Mid-April 2025 finds the tanker market navigating turbulent waters. VLCCs grapple with softer forecasts amid trade wars, Suezmax and Aframax ride high on Atlantic scarcity, and clean tankers seize new routes from Argentina to Mexico. Sanctions choke Venezuelan flows, U.S. port fees loom, and shadow fleets bend under pressure. This is a sector steering through chaos with resilience—let’s dive into its journey.

⏬ VLCC Market: Holding the Line

Earnings Snapshot

The VLCC fleet, crude’s colossal carriers, faces headwinds as global demand forecasts falter. Baltic Exchange spot rates from Middle East-to-Asia hover at $36,500 per day, with Clarksons Securities slashing 2025-2026 projections to $50,000 per day (down from $70,000), citing trade war impacts. Eco-ships are projected to earn $53,000 daily, older units $46,000. DHT Holdings $DHT (+1,51 %) reports Q2 spot bookings at $48,700 per day (56% covered) and time-charter earnings at $45,100. A seven-year charter for DHT Appaloosa at $41,000 daily (plus profit-sharing) signals long-term faith, though tariff jitters keep sentiment cautious.

Supply and Demand Shifts

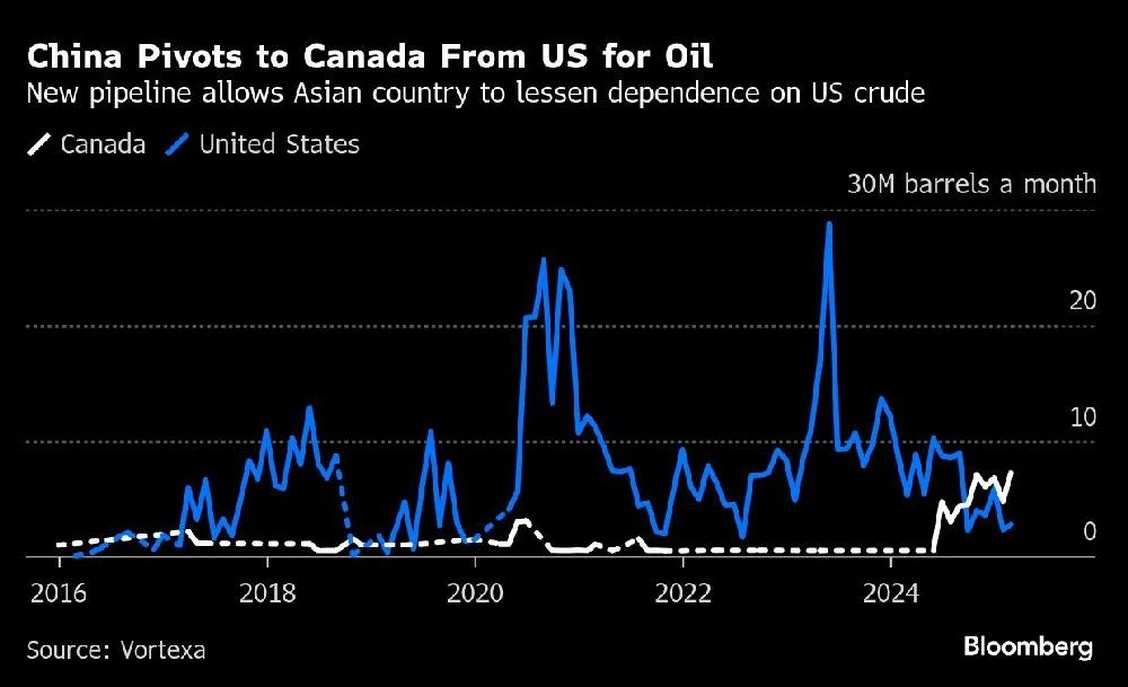

OPEC+’s output hike and Venezuela’s halted U.S. exports reshape flows. Venezuela’s 250,000 barrels per day to China (four VLCCs monthly) may lean on shadow fleets or transshipment hubs like Malaysia, per Braemar, limiting mainstream gains. However, Pakistan’s proposed 16 million barrel U.S. crude imports (eight VLCCs) and China’s 7.3 million barrel Canadian surge via Trans Mountain Pipeline offer long-haul promise. U.S. sanctions sideline Iranian shadow VLCCs (e.g., Bestla, Egret), potentially freeing 13 compliant ships for 500,000 barrels daily—Clarksons sees rates struggling below $45,000 without this shift.

