Datadog- The pitbull of data analysis or just 3rd class after all

Company presentation

Datadog and Dynatrace are two of the leading companies in the field of cloud monitoring and observability solutions.

$DDOG (+1,55 %) Datadog, founded in 2010 and based in New York City, offers a SaaS-based data analytics platform that monitors a wide range of IT infrastructure components - from servers and databases to tools and services - across a cloud environment.

$DT is also an American company that specializes in software intelligence platforms. It provides comprehensive solutions for monitoring application performance, infrastructure and user experience.

Historical development

Datadog has experienced impressive growth since its foundation:

- 2015: Completion of a Series C financing round that supported expansion into new markets and further development of the product range.

- Continuous expansion of the platform, especially log management and application performance monitoring

- 2020: Acquisition of Undefined Labs to strengthen testing and observability capabilities.

Dynatrace has also undergone a remarkable development, although concrete milestones are not specified in the available information.

Business model and core competencies

Datadog:

- Offers a cloud-based platform for comprehensive monitoring.

- Core competencies: Infrastructure monitoring, application performance monitoring, log management, user experience monitoring and security monitoring.

- Focuses on continuous innovation and customization.

Dynatrace:

- Provides a comprehensive end-to-end observability solution.

- Core competencies: Unified platform for observability, security and business data.

- Focuses on automated provisioning and AI-supported analyses.

Future prospects and strategic initiatives

Both companies focus on continuous innovation and the expansion of their product portfolios in order to meet rapidly changing technologies and customer requirements.

Datadog has accelerated the development of new products and doubled the number of its paid solutions within the last year.

Dynatrace is focused on further developing its AI-powered analytics tools and optimizing the automated deployment of its solutions.

Market position and competition

In a dynamic and highly competitive market in which companies such as $SPLK (in the $CSCO (+0,68 %) acquisition), New Relic, Elastic and Hyperscaler are also active, both companies are competing for the leading position.

Datadog is recognized as the market leader for its integrated full-stack monitoring solutions.

Dynatrace is positioned as a leader in end-to-end observability with a particular focus on AI-powered solutions.

Market potential (Total Addressable Market, TAM)

Although exact TAM figures are not provided, it is clear that both companies are operating in a rapidly growing market for cloud monitoring and observability solutions, which is being driven by the increasing digital transformation in various industries.

Share performance

Datadog:

- 1-year performance: 5.7%

- TR since the IPO on 19.09.2019:186.83%

- Currently 19.90% below the 52-week high and 45.61% above the 52-week low.

- 84% of analysts recommend the share as a buy (60% "Strong Buy", 24% "Buy").

Dynatrace:

- 1-year performance: 5, %

- TR since the IPO on 01.08.2019 : 113.42%

- Currently 16.99% below the 52-week high and 28.76% above the 52-week low.

- 77 % of analysts recommend the share as a buy (57 % "Strong Buy", 20 % "Buy").

Despite short-term fluctuations, both companies are performing positively overall.

