getquin Daily Summary 25.07.2022

Hello getquin,

what a hot start to the week... Fashion retailer New Yorker has suffered an as-yet-unknown loss from a scam web setie, Goldman Sachs lowers its earnings forecast for MSCI China, and South Africa looks to combat power shortages.

Europe🌍:

1st fake online store scams New Yorkers

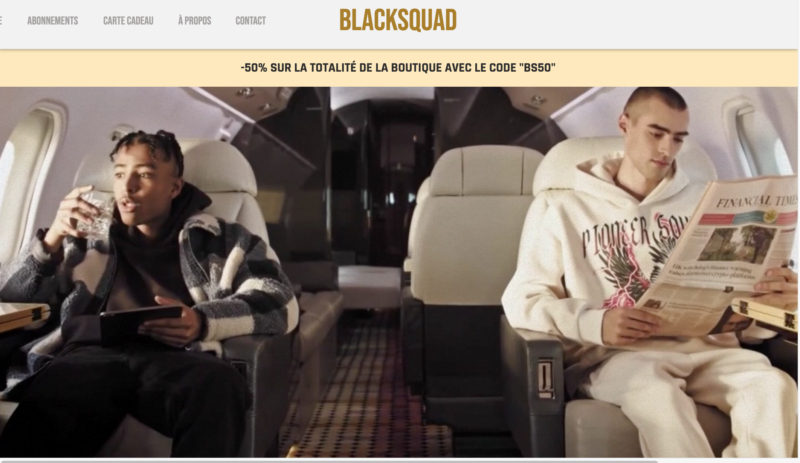

A fake online retailer has defrauded Brunswick-based fast fashion retailer New Yorker. Until recently, unknown fraudsters had used the streetwear retailer's brand name to create a fake internet store called "Blacksquad.fr". The store appeared genuine as the operators also used illegally stolen video and photo content of New Yorker. It is not known how many customers were harmed by the scam.

A fashion business with 1,150 stores without an online store... https://bit.ly/3zwlc8R

Asia🌏:

2nd GS lowers earnings forecast for MSCI China

Goldman Sachs lowered its earnings forecast for the MSCI China stock index to zero growth for the year, from 4% previously, according to a report released Thursday. China's property market has come under renewed pressure in recent weeks as many homebuyers have stopped making mortgage payments. According to Henry Chin, head of research for Asia-Pacific at CBRE, it could take five years for the property market to recover from oversupply in China's smaller cities.

Interested in the topic? https://cnb.cx/3vdg07j

🟥 $36BZ (-0,32 %) (Ex. ETF) (🔽 -0.37%)

Africa🌏:

3rd South Africa wants to solve electricity shortage

South Africa will attempt to address its chronic electricity shortage by making it easier for private companies to build plants and by paying households and businesses to generate electricity from solar panels.

The urgent need to address the country's 14-year power crisis was highlighted by the five-week blackouts that ended last week and were the worst since the power grid nearly collapsed in 2008. President Cyril Ramaphosa and the ruling African National Congress have been heavily criticized for failing to fix the problem despite repeated promises.

Read more here: https://bloom.bg/3PPhixd

Quarterly figures:

Philips $PHIA (-0,25 %)

Investors had to cope with surprisingly weak quarterly figures on Monday. Analysts at Societe Generale had already withdrawn their buy recommendation for the share on Friday

EPS: 🟥 €0.28 expected vs. €0.14 published; difference: 50%.

Sales: 🟥 €4.22 billion expected vs. €4.18 billion published; difference: -0.97%.

Source: https://bit.ly/3cK53Uw

Ryanair $RYA (-0,42 %)

EPS: 🟩 € -0.60 expected vs. € -0.47 published; Difference: 21.21 %

Revenue: 🟥 €1.55 billion expected vs. €1.47 billion published; Difference: 5.11

Stocks of the day:

🟩 TOP $EVEX 9,20 $ (🔼 +7,48%)

🟥 FLOP $HKD , 41,38 $ (🔽 -39,15%)

🟥 Most searched $AAPL (+1,34 %) , 149,47 € (🔽 -1,05%)

🟥 Most traded $UN01 , 6,37 (🔽 -14,24%)

🟩 S&P500, 3,964.01 (🔼 -0.069%)

🟥 DAX, 13,187.16 (🔽 -0.50%)

🟥 bitcoin ₿, €21,443.62 (🔽 +3.15%)

Time: 17:10 CEST

Question of the day:

Where is the largest port in the world?