$LYPG (+0,32 %) - I would like your opinion, maybe you even have another idea.

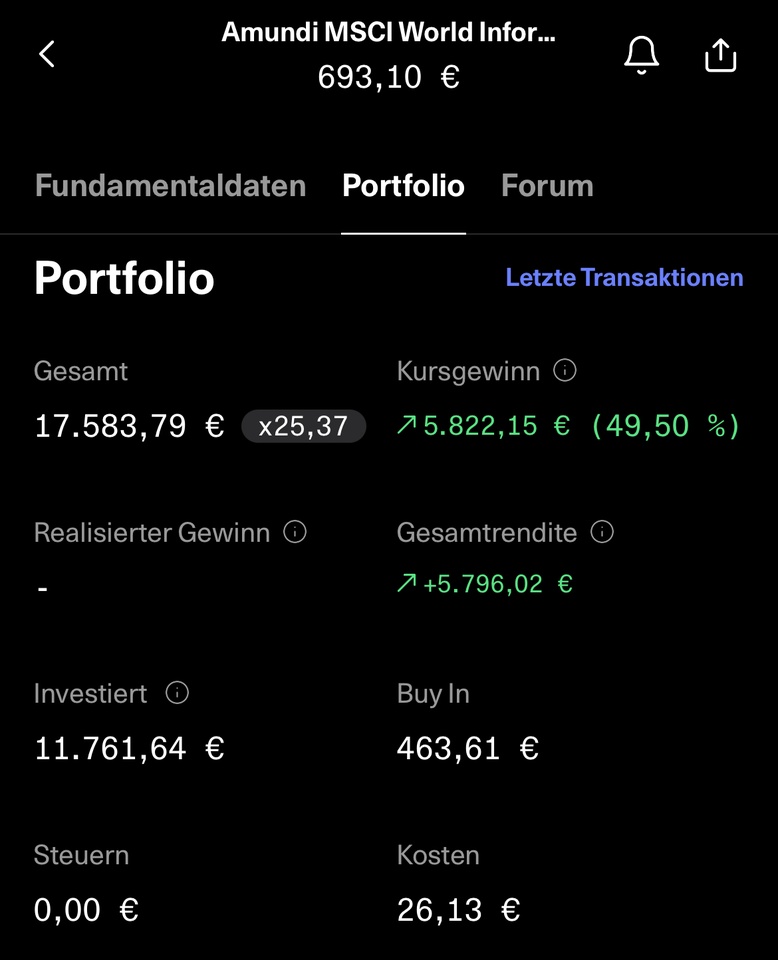

I'm toying with the idea of "parting" with my shares in the tech sector ETF mentioned and have recently been going through a few options.

Background: In the meantime, I think I'm too IT-heavy, I'm also buying individual stocks in parallel (60-70% ETFs) and would like to diversify more and also reduce the lumpy USA risk somewhat. Furthermore, I now find the TER a little too high, the synthetic replication also harbors risks that should not be neglected and I am no longer 100% behind it. This currently applies to sector ETFs in general.

On the other hand, of course, there is the current good performance (what else) and potential taxes when selling.

I'm toying with the following ideas, what do you think?

a) 👍 Sell my shares, take the profits and pay taxes, put the sum into the $VWCE (+0,17 %)which I am also saving for

b) ❤️ stop saving in it and leave it and not take any profits (and only sell it if it falls again so far that the taxes to be paid are minimal). To increase the savings plan of the $VWCE (+0,17 %) increase

c) 🚀 Throw thoughts overboard and continue to save via a savings plan, but reduce tech individual shares if necessary.

d) ...?

Thank you for your (honest) opinions.

#sektoren

#etf

#etfs

#vwce

#tech

#it

#vanguard

#amundi