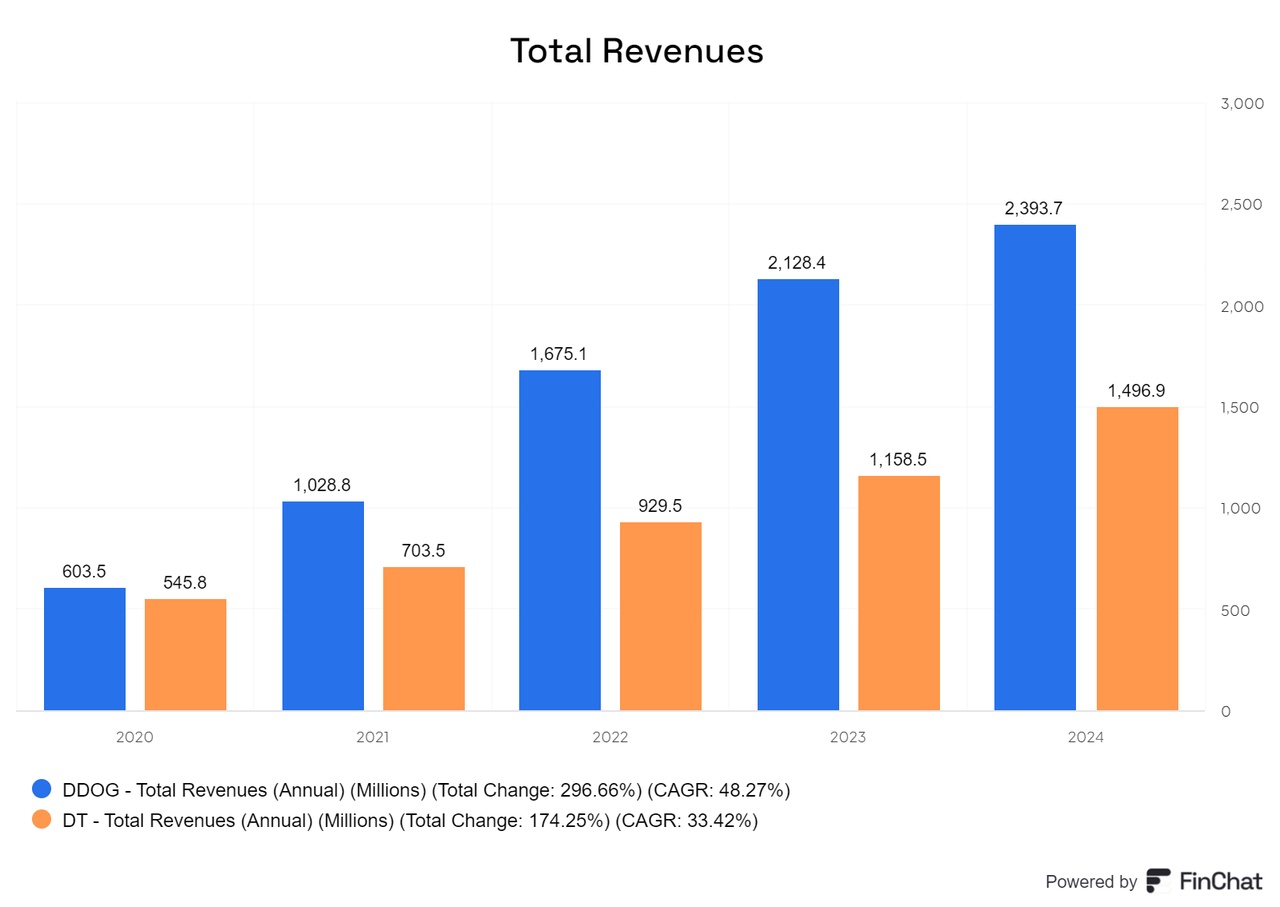

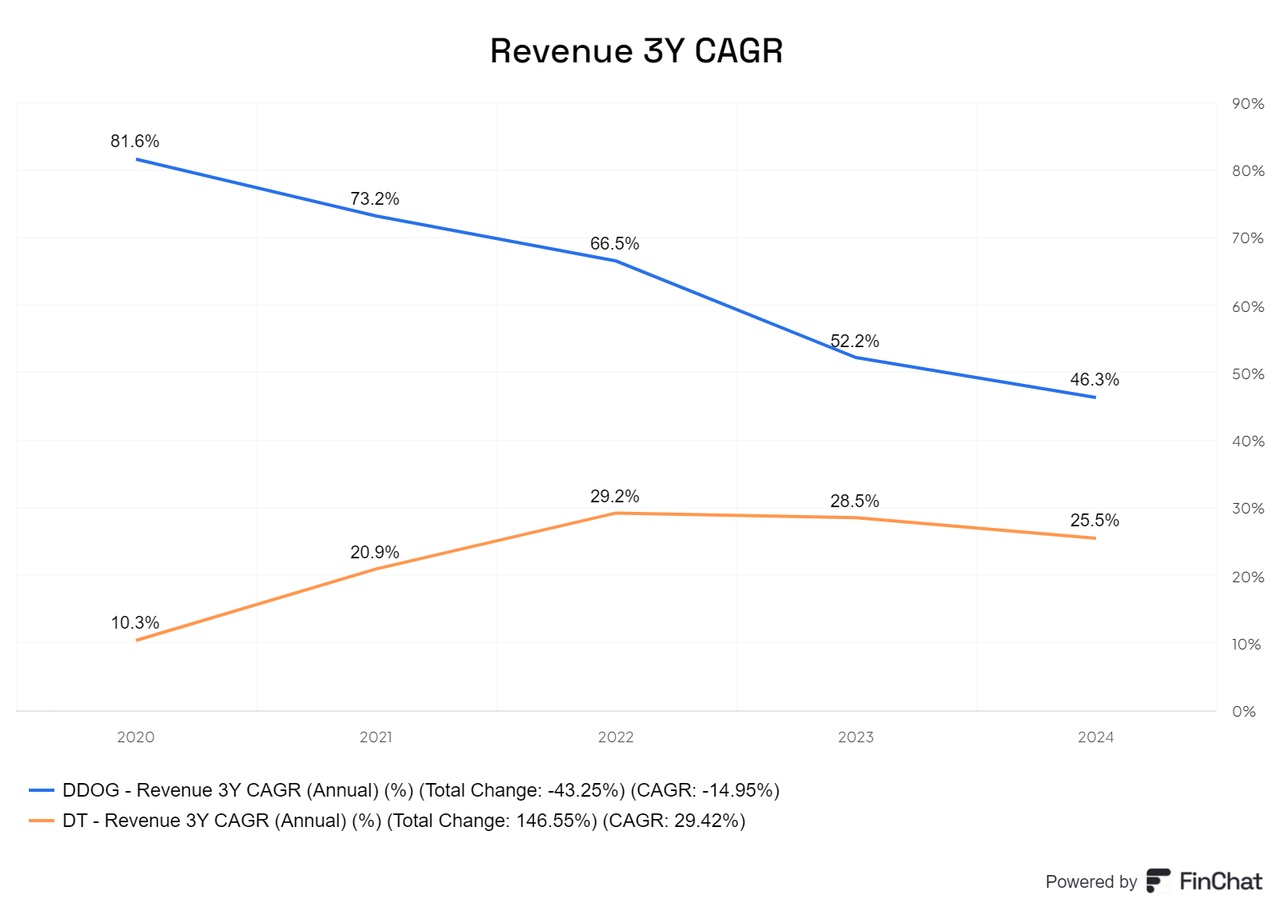

Development

Both companies are recording continuous sales growth, with Datadog showing significantly stronger growth momentum than Dynatrace. As a result, Datadog's turnover is currently around one billion US dollars higher than that of Dynatrace. Nevertheless, the growth rates of both companies are still impressive and are expected to remain at a high level in the coming years.

