💶 Amundi: Europe's financial architect - Does he build the most solid assets? 🏗️ Part 1: https://getqu.in/Erlpxb/

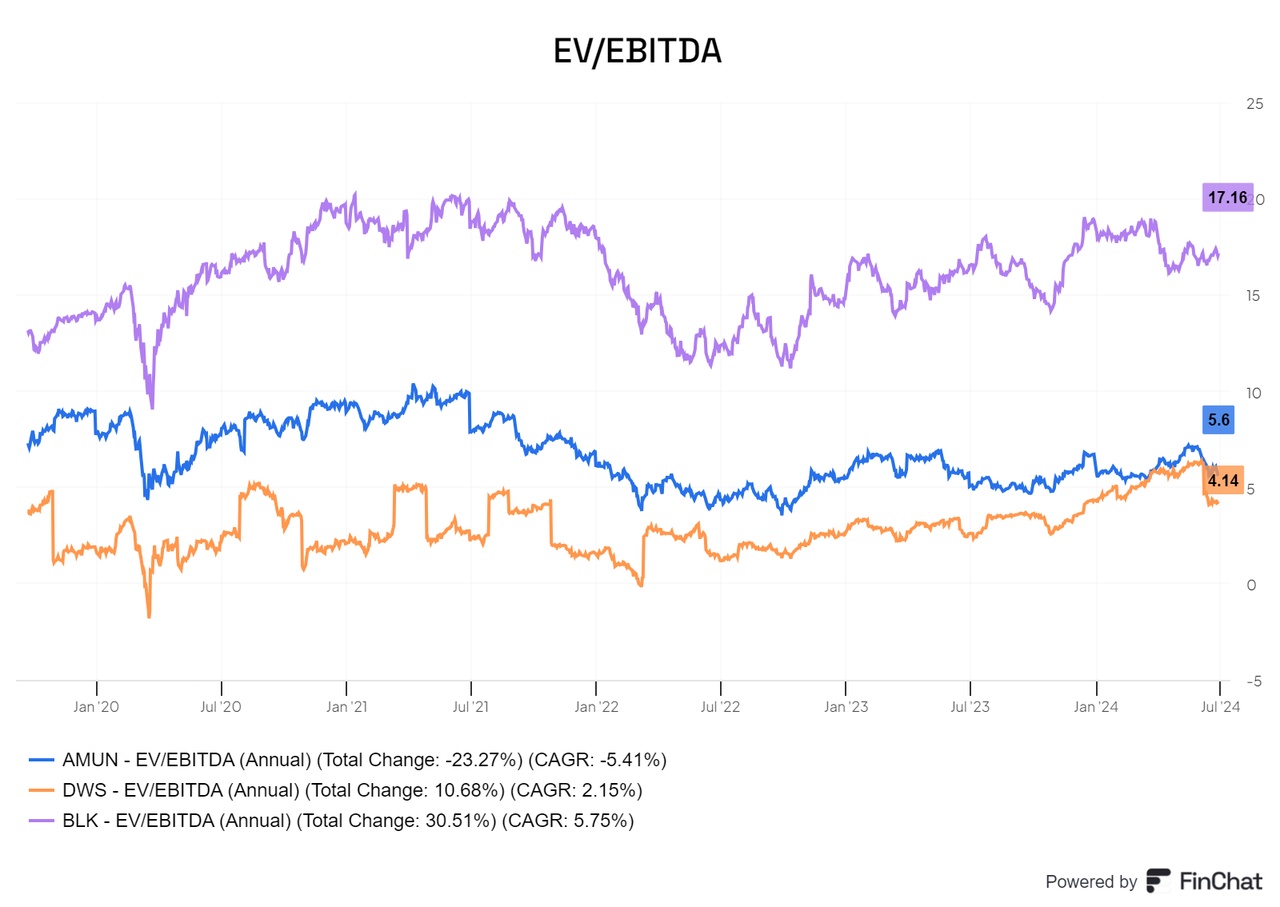

Looking at the EV-to-EBITDA ratio, one would expect much more from BlackRock despite its size. Amundi is above DWS, but both companies are at a very low level overall and are actually very poorly valued.