Broader Impacts

The IEA’s 33% cut in 2025 oil demand growth (to 730,000 barrels per day) and OPEC’s 1.3 million barrel forecast dent confidence, with Brent crude at $61.57 per barrel pressuring shale output by 2026. U.S.-China tariffs (145% vs. 10% globally) and U.S. port fees ($18-$33 per net tonne by 2028) spark caution, though exemptions for ballast vessels ease fears. DHT’s sale of Chinese-built VLCCs Lotus and Peony for $103 million reflects strategic pivots—VLCCs hold steady, eyeing tighter fundamentals.

⏳ Suezmax Market: Atlantic Surge

Rate Climb

Suezmax tankers, mid-tier powerhouses, soar on Atlantic scarcity. Spot earnings top $50,000 per day, with Braemar noting firm markets as Venezuela’s export halt (200,000 barrels per day to the U.S.) floods the basin with available ships. Czechia’s shift to Transalpine Pipeline imports via Trieste (from Russian Druzhba) boosts Mediterranean demand for Norwegian and Azerbaijani crude. Rates for eco-Suezmax climb to $52,000 daily, up from $47,000 last week, driven by tight tonnage and rerouting.

Hot Zones

Venezuela’s suspension of Chevron’s $CVX (+0,76 %) cargoes (e.g., Dubai Attraction, Carina Voyager) leaves eight Aframaxes monthly seeking Atlantic trades, indirectly tightening Suezmax lists. Turkey’s Tupras resumes Russian Urals at $57 per barrel, with Kyklades’ Nissos Christiana delivering 730,000 barrels to Izmit. Pakistan’s potential U.S. crude imports (16 Suezmaxes equivalent) add upside. Mediterranean fixtures rise as Czechia’s 175,000 barrel-per-day refineries tap TAL—scarcity fuels this fiery ascent.

Trade Twists

U.S. sanctions on Iranian tankers (e.g., Reston, Nyantara) and Chinese refiners like Shandong Shengxing curb shadow fleet capacity, nudging mainstream demand. China’s pivot to Canadian crude (7.3 million barrels in March) stretches Pacific hauls, while Venezuela’s pivot to Asia via transshipment hubs like Singapore tests compliance. Tariff pauses (90 days for Pakistan) offer breathing room, but geopolitical heat keeps Suezmax on edge—resilient yet alert.

⏱️ Aframax Market: Atlantic Thunder

Rate Highlights

Aframax tankers, agile crude haulers, roar with spot earnings exceeding $50,000 per day. U.S. Gulf-to-UK Continent rates hit WS195, yielding $54,000 daily, while Mediterranean rates climb to WS180, netting $62,000. Venezuela’s export freeze floods the Atlantic with tonnage, yet redirected ships find work in Brazil-to-China ($18.74 per tonne) and Trieste-bound Czech flows. Baltic TCE rises to $50,500 per day (up $1,200 daily), with eco-Aframax at $53,000—Atlantic vigor prevails.

Tonnage Trends

Venezuela’s halt (six Aframaxes idled, including Pegasus Star, Ionic Anax) creates a surplus, but Braemar expects quick redeployment to non-sanctioned trades like Guyana-to-Europe. George Economou’s sale of eight Aframaxes (e.g., Monarch I, Saraswati) to Chinese buyers for Russian trades tightens compliant tonnage—six ships lift Urals from Primorsk in March. U.S. port fees exempt vessels under 55,000 dwt, sparing smaller Aframaxes—lists tighten as demand holds.

Sanctions Strain

Russian Urals at $57 per barrel (below G7’s $60 cap) draw Greek owners like Stealth Maritime (Suez Enchanted) to Primorsk, with G7-insured tankers up 36% in March. U.S. sanctions blacklist 140 shadow ships, squeezing Russia’s fleet—mainstream Aframaxes fill the gap, hauling to India and China. Czechia’s TAL shift and Tupras’ Russian pivot add cargoes—sanctions reshape routes, but Aframax thrives on Atlantic strength.

For illustrative purposes

⏸️ LR/MR/Handymax Market: New Horizons

Rate Rundown

Clean tankers sail divergent paths. LR2 MEG-to-Japan drops to WS125, netting $30,000 daily, while LR1 MEG-to-UK Continent falls to $2.9 million. MR Pacific rates slide to $19,500 per day (down 15%), but Atlantic MRs hold at $22,000. Torm’s $TRMD A (-0,44 %) MR Torm Singapore pioneers 300,000 barrels of ultra-low sulphur diesel from Mexico’s Dos Bocas refinery, and Tsakos’ $TNP (+0,77 %) LR1 Chantal and Selecao lift 1.47 million barrels of Argentine fuel oil to the U.S. Handymax Med TC6 jumps to WS195, yielding $25,000 daily—West shines, East fades.