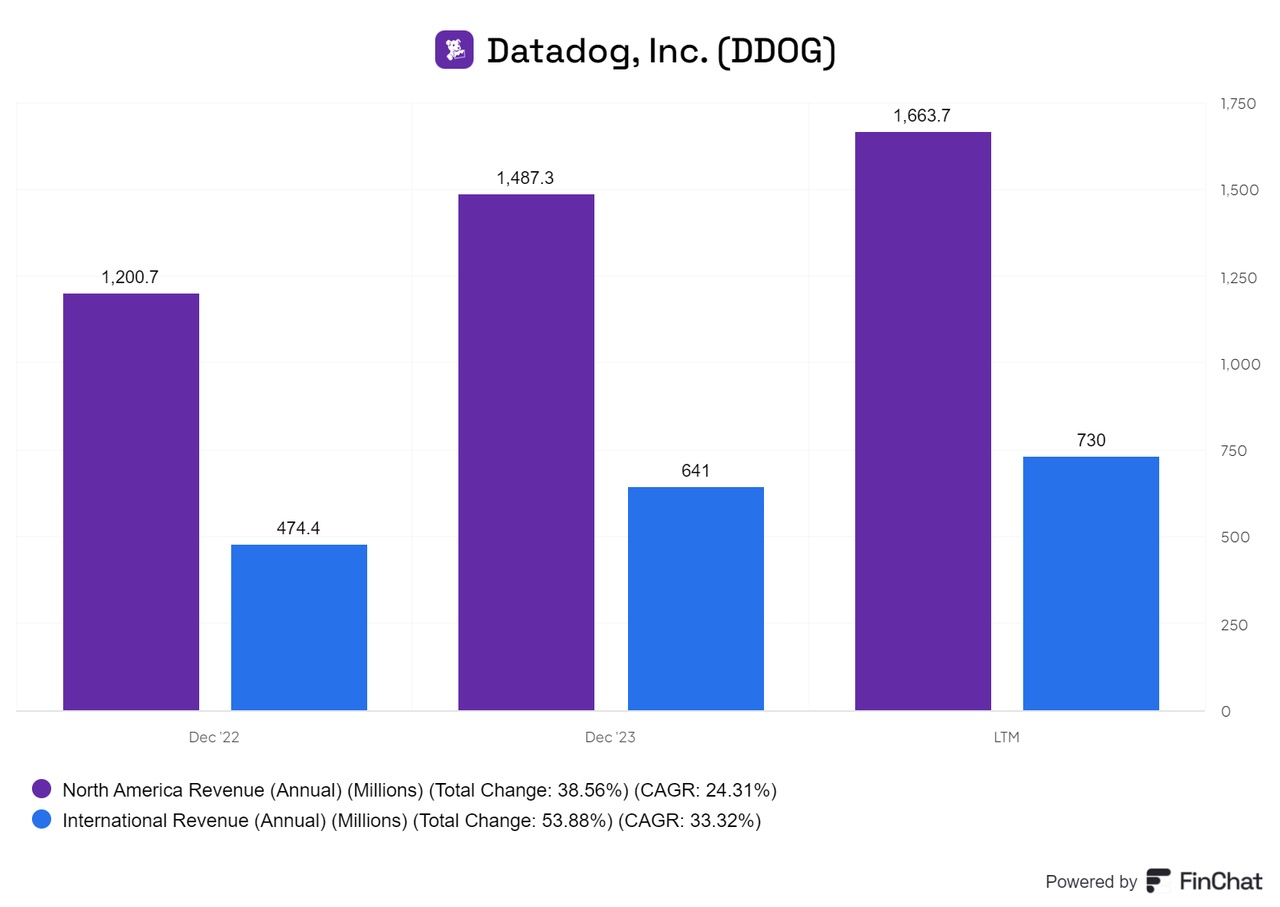

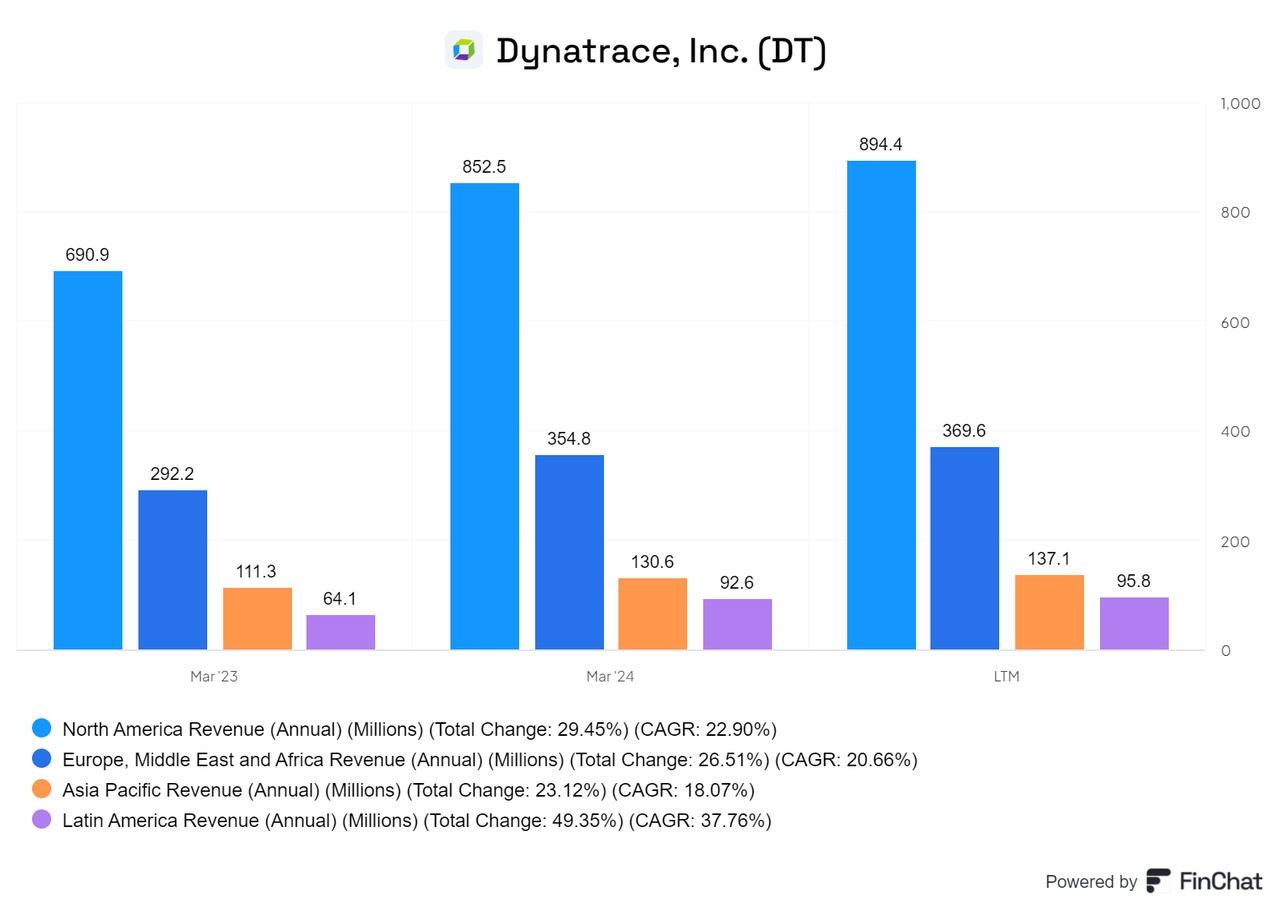

Looking at the distribution of sales by country, it is clear that Datadog concentrates its sales heavily on North America, while Dynatrace is much better diversified internationally.

Despite this difference in geographic focus, Datadog's focus on North America could be seen as a strategic advantage, as the data business in the US is generally more valuable than in many international markets. The strong foothold in North America provides Datadog with a solid foundation to capitalize on the high demand and lucrative business opportunities in the region.

Internationalization should not be difficult for Datadog due to its existing successful model. With its proven product range and high level of innovation, the company is well positioned to gain a foothold on a global level and grow in other markets.