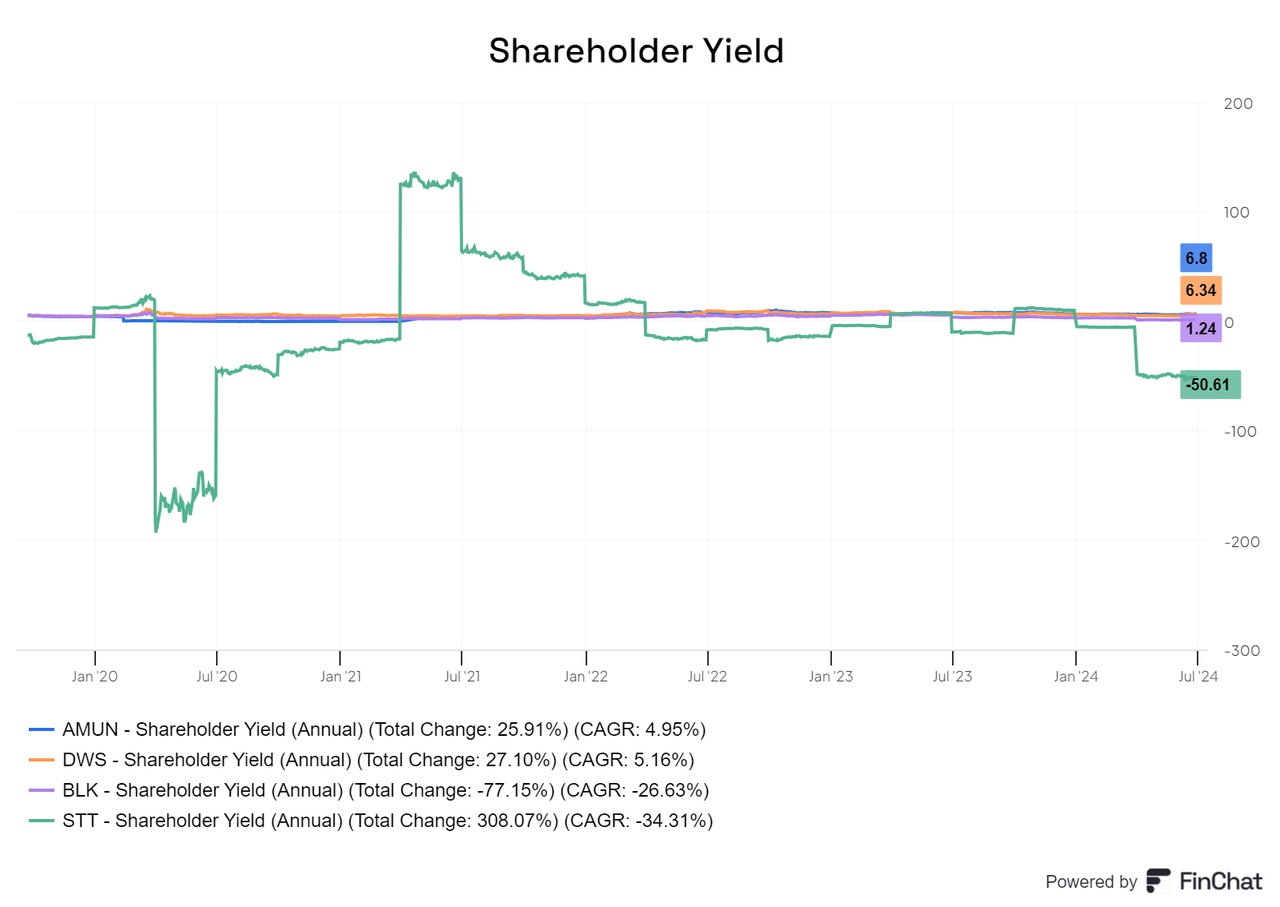

Amundi performs best in terms of shareholder yield, followed by DWS.

