And here is another addition to my portfolio. Nibe is for me a pure play on the revolution of the wHeat sector in terms of heat pumps and Co.

The hype of the last months was well sold off and based on my fundamental analysis, it is now worth buying.

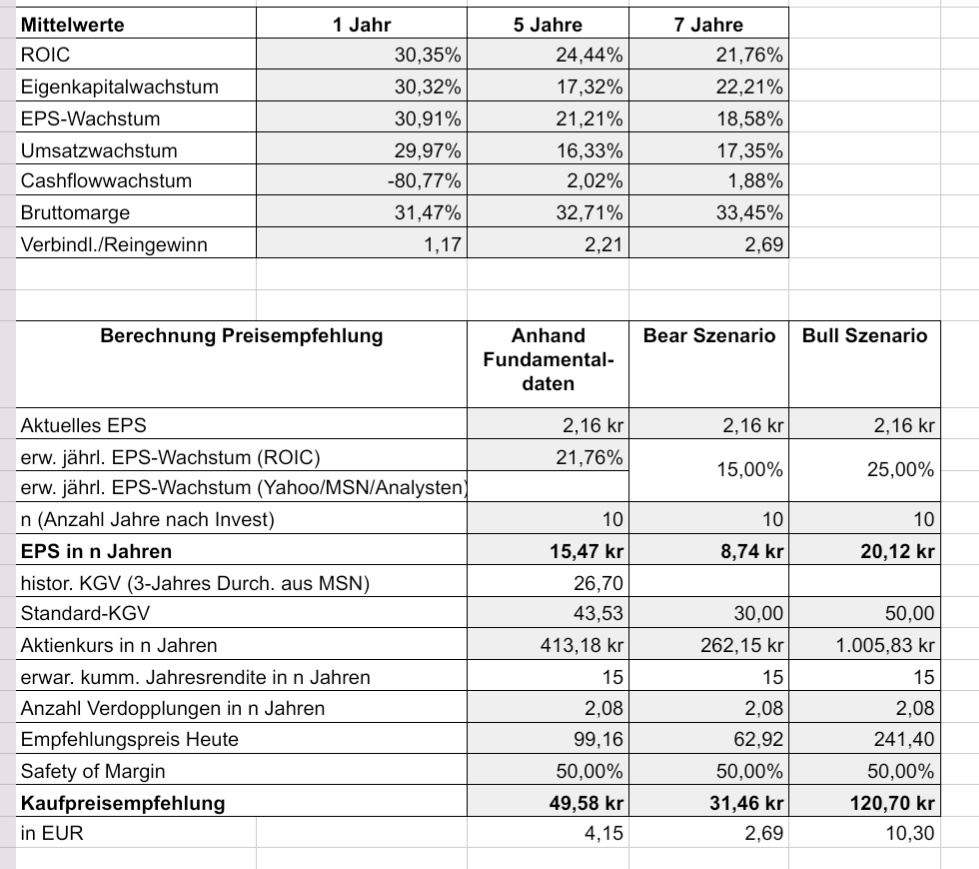

I have also attached an excerpt from my analysis.

What do you think of Nibe? How do you see the future? Do you have the company in your portfolio?