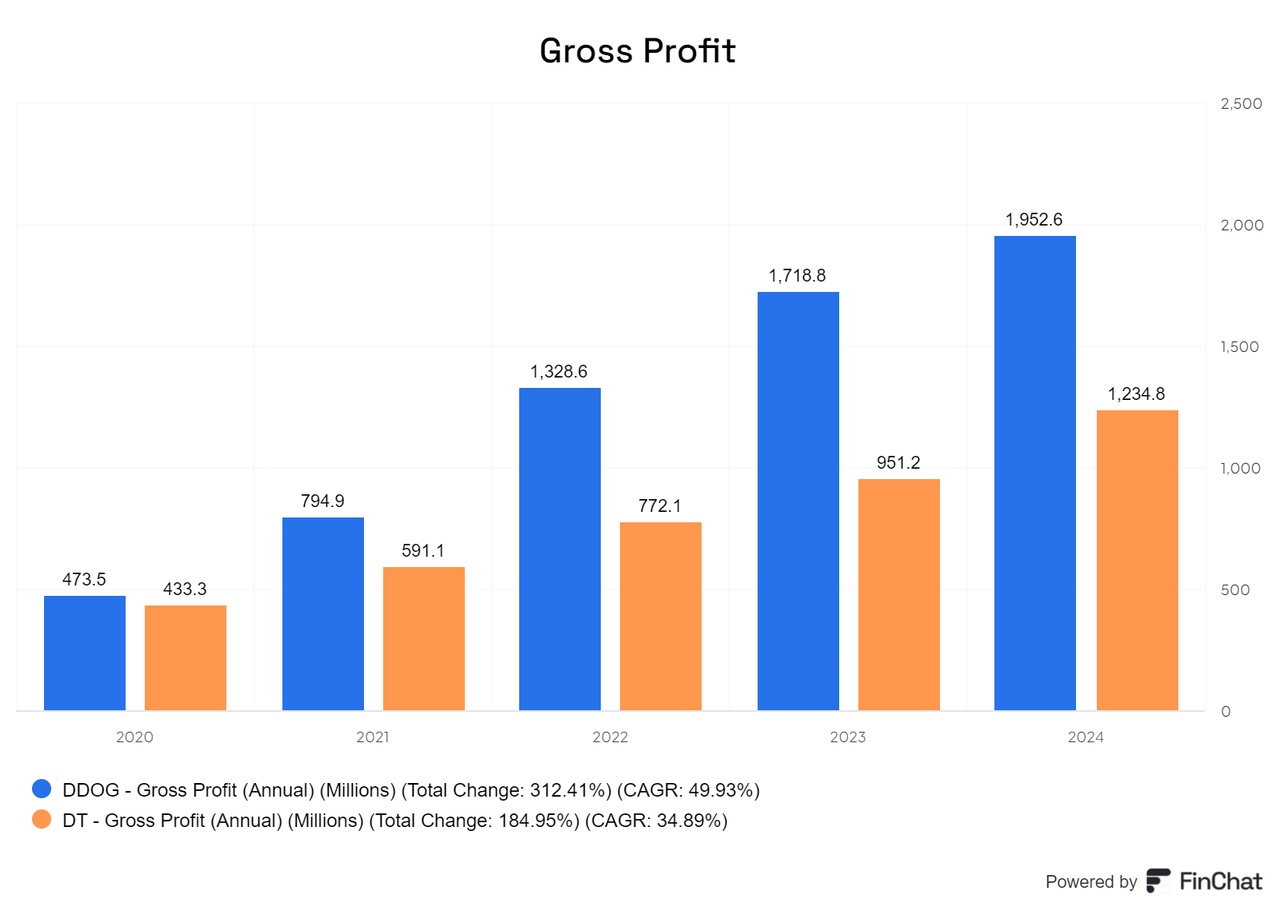

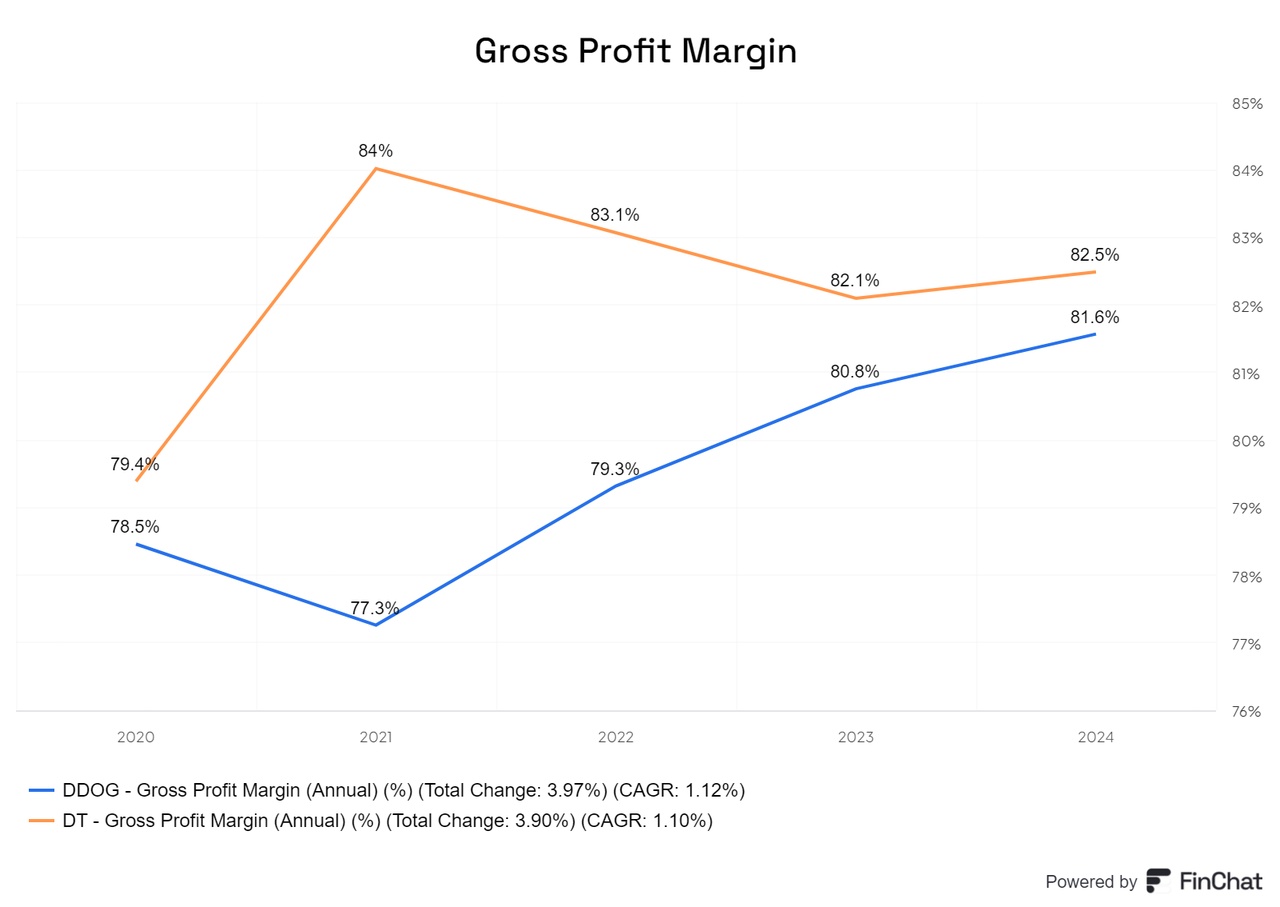

As with sales, Datadog's gross profit is also higher than that of Dynatrace. The gross margins of both companies are almost the same, although Dynatrace had a higher margin at the beginning.