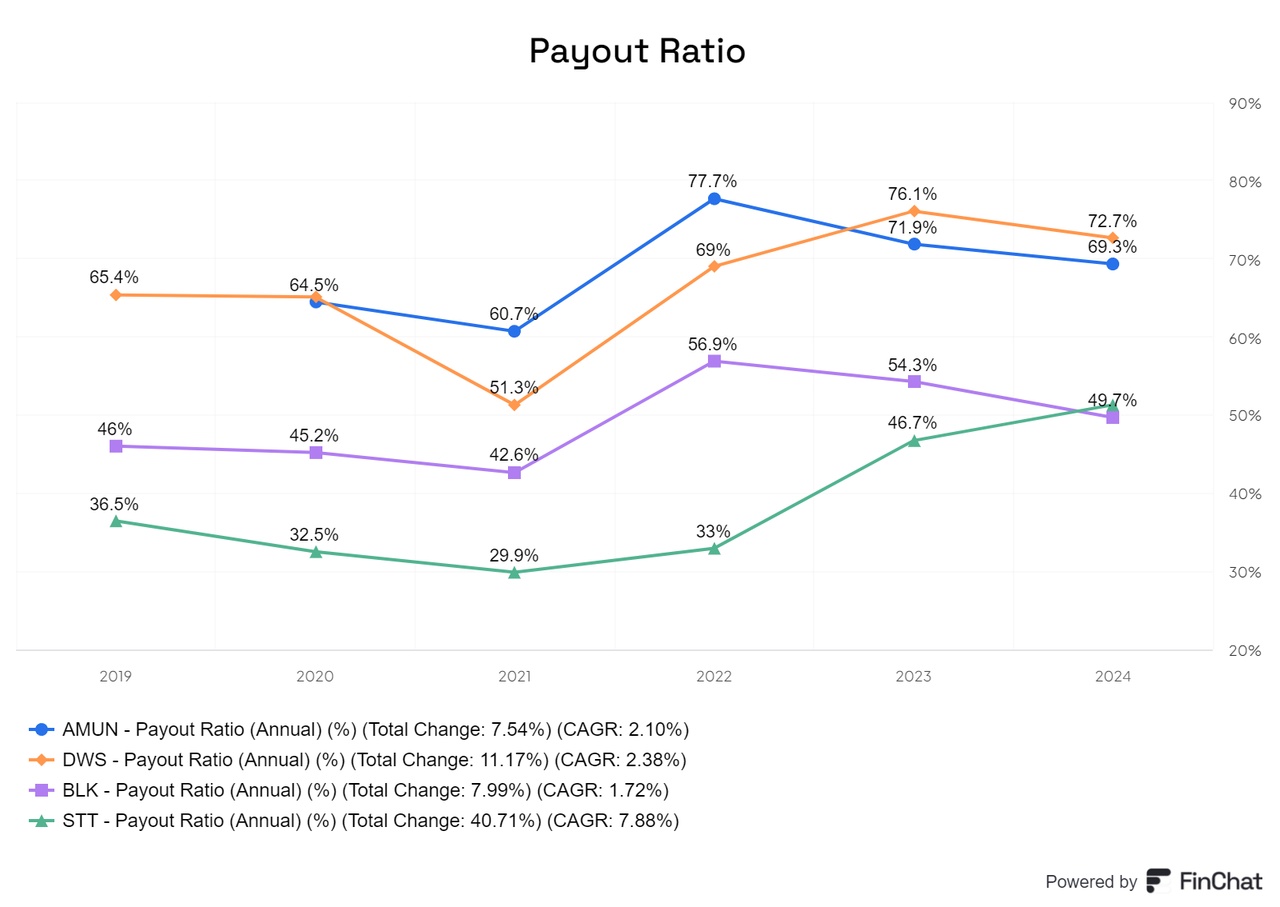

The payout ratio is quite high for Amundi and DWS, but seems quite acceptable for the current models.

