$AAPL (+0,25 %) is on the verge of becoming the second company in history to reach a staggering $4 trillion market capitalization, an achievement driven by the phenomenal demand for its newly launched iPhone 17 series and an invigorated investor sentiment.

iPhone 17: A Record-Breaker

Apple’s iPhone 17 launch has exceeded all expectations, with first-ten-day sales outpacing last year’s iPhone 16 by 14% in both the United States and China, according to Counterpoint Research. The base model saw a 33% sales increase compared to its predecessor, particularly in China, where consumers are clearly favoring the more affordable variants. Meanwhile, in the U.S., the premium iPhone 17 Pro Max has become a consumer favorite, thanks in large part to substantial subsidies from carriers such as AT&T, Verizon, and T-Mobile, which are bundling the device with long-term contracts and making it accessible to a broader audience.

This aggressive carrier pricing strategy has transformed the ultra-premium iPhone into a mass-market product in America, locking in customers for years and ensuring steady recurring revenue for telecom companies.

- Read Counterpoint’s full analysis: Counterpoint Research

- Yahoo Finance coverage: Apple stock price closing in on $4T

Market Sentiment & Analyst Upgrades

Wall Street is buzzing on the back of Apple’s sales momentum:

- Loop Capital raised its Apple price target to $315 (from $226).

- Evercore ISI reaffirmed its “Outperform” rating and added AAPL to its Tactical Outperform list, with a $290 target.

- Wedbush maintains Apple as one of its “Best Ideas” for 2025, estimating the iPhone 17 could unlock the largest upgrade cycle in Apple’s history, with over 300 million users poised to upgrade after four years.

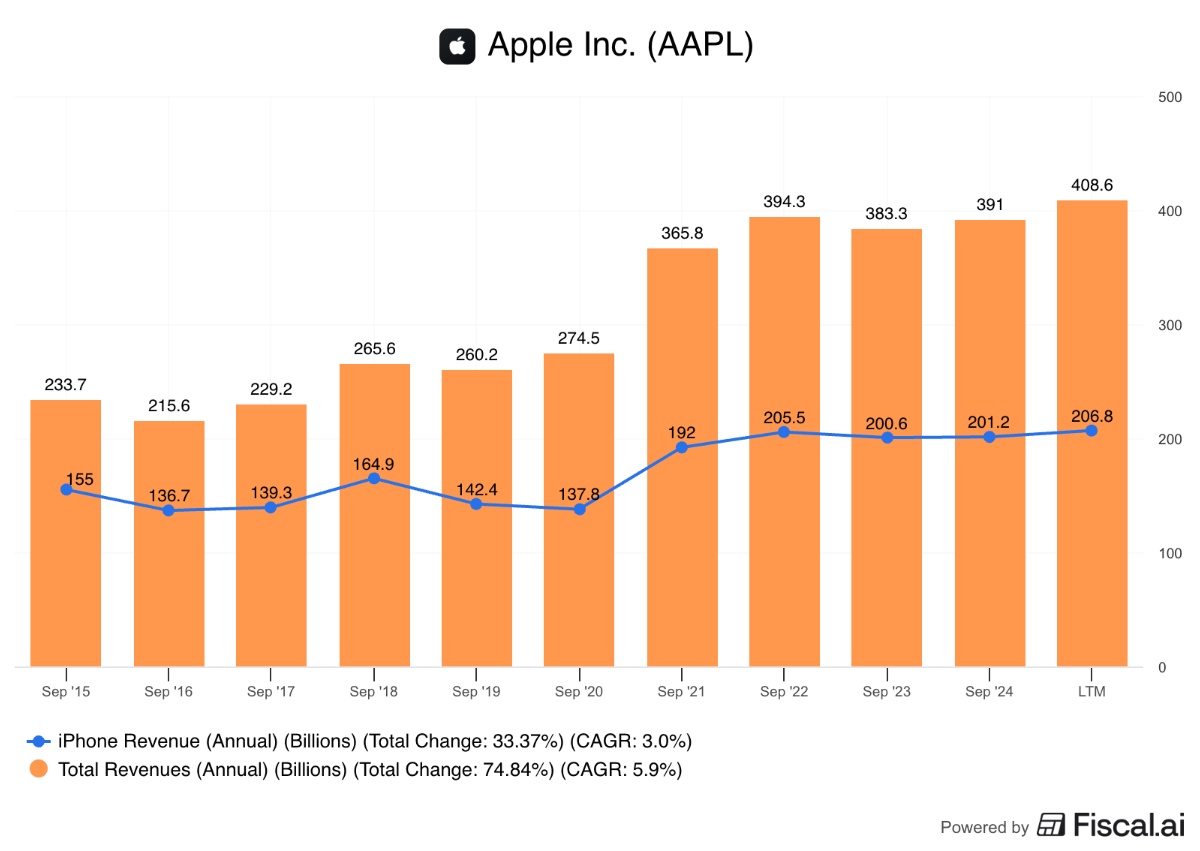

Apple’s market cap is now at $3.89 trillion (October 2025), making it the world’s second most valuable company. Shares recently peaked at $262, surpassing last December’s all-time high.

- See historical market cap: StockAnalysis.com

- Live market data: CompaniesMarketCap

A Comeback in China and Emerging Markets

Apple’s strategy to introduce a cheaper and thinner iPhone Air has been crucial, selling out within minutes in China—a market that has been highly challenging for Apple in recent years. Analysts view the Air model as a game-changer for emerging markets because it combines affordability with premium features, potentially catalyzing rapid adoption in regions previously out of reach for Apple’s flagship devices.

Artificial Intelligence Powers Future Growth

Wedbush analysts expect Apple’s eventual AI rollout to be transformative, leveraging a base of 2.4 billion active iOS devices worldwide. While Apple lags behind rivals Google and Microsoft in overt AI feature releases, its unique advantage is its vast user ecosystem—enabling the company to deploy AI at scale with minimal customer acquisition costs. Wedbush estimates that a successful AI strategy could add $75-100 per share to Apple’s stock price.

- Analyst outlook: Business Insider

- AI trends: Yahoo Finance

The Wall Street Response

Investor confidence is surging for Tim Cook and his executive team, buoyed by the prospect of record-breaking iPhone sales and a strategic pivot toward AI-powered services. Apple’s stock is firmly on every major analyst’s watchlist for 2025, with expectations that it will cross the $4 trillion market cap threshold imminently.

Links for deeper reading:

- Counterpoint Research

- Yahoo Finance: Apple approaches $4T market cap

- Business Insider: Wedbush $4T prediction

- Stock Analysis: Market Cap & Net Worth

With a revitalized product lineup, new strategies in global markets, and AI on the horizon, Apple stands at the precipice of another historic financial milestone—reshaping expectations for growth in consumer technology.