Renewable Energies- Part 3 Atlantica

Hello all,

first of all sorry for the delay. My daughter had baptism on Saturday and due to alcohol consumption and cleaning up, time went down the drain. As mentioned in my last post, the analysis is relatively short, as the key figures and the difficulties/issues of each stock come in the final post.

I hope you like the post anyway.

The Company:

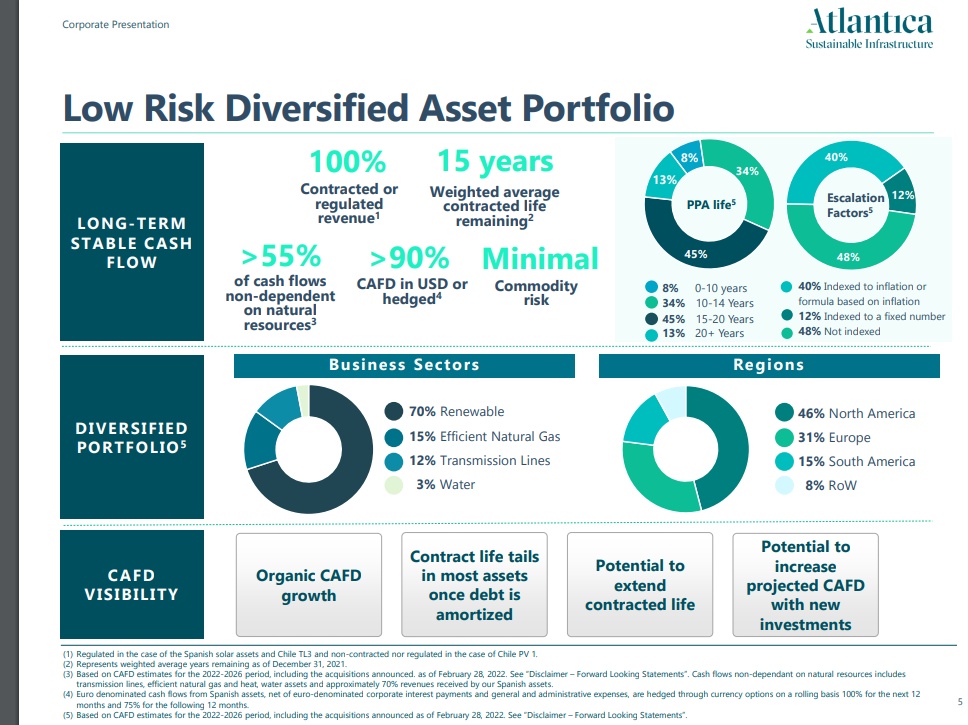

Atlantica Sustainable Infrastructure PLC is an infrastructure company. The company owns, manages and invests in renewable energy, storage, efficient natural gas and heat, transmission line and water assets.

