$CPNG (-0,14 %)

$PLTR (-0,65 %)

Hello my dears,

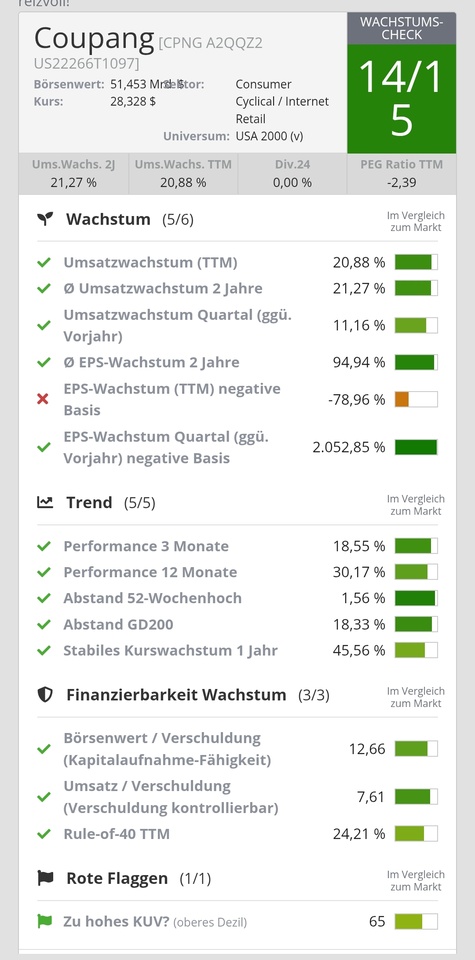

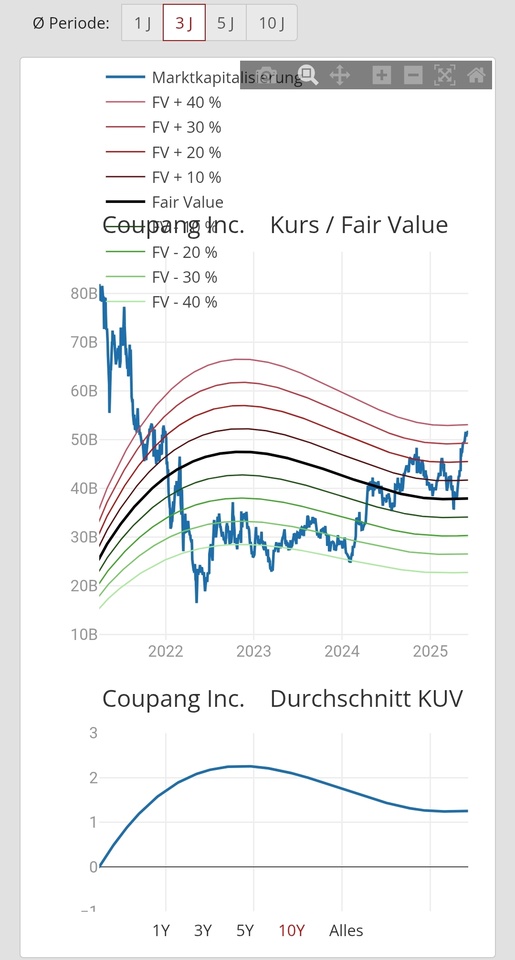

Today I took a look at coupang's key figures.

I am impressed by the triple-digit earnings growth for the next few years.

As a result, the P/E ratio continues to fall and we are at a PEG below 1

(I have made a comparison with Palantir, which you can see in the attachment)

I am invested in coupang and am about to buy more. (Therefore, do not consider this post as an investment recommendation, but as a message about my investments).

Coupang, Inc, a company headquartered in Seattle, Washington, operates primarily in South Korea and, together with its subsidiaries, runs an extensive e-commerce business. This is mainly conducted via mobile applications and websites. The company is active in two areas: product trading and the development of new offerings.

Coupang offers a wide range of products and services. These include household goods and decorative items, clothing, beauty products, fresh food, sporting goods, electronics and everyday consumer goods. The company also offers travel and restaurant ordering and delivery services.

Coupang's specialty services include Rocket Fresh, a fresh food delivery service, Coupang Eats, a restaurant ordering and delivery service, and Coupang Play, an online content streaming service. The company also offers advertising products.

In addition to South Korea, Coupang also operates and provides operational and support services in the United States, Japan, Taiwan, Singapore and China. The company was founded in 2010.

Morgan Stanley names Coupang (CPNG) as its new top pick and raises price target

Park Dae-jun to drive Coupang's AI expansion as sole CEO

Strong growth and higher profitability: Coupang launches 1 billion share buyback