Why I am (almost) throwing out the DWS Top Dividende.

With 18 billion, it is the largest actively managed fund in Germany. I do not bore you with copy paste facts so straight to the opinion:

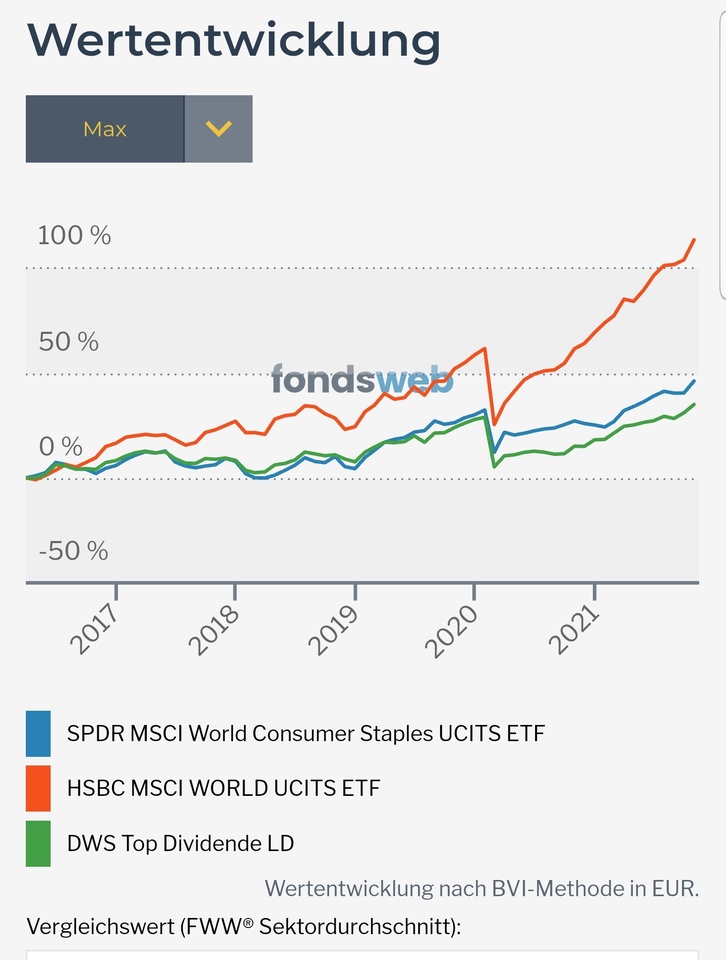

The fund is virtually a copy of a consumer staples index (basic consumer goods). Performance lags compared to a msci world, especially after Corona. Dividend yield was 3% in 2020. That's not enough this year for the current inflation rate. TER of 1.45% puts it at savings bank level. It goes cheaper.

The annual dividend is expected in a few days. After that, it's bye-bye.

I'm thinking of leaving a reminder position in, and the rest will go into the USA dividend payers from my last post.