Power generation from the sun

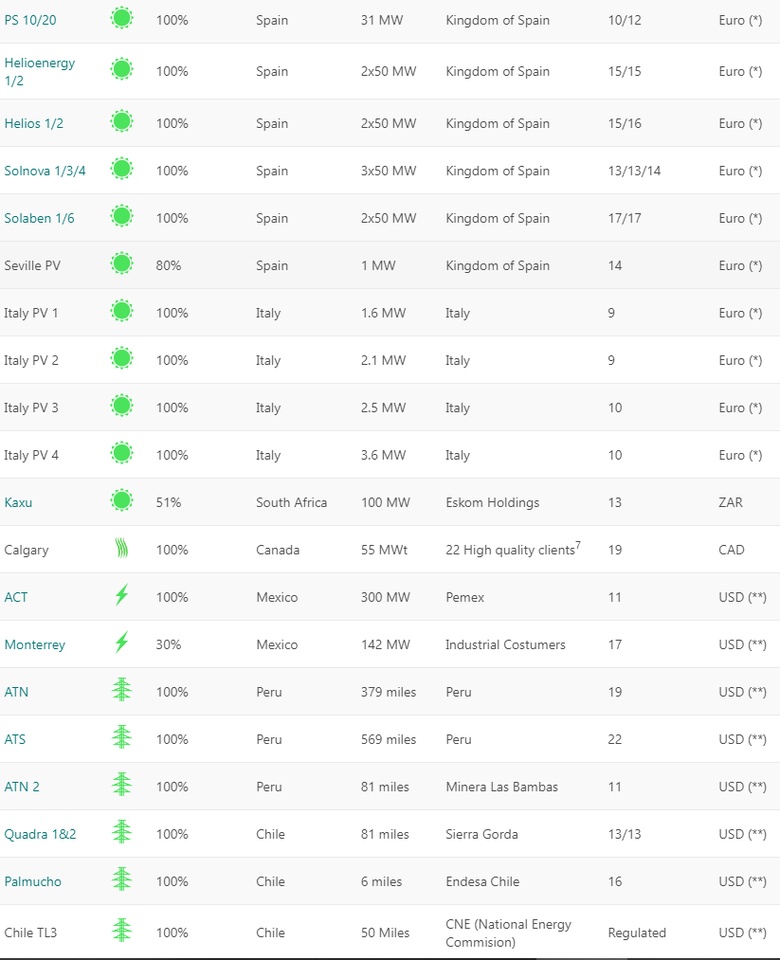

Here Atlantica has 18 assets located around the world. (USA, Chile, Colombia, Spain, Italy and South Africa).

The capacity on the 100% owned plants amounts to 1,070.8 MW. In addition, there are 242.05 MW on a pro rata basis.

This results in a total capacity of 1,313 MW for Atlantica.

Power generation from gas.

The total rated gas capacity is 442MW. Of this, 342MW is Atlantica and gas-fired power generation is currently limited to Mexico with 2 plants.

Power generation from wind.

The total nominal capacity amounts to 750 MW, whereby Atlantica does not account for the total capacity, but has a 49% share in the USA region. In Uruguay, however, Atlantica is the sole operator.

This results in a capacity of 446 MW for Atlantica.

In total, Atlantica has a nominal capacity of 2.101 MW and is thus somewhat smaller than TransAlta in terms of figures, but they have a broader portfolio. This is because power generation is supplemented by pipelines/lines with a length of almost 2,000 km, which are operated by Atlantica alone.

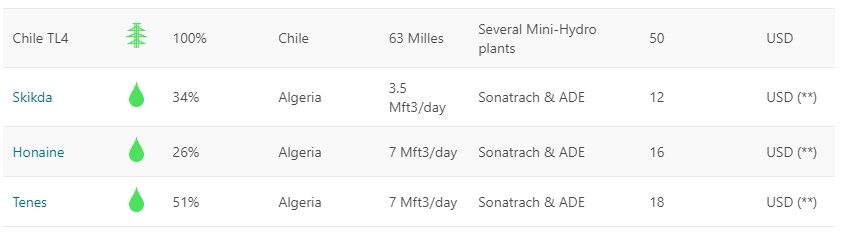

In addition, Atlantica operates 3 plants in Algeria for the treatment of salt water in order to produce drinking water.

In addition, there is a geothermal plant in California (135 MW).

The duration of the concluded contracts is also very solid with an average duration of 15 years.

The dividend

The dividend has been paid since 2014, but in 2016 the dividend had to be cut. Since then, the dividend has developed positively and rises annually. The dividend is paid quarterly. The increase amounts to approximately 5% per year. (However, as these partly take place during the year, this is only a guideline).

The current dividend yield for 2022 is 5.44%.

The numbers:

Enterprise Value/Development:

- 2018: $6,867 million à€

- 2019: $7,775 million à€

- 2020: $9,542 million à€

- 2021: $9,439 million à€

The trend is quite positive with the exception of 2021. The value of the company has developed by +37% since 2018 and as new projects are also planned, the company should continue to develop positively.

Revenues:

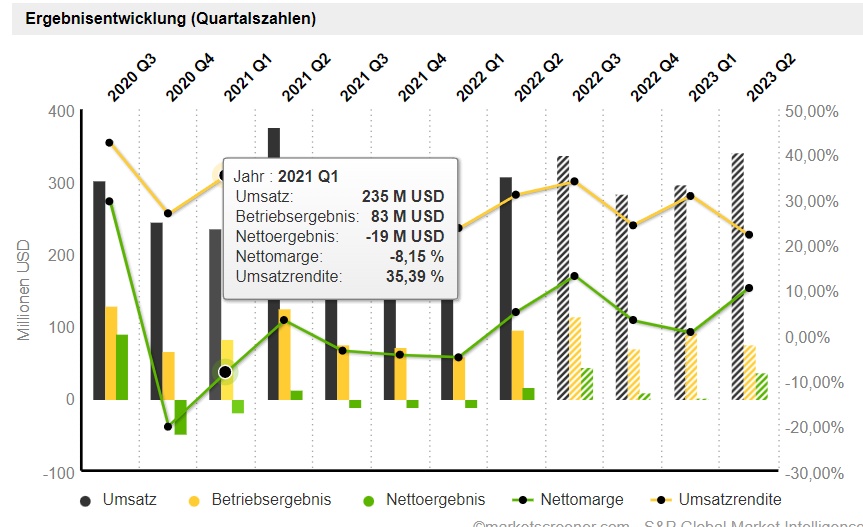

Sales have not developed particularly well so far since 2018 or have even shrunk in 2019 and 2020. However, the forecasts for this and next year are already very good or suggest that future development will be more positive.

- 2018: $1,044 million à€

- 2019: $1,011 million à€

- 2020: $1,013 million à€

- 2021: $1,212 million à€

Sales shrank from 2018 to 2019 and were almost flat compared to 2020. However, investments enabled a significant increase in sales for 2021. (20,5%)

EBITDA:

- 2018: $859 million à€

- 2019: $822 million à€

- 2020: $796 million à€

- 2021: $824 million à€

Ebitda has developed similarly to sales, but the increase from 2020 to 2021 is rather moderate at 3.5%.

EBIT:

As Atlantica operates the plants itself, relatively high depreciation, amortization and other financing expenses are to be expected. This is also reflected in the EBIT, i.e. the financial result after taking depreciation and amortization into account.

- 2018: $488 million à€

- 2019: $500 million à€

- 2020: $373 million à€

- 2021: $354 million à€

With the exception of 2019, Ebit is constantly decreasing, this may of course be due to depreciation and amortization. Also the forecasts do not show a significantly better development for the current year, but in 23 a jump, of 17% is expected. However, since these are forecasts, the figures should rather serve as a guide.

EBIT margin:

Let's now take a look at EBIT in relation to sales.

- 2018: 46,7%

- 2019: 49,5%

- 2020: 36,8%

- 2021: 29,2%

The Ebit margin especially in relation to 2018-2020 is really convincing. Even the margin in 2021 is still okay and suggests a further positive development.

Earnings per share

- 2018: 0,42$

- 2019: 0,61$

- 2020: 0,12$

- 2021: -0,27$

Unfortunately, earnings per share are currently decreasing every year and will be $0.27 per share in 2021. This is also a point that needs to be looked at more closely in the further comparison.

As above in my previous post on renewable energy, I would like to first introduce the companies and then compare them, so the other metrics that allow a comparison will follow in the closing post on renewable energy.

Preliminary Conclusion:

The 1st thing that struck me was the similarity between TransAlta and Atlantica. (Yes I know myself industry and all.) But the size and numbers are very similar. However, Atlantica has a broader portfolio. Both in terms of regions and sources of power generation. However, the revenue and earnings per share performance are not compelling. Without comparing the stocks based on other metrics, I find it difficult to determine a preliminary preference. On a positive note, sustainability actually plays a big role at Atlantica. For example, they are in the top 3% of the ESG Risk Rating and rank 8/100 in terms of sustainability.

Additionally, the longer duration of the investments (15 years on average) creates a solid and predictable cash flow and the dividend at least to some extent seems assured. However, I find the stock currently very expensive, even compared to TransAlta. Without comparing the shares further, which will follow in the final post, the share is suitable for dividend lovers or collectors.

Since I find the share currently very expensive, it is difficult to name a good entry point without immediately going into the other figures. However, I would assume a price of around €28 to €29.

Disclaimer:

This post is not investment advice. Since this is a multi-part series, but even so DYOR is appropriate.

https://www.atlantica.com/web/en/investors/financial-results/2022/

https://www.atlantica.com/web/en/investors/corporate-presentation/

https://de.marketscreener.com/kurs/aktie/ATLANTICA-SUSTAINABLE-INF-16686514/

If you like the post and you are also interested in the last 3 posts on renewable energy, I would be happy about a follow. Next is Nextera Partners, then Greencoat UK, and finally the comparison.

@Divmann , for you the data are finally 😉