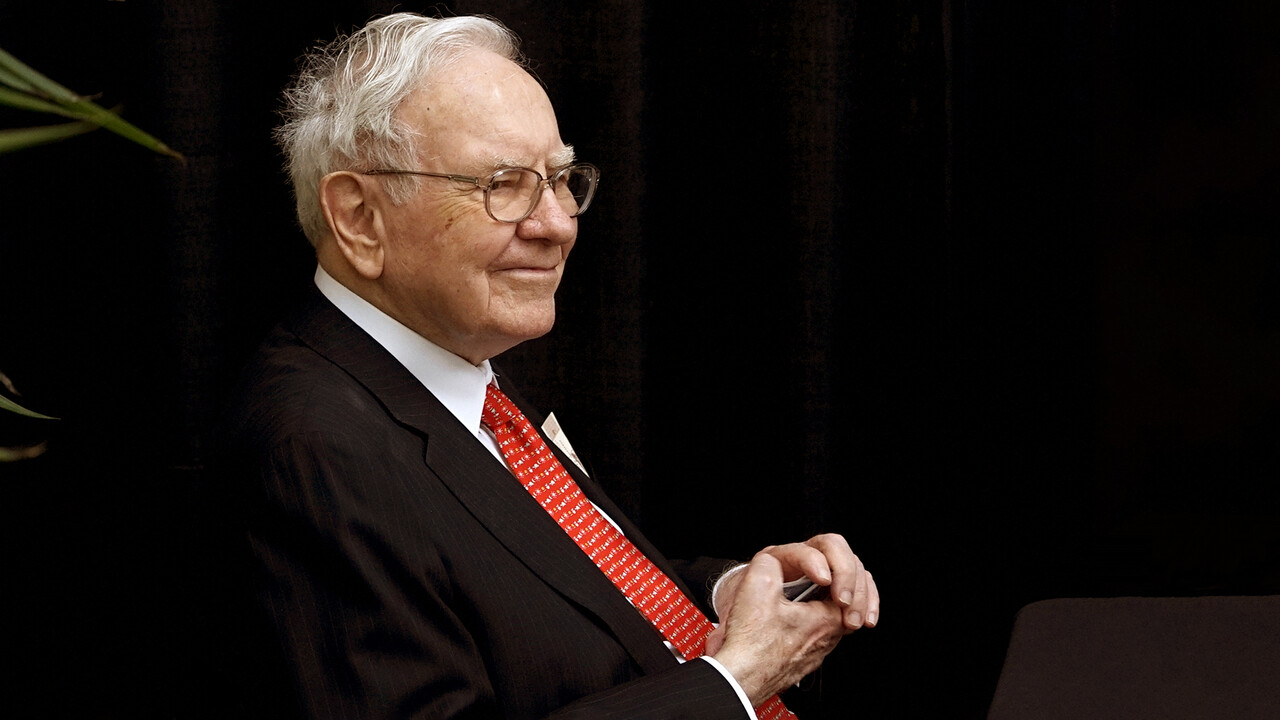

Warren Buffett recently made headlines by selling numerous shares in his largest holdings, Apple and the Bank of Americasignificantly. Some even suspect that the Oracle of Omaha may have predicted the crash that really got rolling on August 6.

What is striking, however, is that the old stock market master made a strong move on another share during this period. Could it possibly be his secret strategy that he is now relying on in turbulent times? And is it worthwhile for you to get in?

The share in question is the energy company Occidental Petroleum

$OXY (+3,44 %) . A look at the Bloomberg database shows that Warren Buffett bought more than seven million new shares in the company according to a filing on June 17. Not only that: he even bought on nine consecutive days in June. According to CNBC, Buffett bought Occidental shares every trading day from June 5 to June 17. The investor is said to have increased his stake in the company to almost 29%.