$BG (-1,47 %)

BAWAG GROUP quarterly figures

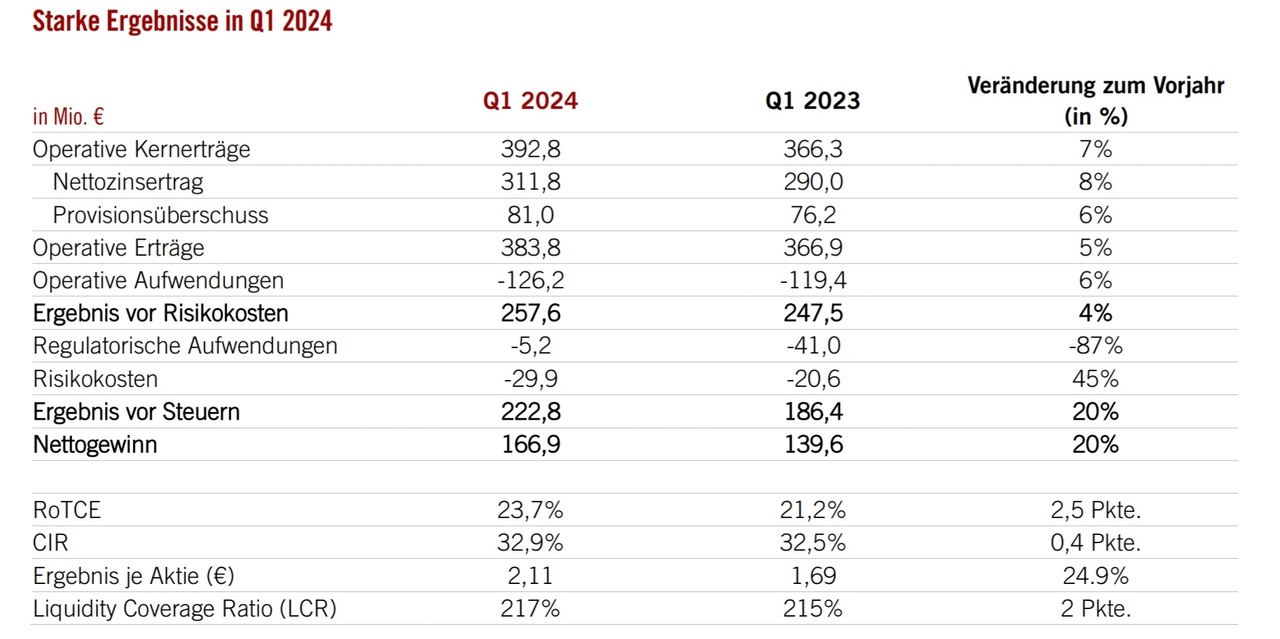

- Q1 '24 net profit of € 167 million, EPS of € 2.11 and RoTCE of 23.7%

- Customer deposits +1% and customer loans stable compared to Q4'23 (both on average)

- Profit before risk costs of € 258 million (+4% compared to the previous year) and cost/income ratio of 32.9%

- Risk cost ratio of 28 basis points ... NPL ratio at 1%

- CET1 ratio of 15.6% after deduction of the deferred dividend of € 92 million for Q1'24

- 2024 targets confirmedEarnings before taxes > € 920 million, RoTCE > 20% and CIR < 34%

Anas Abuzaakouk, CEO, commented on the financial results as follows: "In the first quarter, we delivered strong results with a net profit of €167 million and a RoTCE of 24%. We generated a significant amount of capital during the quarter, increasing our CET1 ratio by 90 basis points to 15.6% and our excess capital to € 623 million. This already takes into account the deduction of the deferred dividend of € 92 million for the first quarter of 2024. We have earmarked our excess capital for the acquisition of Knab Bank, which we signed earlier this year, as well as for further M&A, which is at an advanced stage. These strategic opportunities not only offer us high added value in terms of earnings, but will also allow us to further expand both our Retail & SME business and our presence in the DACH/NL region. Today, I am more excited than ever about our future growth opportunities."

The BAWAG Group AG is

the listed holding company headquartered in Vienna, Austria, and serves 2.1 million private, SME, corporate and public sector customers in Austria, Germany, Switzerland, the Netherlands, Western Europe and the USA. The Group offers a wide range of savings, payment, credit, leasing and investment products as well as building society savings and insurance under various brands and via different sales channels. The provision of simple, transparent and first-class products and services that meet the needs of customers is at the heart of its strategy in all business areas.