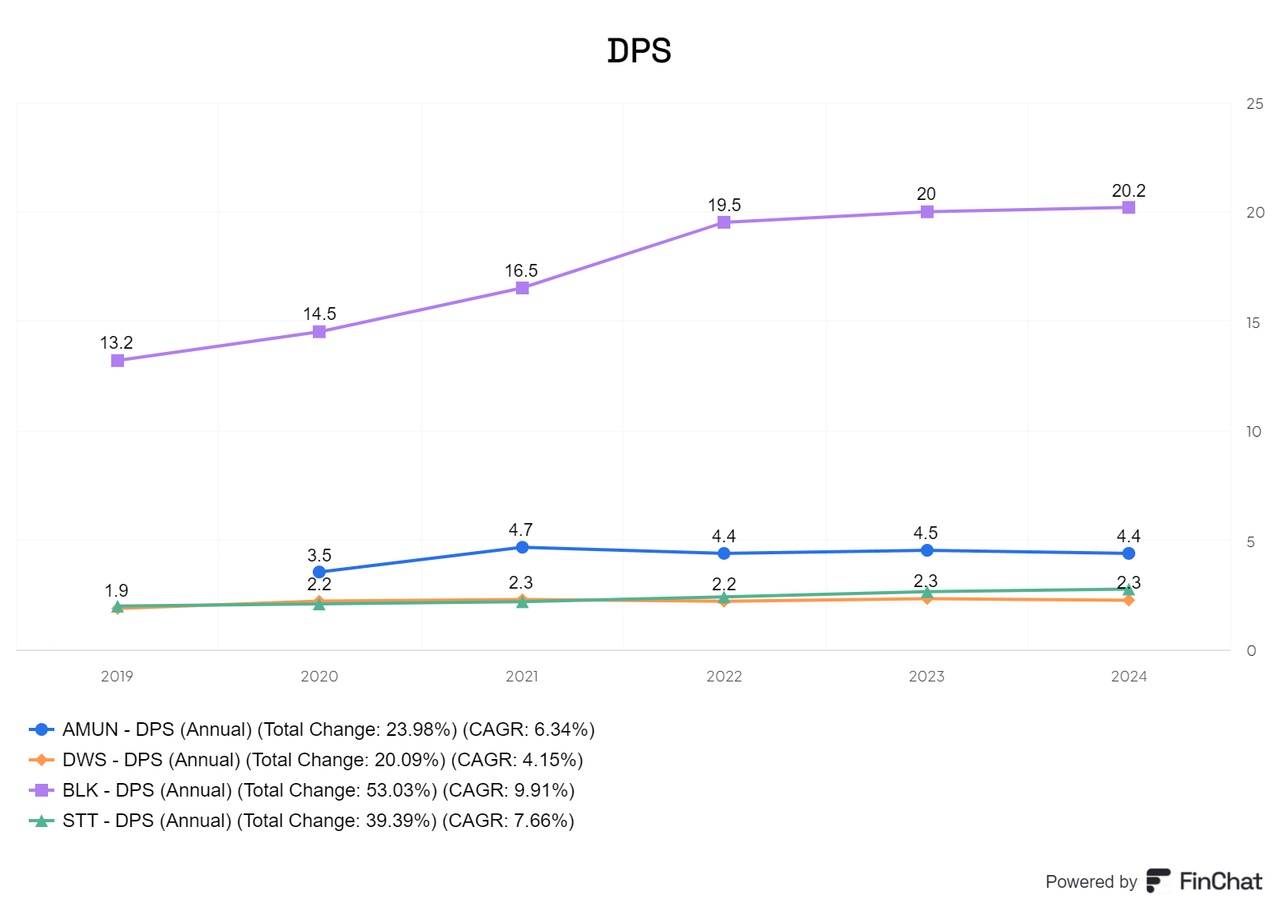

BlackRock also leads by a wide margin in terms of dividend per share (DPS).