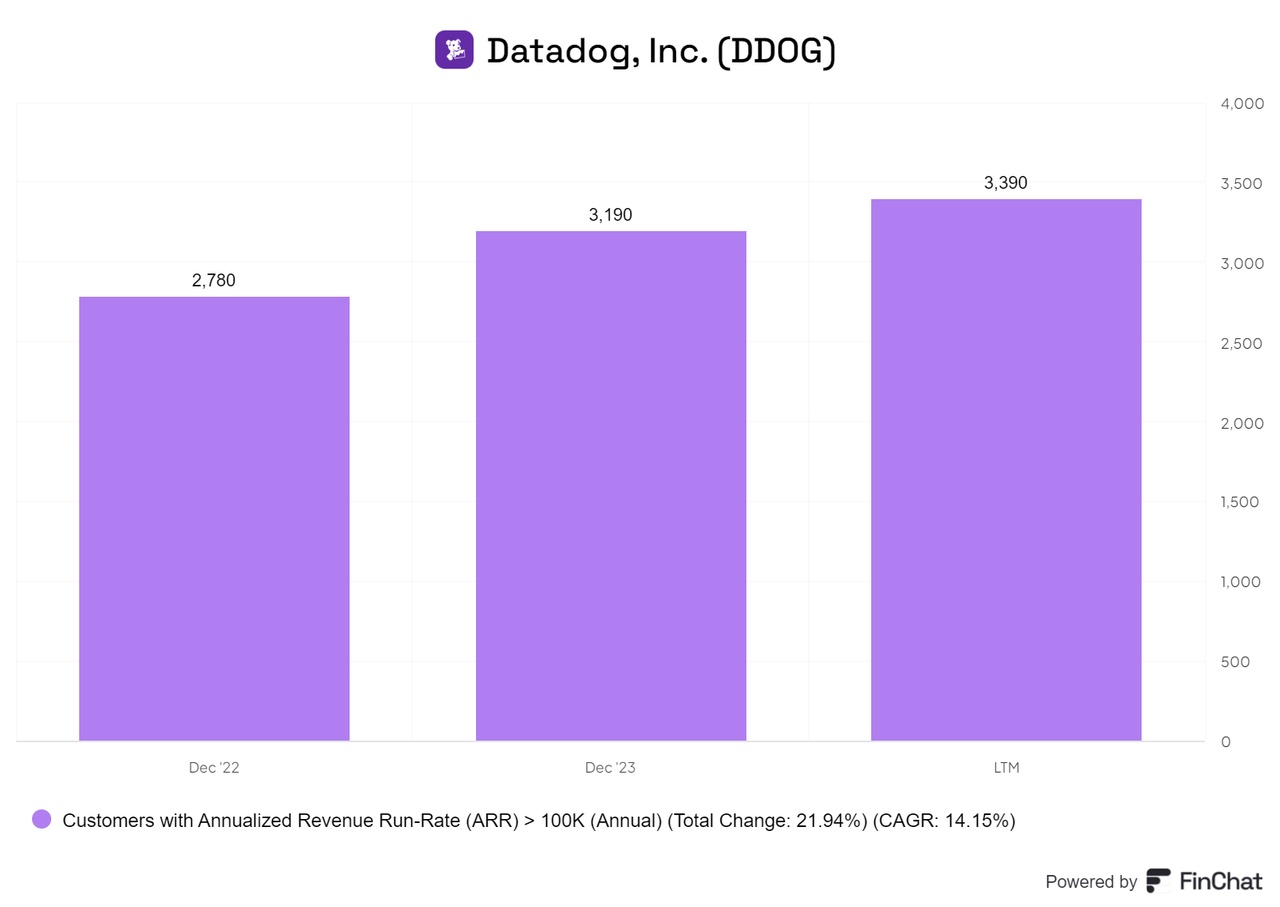

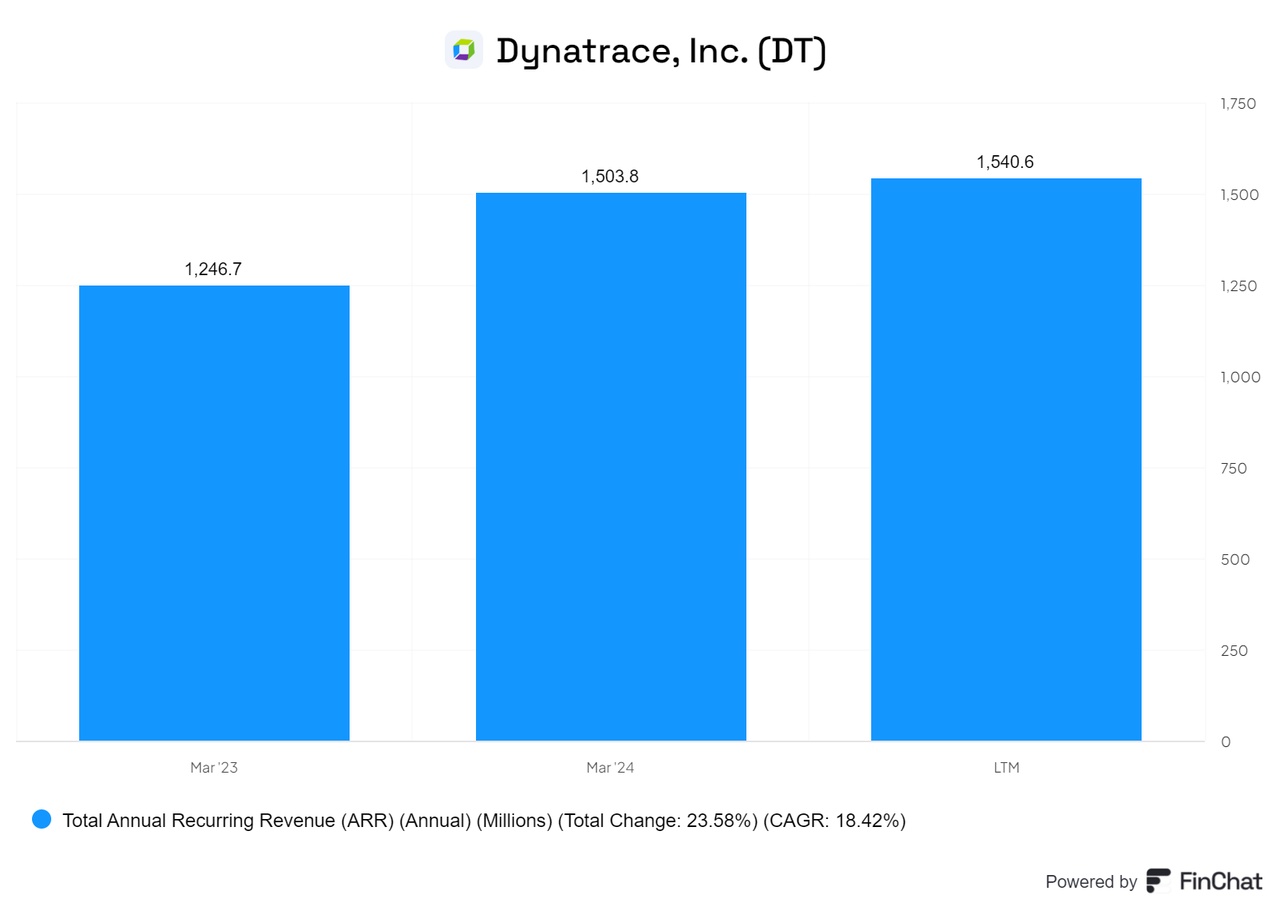

The Annual Recurring Revenue (ARR) of Datadog is currently twice as high as that of Dynatrace, which underlines Datadog's strong growth momentum and market position.

A higher ARR means that Datadog is able to grow recurring revenue faster and effectively leverage long-term customer relationships. This growth may have been driven by successful expansion into new markets and the introduction of additional products and services. A high ARR is also a sign of strong demand and high customer satisfaction, which could be due to the broad offering and versatility of the Datadog platform.

Dynatrace, although also with solid growth rates and a stable ARR, remains smaller compared to Datadog. Nevertheless, it shows that both companies have strongly focused their business models on recurring revenues, which is an important indicator of sustainable growth and financial stability in a competitive market.