Market Moods

New trades spark optimism. Argentina’s fuel oil exports hit 66,000 barrels per day in March (up from 7,000), driven by arbitrage to Houston and Honolulu. The UK-to-Colombia petrol route (Energy Ariadne, 41,000 tonnes) reopens after a year, fueled by Europe’s 350,000 barrel-per-day surplus. Mexico’s Olmeca refinery curbs U.S. clean imports, yet Dos Bocas exports lift MR demand. Eastern LR rates sag, but Western MRs and Handymax surge on tight supply—split seas define this market.

Outside Forces

U.S. port fees (71% of tanker orderbooks Chinese-built) prompt sales like DHT’s VLCCs, but exemptions for small vessels shield MRs. Tufton $SHPC Assets sees tankers benefiting from tariff-driven rerouting—South America’s petrol deficit and Europe’s surplus stretch tonne-miles. Sanctions on Iranian and Venezuelan flows push shadow trades to Asia, capping clean tanker gains—Western markets lead, buoyed by new routes.

The Petroleos Mexicanos Dos Bocas Refinery in Paraiso, Mexico - For illustrative purposes

🌐 What’s Moving It: Oil and Geopolitics

Oil and Supply

IEA’s 730,000 barrel-per-day demand growth (down 300,000) and OPEC’s 1.3 million forecast signal softer oil needs, with Brent at $61.57. Venezuela’s 680,000 barrel-per-day exports pivot to China (250,000 barrels), Pakistan eyes 16 million U.S. barrels, and Czechia’s TAL shift adds Mediterranean cargoes. Sanctions sideline shadow fleets (140 Russian, five Iranian tankers), lifting mainstream utilization—oil flows steer this market’s course.

Global Dynamics

U.S.-China tariffs (145%) and Venezuelan sanctions (25% on buyers) disrupt flows, though 90-day pauses offer relief. U.S. port fees ($18-$33 per net tonne) and Houthi strikes in Yemen add tension, but tankers outpace containers, per Tufton, via rerouting. George Economou’s ISAB refinery seeks new suppliers, signaling trade shifts—geopolitical storms test tanker resilience.

🌐 Market and Stocks: Value in the Vortex

Stock Swings

Tanker stocks rebound 13% week-on-week, per Clarksons, after a 13% tariff-driven drop. Frontline $FRO (-1,15 %) jumps 20% to $15.50, DHT $DHT (+1,51 %) rises to $10.71, but IEA’s demand cut trims gains—Frontline, DHT, and International Seaways $INSW (-0,89 %) dip 2%. Tufton’s $SHPC Q1 profit falls to $8 million (from $11.76 million), with a -10.4% NAV return as asset values slide. Clean tanker stocks like Scorpio $STNG (-0,04 %) (down 1%) and Torm $TRMD A (-0,44 %) (down 2%) hold firmer.

Investor Angles

Clarksons sees tanker equities at 73% of NAV for crude (58% for clean), implying VLCC rates below $40,000—undervalued with upside. Suezmax and Aframax earnings above $50,000 draw buyers, per Seaborne’s Eva Tzima, with IMS’ $26.3 million LR2 purchase signaling confidence. Tufton eyes rerouting benefits, while sanctions on shadow fleets could tighten markets—investors see value, but tariff risks linger.

Sector Outlook

Scaled-back port fees and tariff pauses lift sentiment, but Chinese tariffs threaten costs. Aging fleets (12% over 20 years) and low orderbooks (3% growth) hint at 2026 tightness. Stocks lag fundamentals, ripe for gains if trade stabilizes—tankers gleam as undervalued bets in the chaos.

For illustrative purposes

🌐 Outlook: Shifting Currents

Fluid Futures

VLCCs hover at $36,000-$50,000 daily—sanctions and new trades offer lift—steady. Suezmax at $50,000-$55,000—Atlantic scarcity powers on—robust. Aframax at $50,000-$62,000—Atlantic thunders—strong. Clean tankers split: LR at $25,000-$30,000, MR at $19,000-$22,000—West rises, East wanes—mixed. Rerouting and sanctions shape upside—2026 beckons if stability holds.

Your Call

Will Suezmax keep soaring, or clean tankers steal the show? Share your take—let’s chart the seas! 🚢

*The Worldscale (WS) rate is a system used to calculate tanker freight rates, where WS 100 represents a standard base rate for a specific route. Rates above or below this benchmark indicate how much more or less a charterer will pay relative to the base cost. A higher WS rate means better earnings for shipowners, while a lower WS rate means lower transportation costs for charterers.