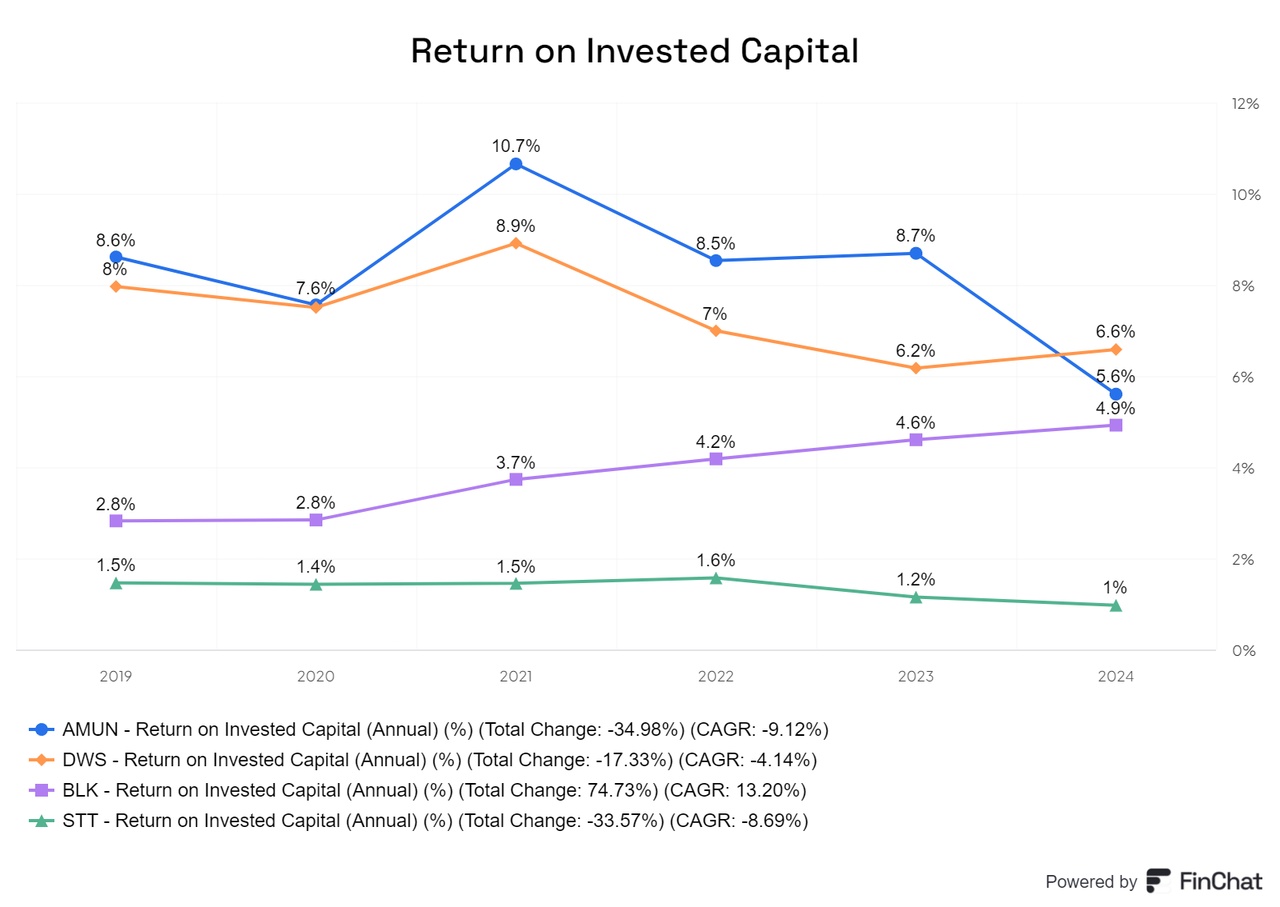

In terms of return on invested capital (ROIC), none of the companies exceed 10%.

