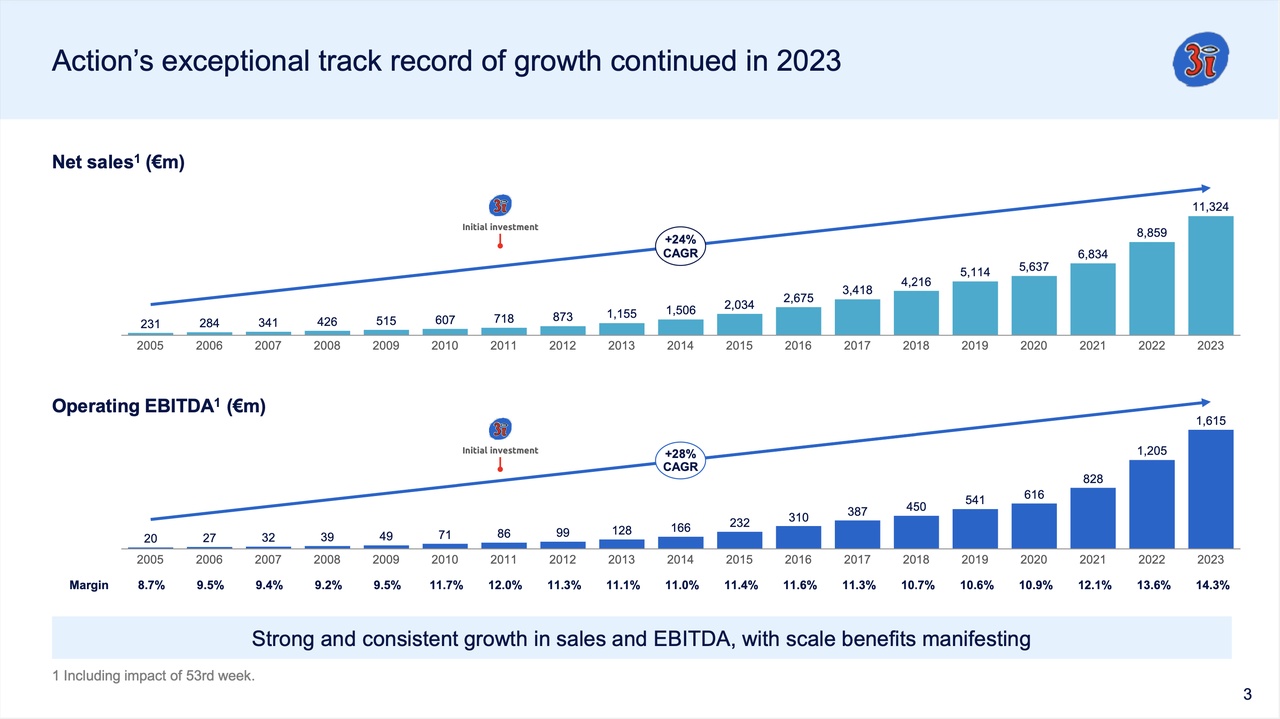

Promotions bring in revenue of around €8 billion per year and are still growing at a steady pace. In 2023, there was a 30% increase in sales and a 46% increase in EBITDA to 1.2 billion euros. Every week, the company adds over 150 new products to its range to continuously update its inventory. Its range is still changing, with only around 35% of it still fixed. Action also prioritizes sustainability, sourcing 90% of its cotton goods through the Better Cotton Initiative and using sustainably sourced materials in 92% of its paper and wood products, which sets it apart from other low-cost suppliers, particularly Chinese ones like Temu.

To be honest, the growth rate of sales and EBITDA is simply spectacular.

The company is growing by opening new stores as well as increasing sales per store.

Most exciting to me is Action's rapid geographic expansion, as mentioned above, they are currently present in 14 European countries, with more to come.

The undervaluation:

3i Group is currently trading at a P/E ratio of 8.75. That seems quite expensive if we exclude the big outliers in 2020 and 2021.

However, as mentioned in the title, I believe that only Action, with "only" 72% of 3i's holdings, justifies an even higher multiple. For this reason, I have performed a discounted cash flow (DCF) analysis for Action with the following assumptions:

EBITDA margin: I averaged over the last four years - including Covid-19 - and assumed that the margin would remain constant at the average 12.7%.

Sales growth rate: Action's average sales growth rate over 4 years is currently 22%, while the growth rate since the 3i buy out in 2011 is a whopping 26%. To adjust the bear case, I have used the following assumptions: Bear case: 15% p.a. Bull case: 22 % p.a.

Free cash flow: Since 3i does not explicitly declare the FCF of a particular holding in the earnings calls, it was quite difficult to get a suitable assumption for the FCF conversion from stock. Fortunately, however, the CEO stated in the last earnings call that the EBITDA to FCF conversion for 2023 was 101%, which gives us the following assumptions: Bear case: 80% of EBITDA Bull case: 101% of EBITDA

WACC: I used 10% for the WACC.

Perpetuity Growth Rate: I have assumed 3.5% for the perpetuity growth rate. This seems conservative if you look at the historical growth rates.

Within the bear case, our DCF gives us a share price with a fair value of around €44, which suggests that the company is currently fairly valued.

If we look at our bull case, we get a fair value target price of around €100, suggesting that the company could currently be undervalued by a whopping 57%.

Conclusion

Our two DCFs give us a price range of €44 to €100 or a valuation gap of 0% to 57%.

Considering that our DCF only takes into account one stake of 3i, one could argue that the remaining 28%, apart from Action, is completely free when investing in 3i. In my opinion, this increases the margin even further.

For me, there are two potential risks that could hinder our investment case: Economic downturns: although bargain stores often do well during downturns, prolonged crises can impact consumer spending and reduce sales. Measures could be under pressure to raise prices if inflation continues to drive up the cost of goods and transportation, which could scare off budget-conscious customers.

Competition: with Chinese players on the rise, Action needs to consistently innovate and differentiate itself from the competition to maintain its market position. This could put pressure on margins. However, the recent push on sustainability and higher quality compared to Chinese competitors sets Action apart.

Nevertheless, I think 3i is currently at a very compelling entry point even after the recent run the stock has had. I am gradually increasing my investment in this stock. I rate the share as a strong buy.