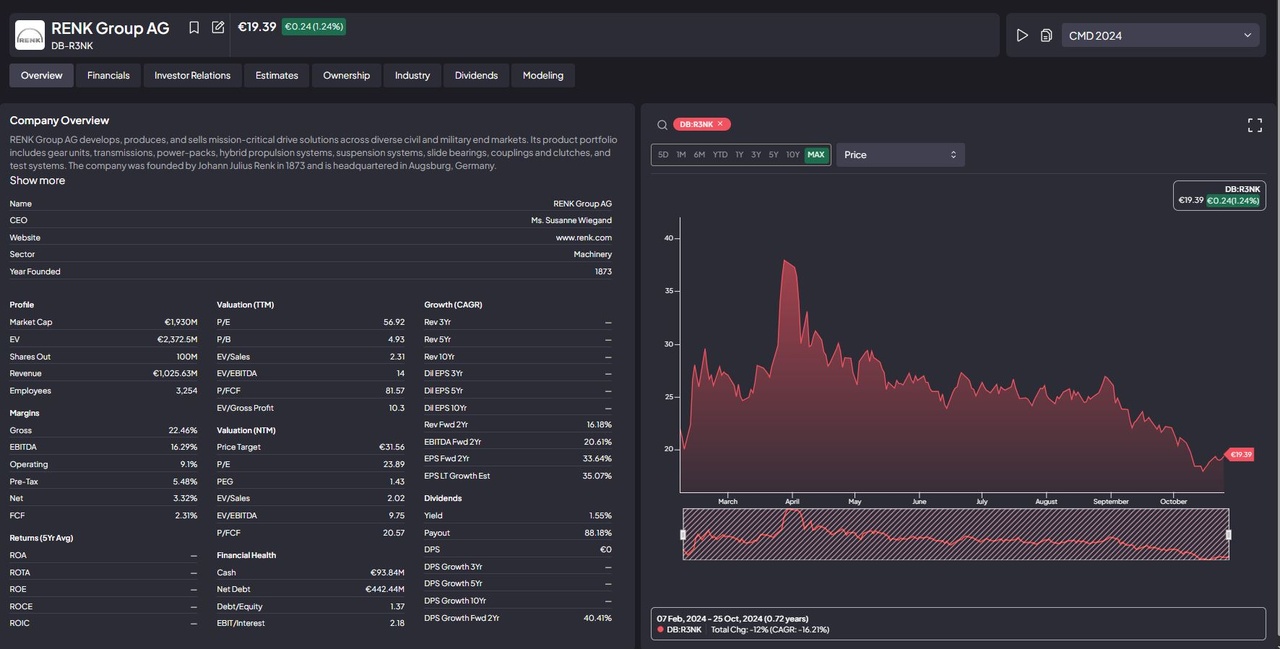

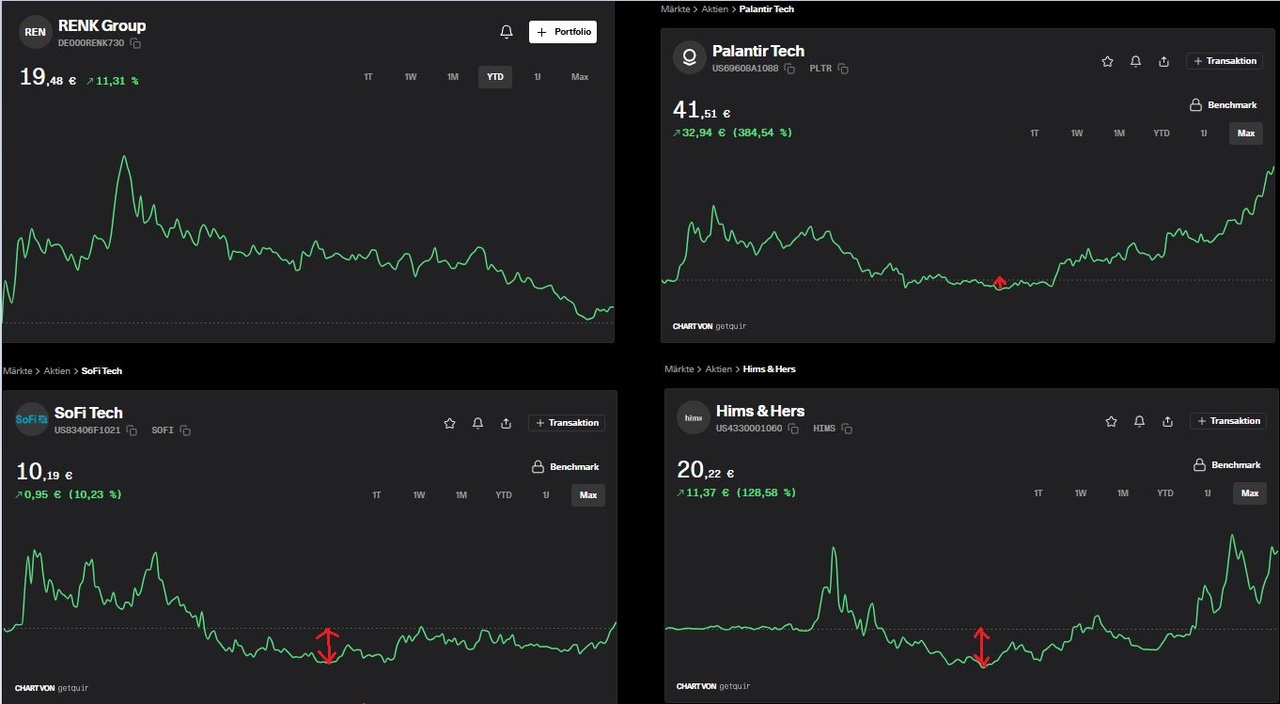

I played around a bit in finchat today. It has a very good screening function where you can filter by several parameters. Among other things, I noticed the share from DE $DE000RENK730 (-3,53 %) caught my eye. The chart after the IPO actually looks completely like many other shares after the IPO. Either shares are sold off immediately after the IPO or you first see a parabolic rise followed by a sell-off. At some point, -30% to sometimes -70% below the listing price, they then usually form a bottom, similar to $PLTR (+6,35 %)

$SOFI (+1,24 %)

$NU (-0,2 %)

$ENR (+2,08 %)

$COIN (+0,27 %)

$HIMS (-1,68 %) . With the given growth prospects, the share could become quite interesting after another halving of the price. Does anyone here have them on their radar?