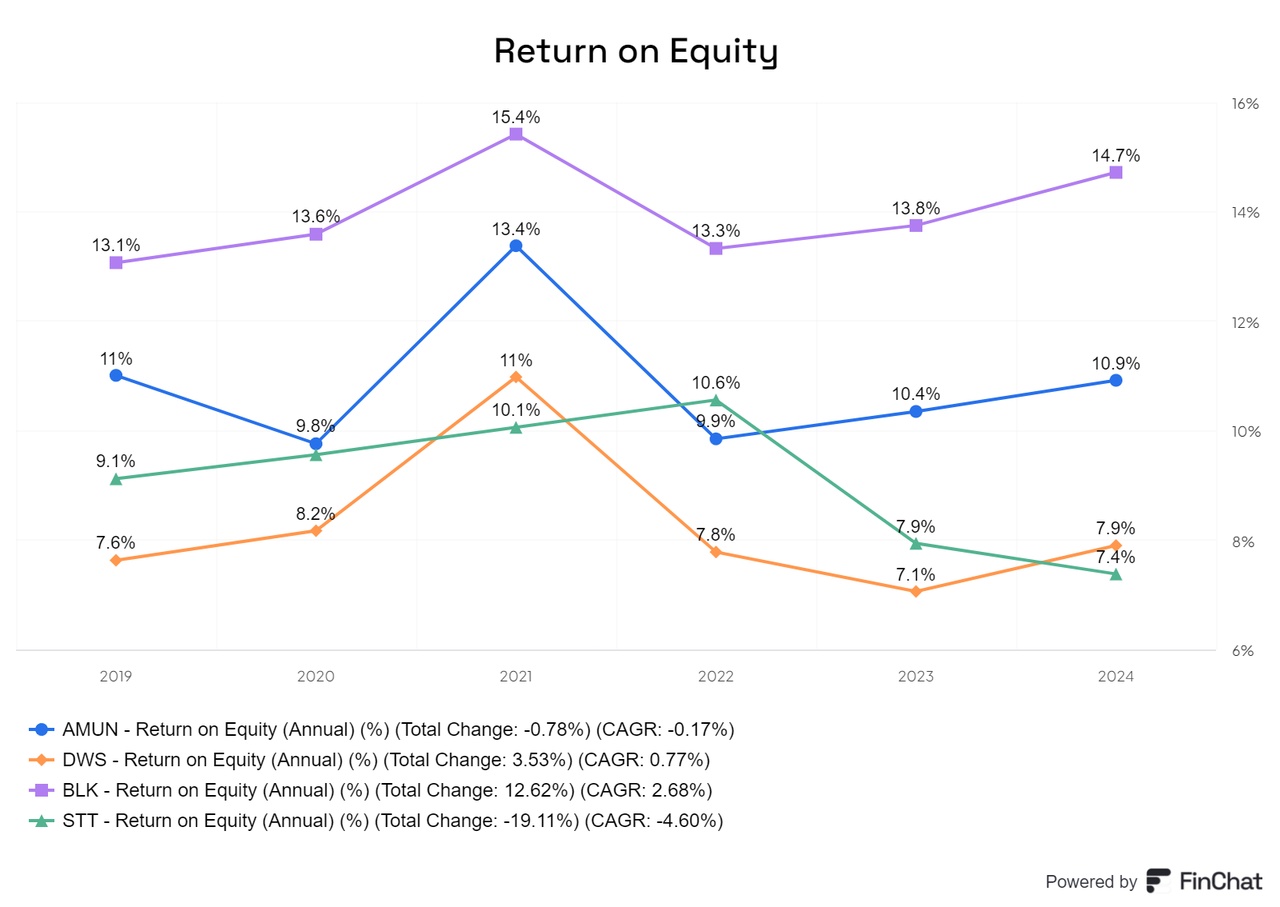

In terms of ROE, Amundi and BlackRock are above 10%, with BlackRock consistently above it.

