Bond ETF "experts" needed!

Hello again dear community,

today I would like to discuss a topic that I rarely see mentioned (if not at all) here on Getquin: Bond ETFs

After a month or so of DD and research on bonds ( @RaphGM thanks for pointing it out in a comment and sparking my interest on the subject ), much has been learned, and I think I've got the basics down. I'll leave a link to a, in my opinion, well written series of articles for whoever is interested here https://www.bankeronwheels.com/the-definitive-guide-to-bond-index-investing/

To the topic at hand: I've decided to add an initial 5% allocation to bonds in my ETF portfolio, and I think I've got the possible picks all lined up, all distrubiting. Out of this list, I want to pick up at most 2:

So let's start with an overview of each, I purposedly left out all info that classifies as bond jargon, that can be found in the Factsheets, which I'll provide (language specific ones can be fount at justeft when navigating on etf page with your localization, or on issuer official websites).

$ICBU (+0,09 %) iShares USD Intermediate Credit Bond UCITS ETF (Dist)

TER: 0,15%

HEDGED: NO

BENCHMARK: Bloomberg U.S. Intermediate Credit Bond Index

AUM (M): 228,01

YIELD TO MATURITY: 5,24

AVERAGE MATURITY: 5.05

CURR. DIV YIELD: 3,35%

Credit rating composition:

AAA: 9,5%

AA: 6,3%

A: 41%

BBB: 43%

$SEGA (-0,15 %) iShares Core Euro Government Bond UCITS ETF (Dist)

TER: 0,07%

HEDGED: YES

BENCHMARK: Bloomberg Euro Treasury Bond Index

AUM (M): 4440

YIELD TO MATURITY: 3,05

AVERAGE MATURITY: 8.95

CURR. DIV YIELD: 1,47%

Credit rating composition:

AAA: 23%

AA :36%

A: 17%

BBB: 23%

$SPFE (+0,02 %) Bloomberg Global Aggregate Bond UCITS ETF EUR Hedged (Dist)

TER: 0,1%

HEDGED: YES

BENCHMARK: Bloomberg Global Aggregate Bond (EUR Hedged) Index

AUM (M): 566,41

YIELD TO MATURITY: 3,8

AVERAGE MATURITY: 8.48

CURR. DIV YIELD: 2,53%

Credit rating composition:

AAA: 12,3%

AA : 41,8%

A: 31%

BBB: 14%

$IGLE (-0,03 %) iShares Global Government Bond UCITS ETF EUR Hedged (Dist)

TER: 0,25%

HEDGED: YES

BENCHMARK: FTSE G7 Government Bond Index (USD)

AUM (M): 432,94

YIELD TO MATURITY: 3,6

AVERAGE MATURITY: 9,22

CURR. DIV YIELD: 1,98%

Credit rating composition:

AAA: 9,3%

AA :68%

A: 14%

BBB: 8,3%

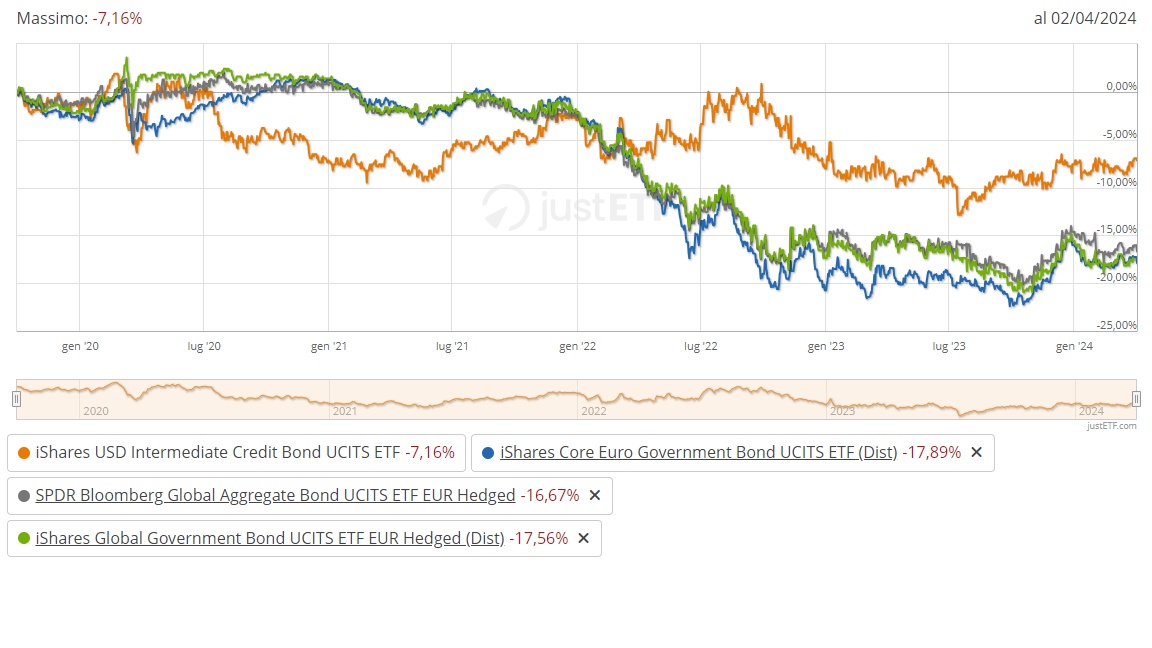

Let's see now how they performed with a quick comparison. First without dividends