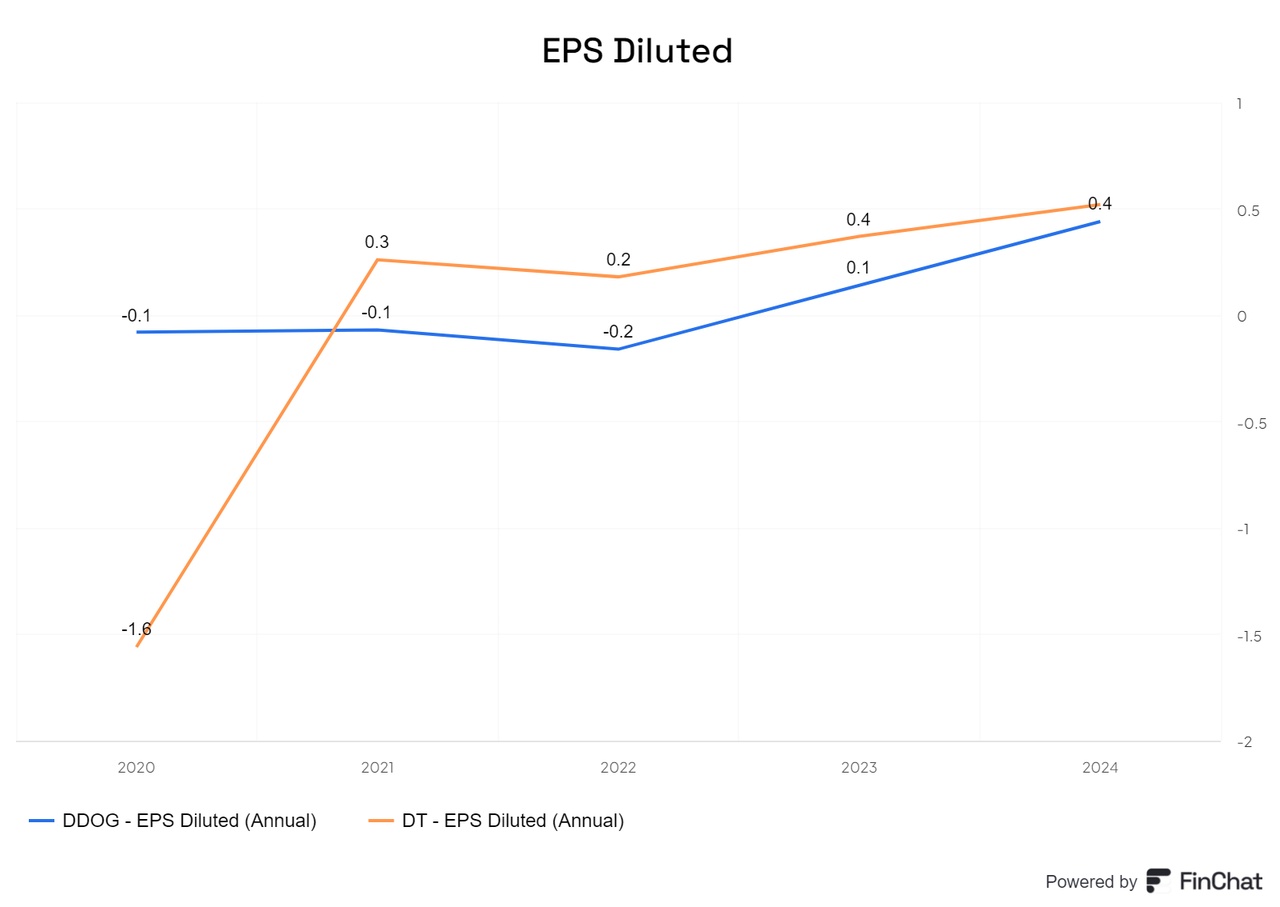

Despite the smaller revenues, it shows that Dynatrace has a better EPS than Datadog.

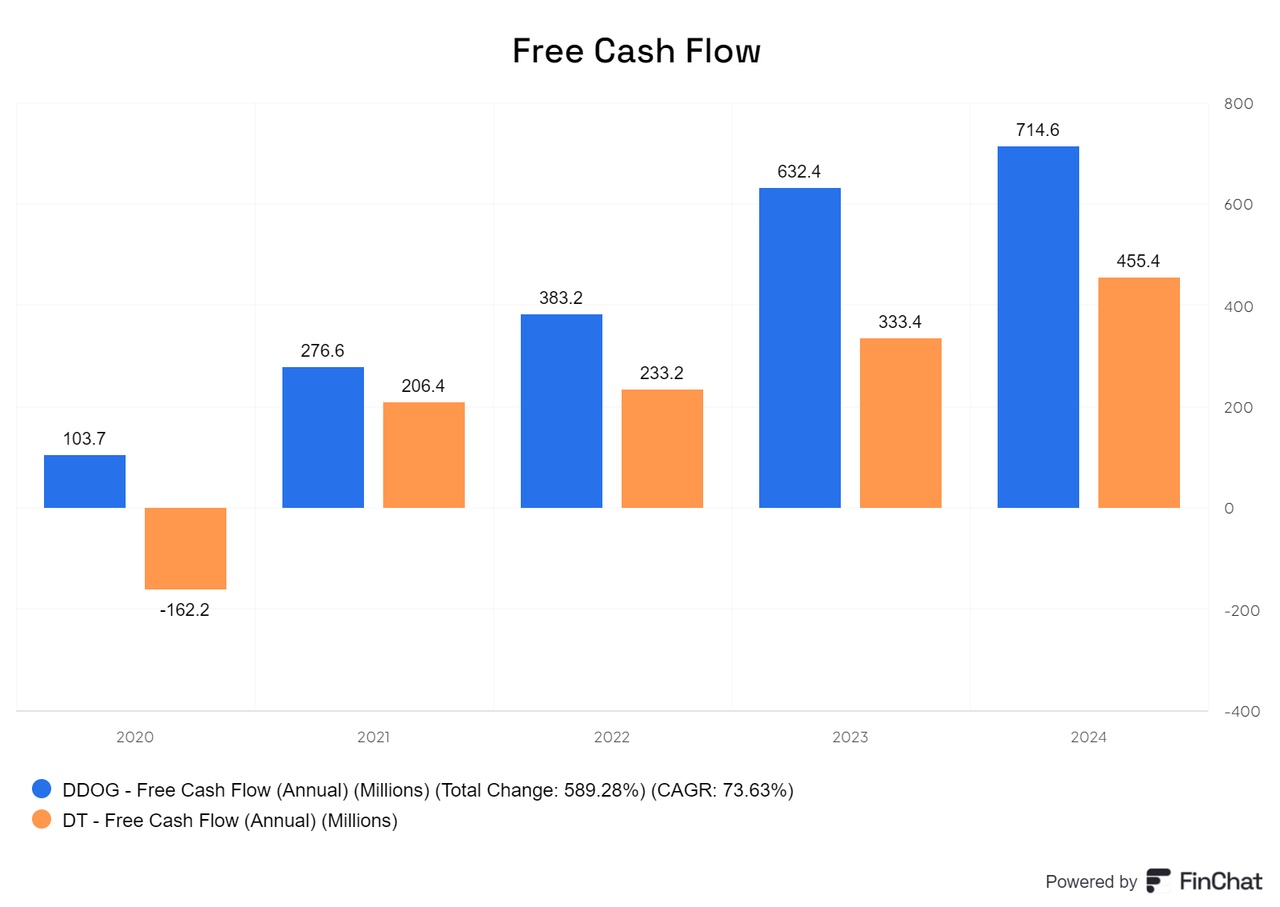

FCF is positive for both

Part 2: https://getqu.in/wuxnDJ/