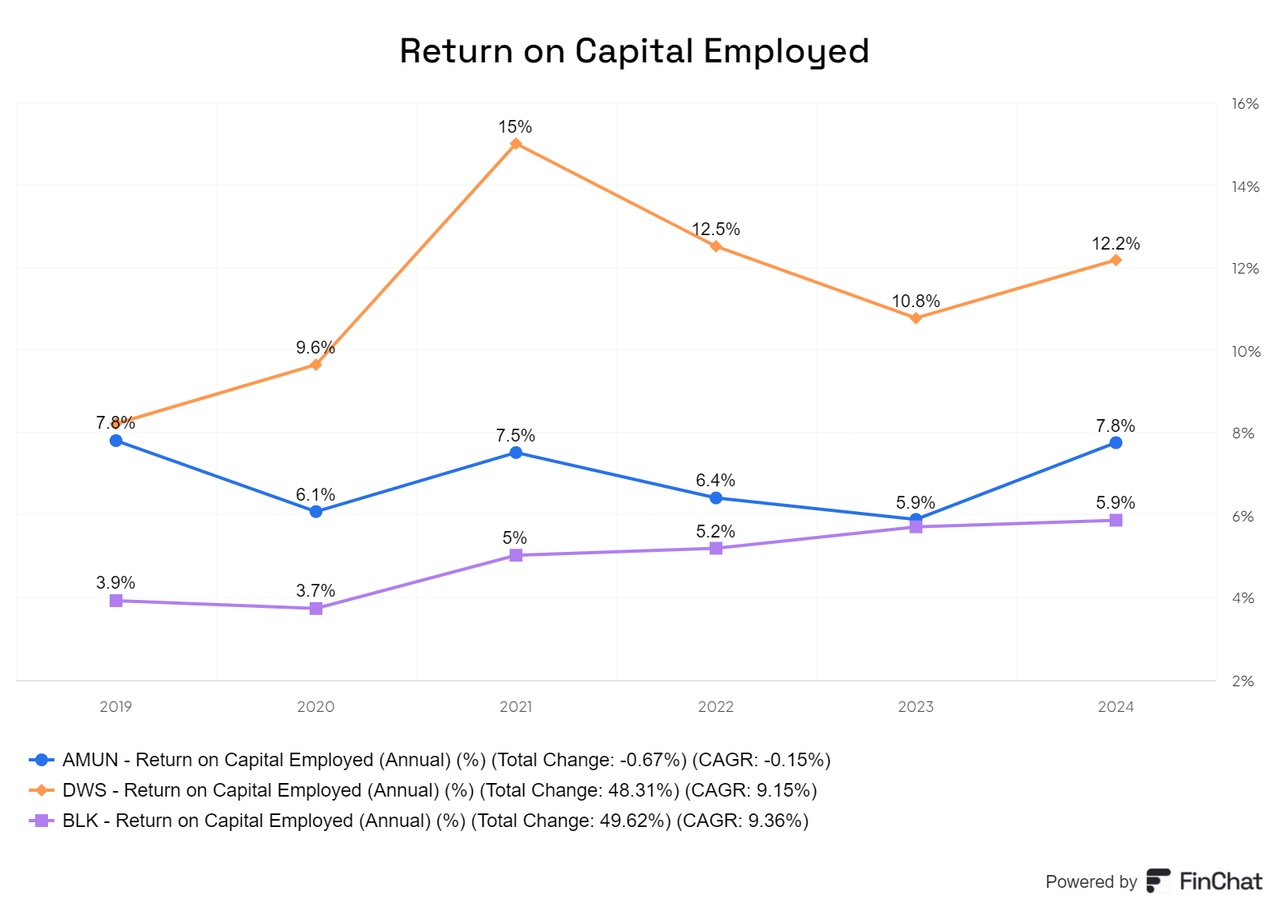

DWS is best positioned in terms of return on invested capital (ROCE) and has been above 10% for some time.

Conclusion

The asset management industry is a growing and highly lucrative industry, and in Europe it is still at the beginning of its development. It is clear that $BLK (-0,27 %) is the leading provider and the first choice for any investor who wants to cover this area with a single share. However, the ETFs from $AMUN (+0,72 %) are hardly any worse and are also attractively valued. In addition, Amundi offers many undiscovered opportunities that have great potential.

What I like about Amundi are several factors, some of which are not purely rational. As a European provider, Amundi differs from $DWS (-0,04 %) and Blackrock because, unlike DWS, it has a better reputation and a better shareholder structure. There is no$DBK (+0,75 %) bank in the background, but the interesting holding company SAS Rue La Boetie, and with it there is not a scandal every two weeks. In addition, Amundi offers incredibly cheap ETFs that should tie up capital in the long term and works closely with the German provider Solactive. Anyone familiar with Prime ETFs knows that they are exceptionally cheap. Although they are not yet recognized by many, they have already had an excellent start. Amundi also offers ALTO, an in-house financial technology that, while not quite at the level of BlackRock, is cheaper and just as helpful in its field. Amundi is also a leader in the ESG market and is one of the pioneers in the field of sustainable investments.

The cheap valuation, proximity to us, a good dividend, low-cost ETFs and solid values alongside BlackRock make an overall investment in Amundi attractive to me. It's not for everyone, mainly due to the withholding tax, but for me it's a good source of dividends that I can also support with my own ETFs.

Overall, I can only recommend buying more European provider ETFs. It doesn't always have to be Amundi - have a look here:https://getqu.in/5nb3cO/