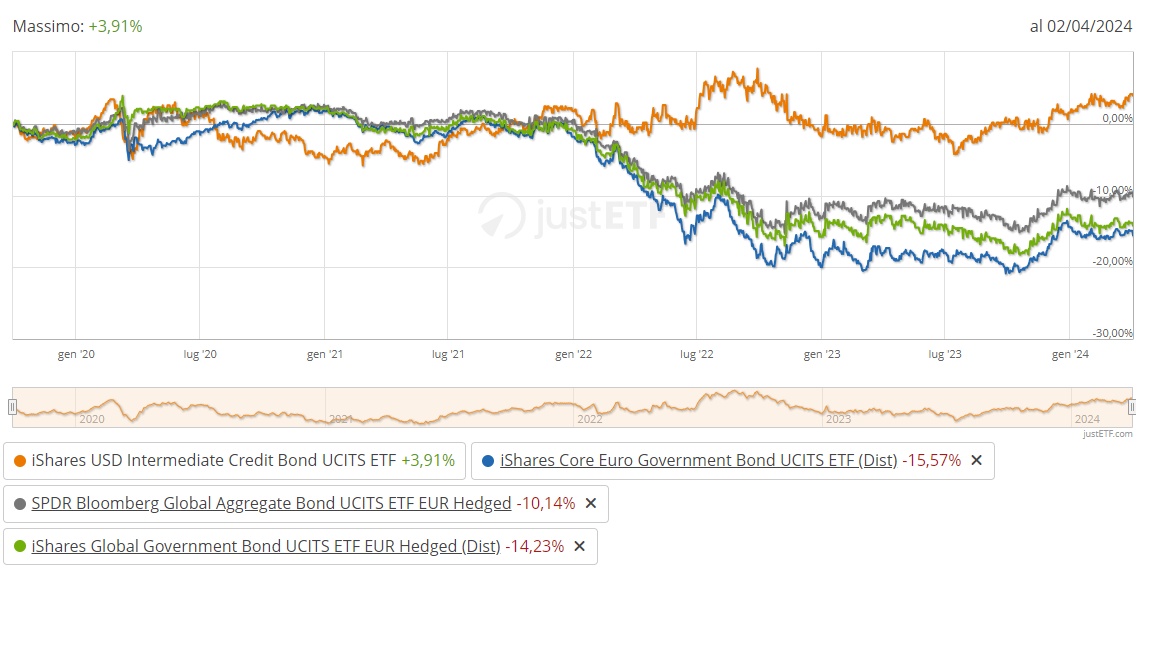

Then including dividends

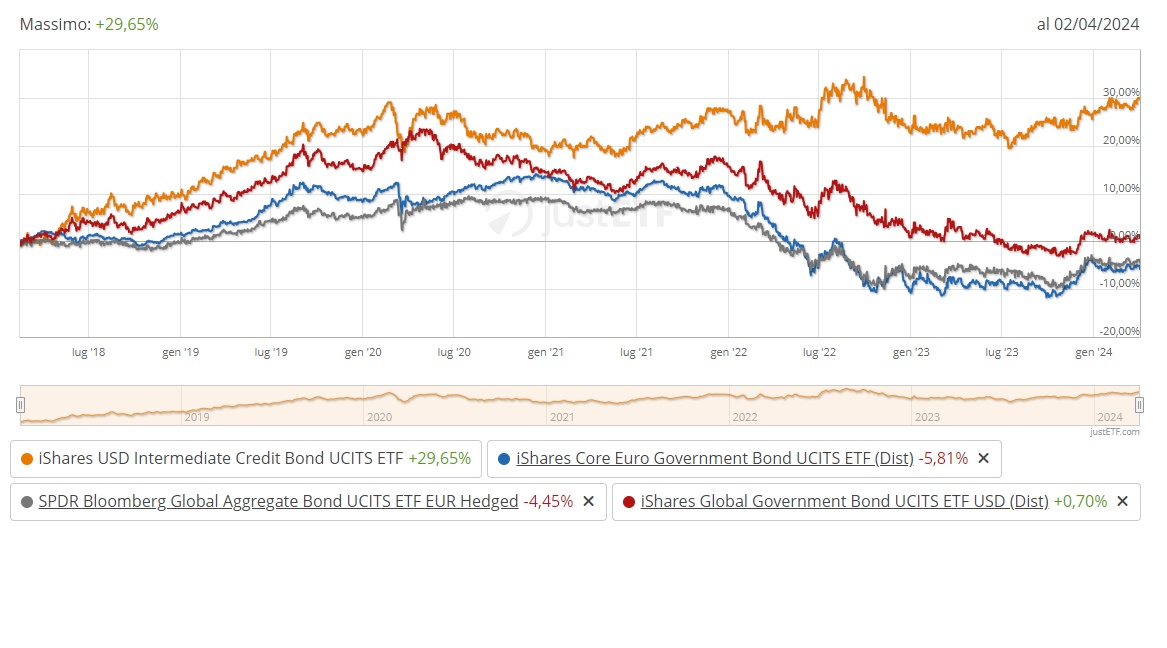

Since I wanted a broader timespan and $IGLE (-0,03 %) is the younger etf of the bunch, we'll swap it in the chart with its unhedged version $IGLO (-0,09 %) and go back to 2017 (divs included)

The charts show some interesting insights:

$ICBU (+0,09 %) is the only one that actually made returns since 2017. After 7 years (7 years of average relative hardship in the global economy) you've actually gained money instead of losing it. One big caveat: USD currency exposure with no hedging

$IGLE (-0,03 %) is the best portfolio stabilizer: lowest drop in the pandemic (extreme event). G7 is the best overall mix of solvency, stability and yield

Eurozone bonds have low distributions and behave like eurozone shares in the timespan: last of the pack. Admittely low risk due to eurozone solvency rate, lowest ter and no currency risk, but with this yield I'm better off with a fixed rate deposit

Global aggregate bonds suffers from exposure to Eurozone, and contains China at ~10%, which leaves me on the fence. Actual regional distribution is 43% North America, 10% JPN, ~47% combined Asia and EU, so assumptions about Eurozone+Asia ex JPN+China seem to be on point.

With all said and done, I just see three options:

$ICBU (+0,09 %) + $IGLE (-0,03 %)

$ICBU (+0,09 %) alone for the time being

$ICBU (+0,09 %) + $SPFE (+0,02 %) but I would have a lot of exposure to corporate bonds

Personally leaning toward one or two, but I'd like to know your opinions on the matter. I might be missing some key points of view, so feel free to drop by in the comments to discuss some more if you want to :)

All the best