Hello again,

2-3 months ago I shared a post that received a lot of comments. I noticed that many have since deleted their comments. There is something I want to share with you, friends: the stock market is not just statistics and calculations. If you understand human psychology, you understand the stock market.

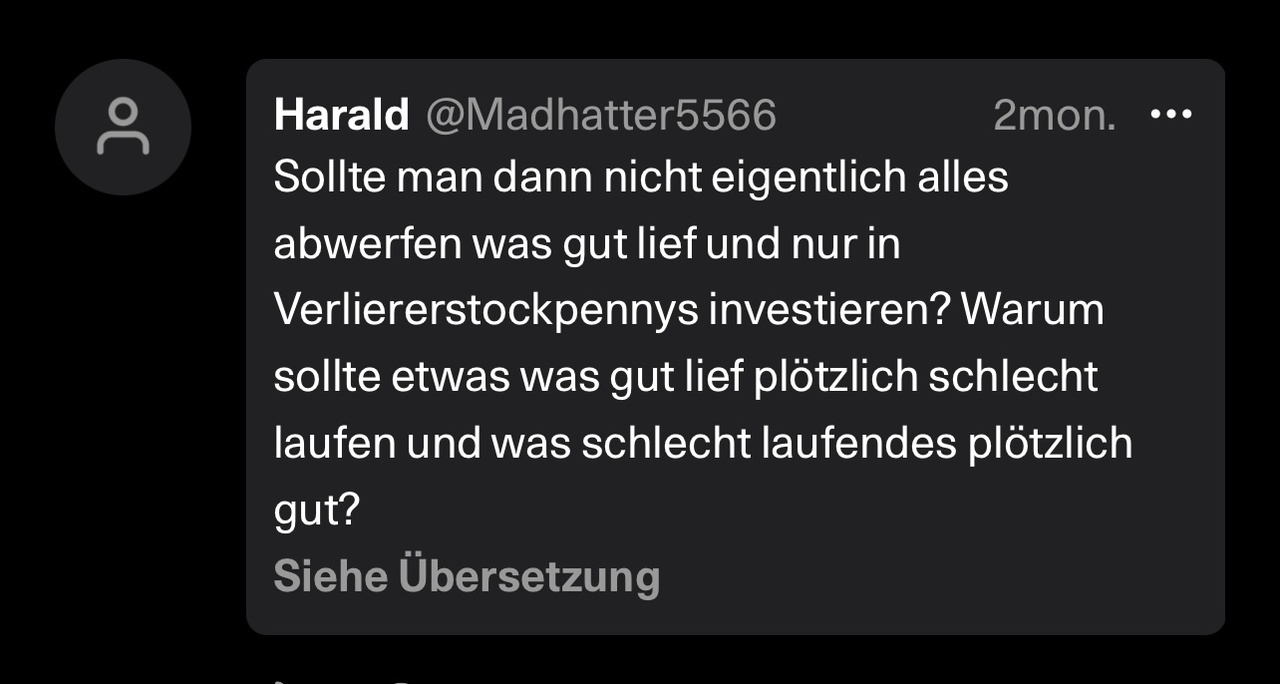

Usually this is the psychology of the stock market. 2 months ago I didn't answer because I don't like discussing with people who have such a mindset. However, now there is a reason why I am replying. I just ask you to take a quick look. It would take too long to explain why that is, and even if I explain it, it is often not understood because some people just don't want to understand it.

What I want to explain is this: If an investment instrument is making a lot of profit, it is more likely to keep going up than an investment instrument that has not yet made a profit. This is because money doesn't always stay in the same place. Many people buy at the highs, but investing in something that is already going wrong is very risky. Many of you have probably flown before. Before the plane takes off, it starts the engines, stops, accelerates and then takes off. The aim is to invest in strong investment instruments that are 'standing still' or moving sideways and collect them at this stage.

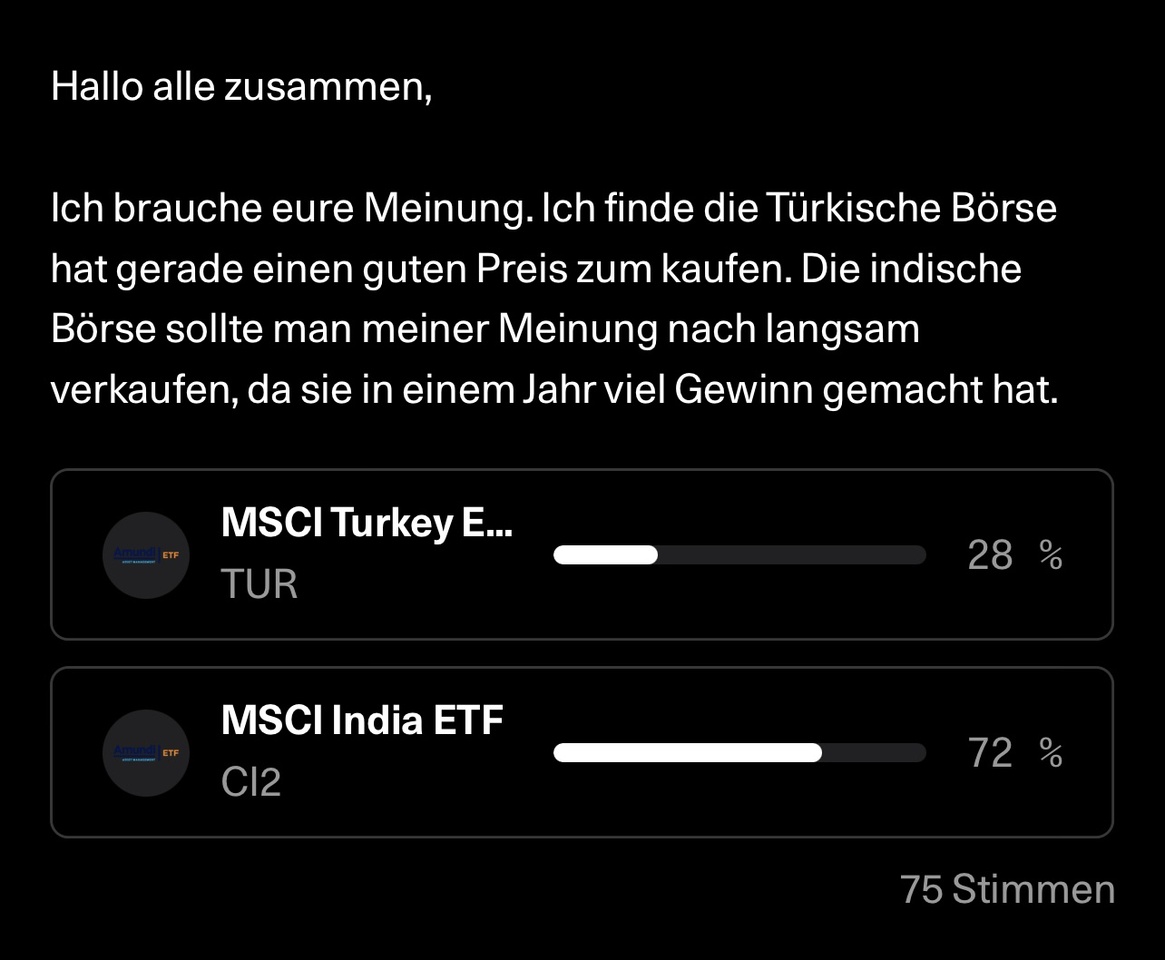

Just take a quick look at $CI2 (-0,31 %) (MSCI India) and $TUR (+0,28 %) (MSCITurkey). That's how it works, my friends. Best regards and respect!