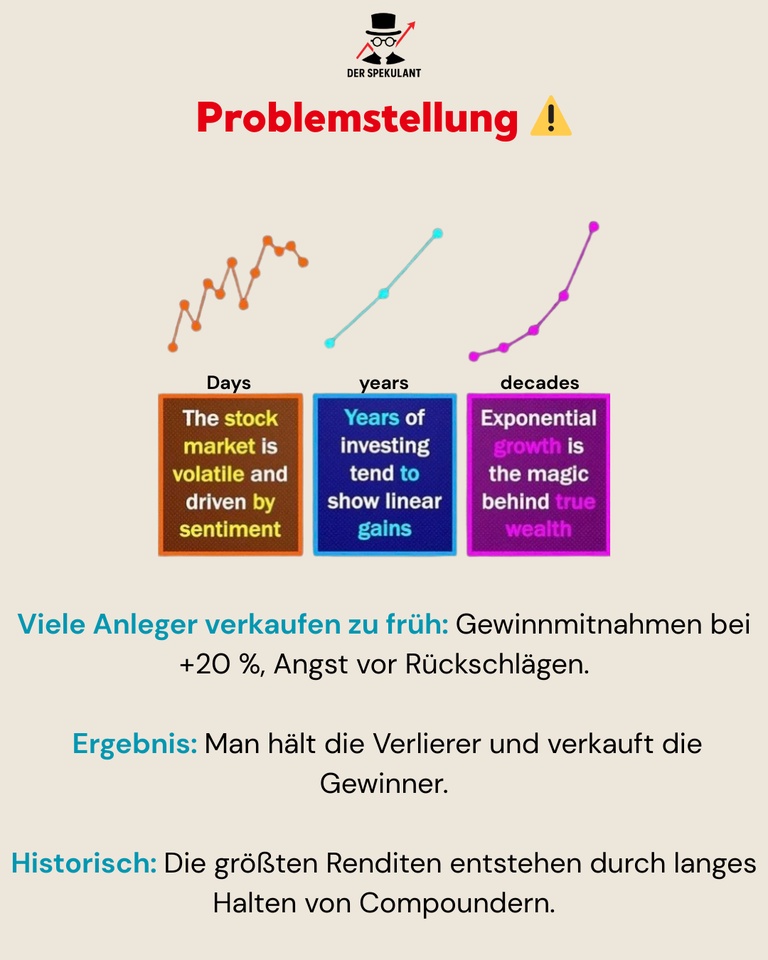

Most investors don't lose because they buy bad stocks -

but because they sell good shares too early.

Selling out of fear, impatience or the urge to "secure" profits often destroys the very thing that makes the biggest difference in the long term: the compound interest effect over time.

Long-term investing is less a question of intelligence - and more one of psychological maturity.

💡 Principles of patience

✅ Price gains are not a reason to sell.

The share price only reflects emotions, not necessarily fundamentals.

If the investment thesis remains intact, stay invested.

✅Thesis > price.

Selling should only follow if fundamentals change - not because the price seems to have "run too far".

✅ Let profits run, limit mistakes.

The greatest returns come from a few exceptional compounders. Capping them destroys performance.

✅ Compound interest beats timing.

Short holding cycles destroy exponential growth. Long-term capital commitment multiplies returns.

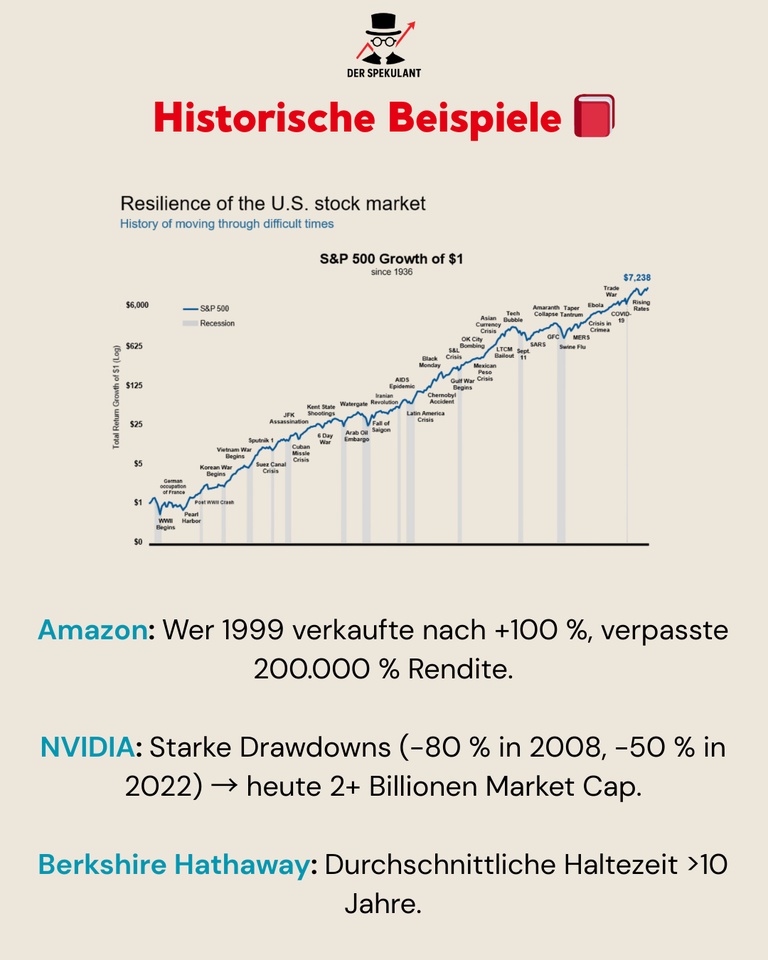

📚 Historical perspective

➡️ Amazon ($AMZN (+2,94 %)

):

Many investors sold after +100 % gains. Those who held on saw a return of over +200,000 %.

➡️ NVIDIA ($NVDA (+4,33 %)

):

Crashes of -80 % (2008) and -50 % (2022) did not stop investors.

Today: over $2 trillion market cap.

Patience > market timing.

➡️ Berkshire Hathaway ($BRK.B (+1,4 %) ):

Average holding period: over 10 years.

The compound interest effect does not result from activity - but from doing nothing.

🧠 The psychology of selling

The biggest enemies of the investor are FOMO and fear of loss.

The brain seeks short-term confirmation - realizing profits feels good.

But good decisions rarely arise from emotion, but from discipline and context.

"Don't interrupt compounding." - Charlie Munger

Returns take time, and time requires patience.

If you are constantly trading, you are working against the mathematics of capital accumulation.

⚠️ When selling makes sense

📋 The investment thesis is broken (technology, product, market).

📋 Management destroys shareholder value or allocates capital poorly.

📋 There is a clearly superior opportunity with a better risk/return profile.

📋 A position grows over 20% of the portfolio → Rebalancing off

📋 Risk management perspective.

Selling should be strategicnot emotional.

📊 Conclusion

The biggest gains are not made by reacting frantically,

but through constant calm in the storm.

Hold as long as your thesis holds.

Act when it breaks.

Patience is not a sacrifice -

it is the ultimate source of return for the long-term investor.

💬 Community question

When was the last time you sold too early - and how much return did impatience cost you?