- Adj. EPS: $0.73 (Est. $0.75) 🔴

- Revenue: $25.71B (Est. $27.21B) 🔴

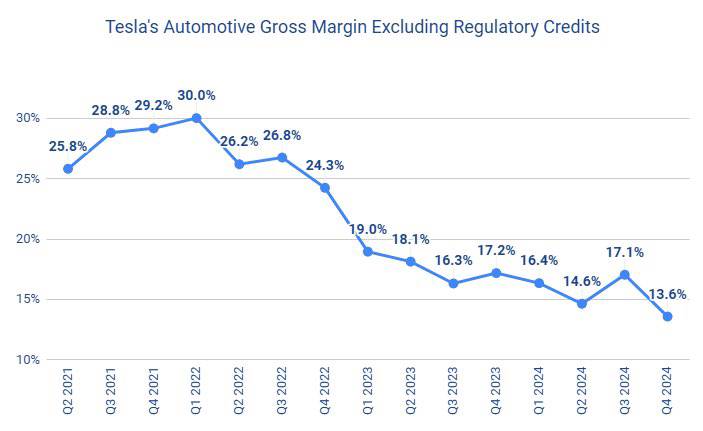

- Gross Margin: 16.3% (Est. 18.96%) 🔴; DOWN -138 bps YoY

- Operating Margin: 6.2% (Est. not provided); DOWN -204 bps YoY

Segment Revenue Breakdown:

- Total Automotive Revenue: $19.8B (Est. $21.51B) ; DOWN -8% YoY

- Energy Generation & Storage Revenue: $3.06B (Est. $2.68B) ; UP +113% YoY

- Services & Other Revenue: $2.85B (Est. $2.80B) ; UP +31% YoY

Operational Metrics:

- Total Deliveries: 495,570 (+2% YoY)

- Model 3/Y Deliveries: 471,930 (+2% YoY)

- Other Model Deliveries: 23,640 (+3% YoY)

- Total Production: 459,445 (-7% YoY)

- COGS per Vehicle: Achieved an all-time low of <$35,000 due to raw material cost improvements

- Energy Storage Deployments: Record 11 GWh; UP +244% YoY

Cash Flow & Liquidity:

- Operating Cash Flow: $4.81B (+10% YoY)

- Free Cash Flow: $2.03B (-2% YoY)

- Cash & Equivalents: $36.6B (+26% YoY)

Guidance & Outlook:

- Tesla reiterated Model Y is expected to be the best-selling vehicle globally in 2024

- Cybercab Robotaxi will follow the "unboxed" manufacturing strategy, with volume production targeted for 2026

- Vehicle Volume Growth expected to return in 2025, dependent on: Acceleration of autonomy efforts Production ramp-up at factories; Macroeconomic conditions

- Energy Storage Deployments projected to grow at least 50% YoY in 2025

- Cybertruck expected to qualify for IRA consumer tax credit

- FSD (Supervised) continues improving, aiming to exceed human safety levels

Comment from CEO and management:

- Lower cost reduction than originally expected

- CEO Elon Musk: "Tesla continues to expand production and invest in autonomy. While margins were impacted this quarter, we expect long-term growth to be driven by AI, energy and next-generation vehicle innovation."

- The CFO said that growth in capital expenditure will remain unchanged until 2025, while $TSLA (-0,23 %) CEO Elon Musk expects unattended FSDs to come to market in many regions of the US this year, including California.

- CEO Elon Musk: "We expect to scale Optimus production not by 50%, but by 500% per year."

- CEO Elon Musk: "We will launch FSD in June as an unsupervised paid ride-sharing service in Austin."

Further information:

$TSLA (-0,23 %) plans to increase production of the Optimus to between 10,000 and 100,000 units per month at a price of 20,000 US dollars per unit. External deliveries are expected in the second half of 2025, with possible deliveries to other companies by the second half of 2026.

#quartalszahlen

#quartalsbericht

#earnings

$UBER (-0,24 %)

$GOOG (+2,67 %)

$GOOGL (+2,73 %)