Keytruda: $29.48 billion in revenue in 2024, accounting for 46% of Merck’s total sales.

The King of Oncology is about to lose its crown jewel. What happens when your $30B baby hits the patent cliff?

Big Pharma, Bigger Problems

Merck & Co. is the pharma titan behind Keytruda, a cancer-fighting blockbuster that made up 46% of Merck’s total 2024 revenue. That’s $29.5B out of $64B. Wild.

Keytruda’s patent expires in 2028.

You know what that means? Biosimilar wolves at the door.

Segments & Moat: Beyond the Big “K”

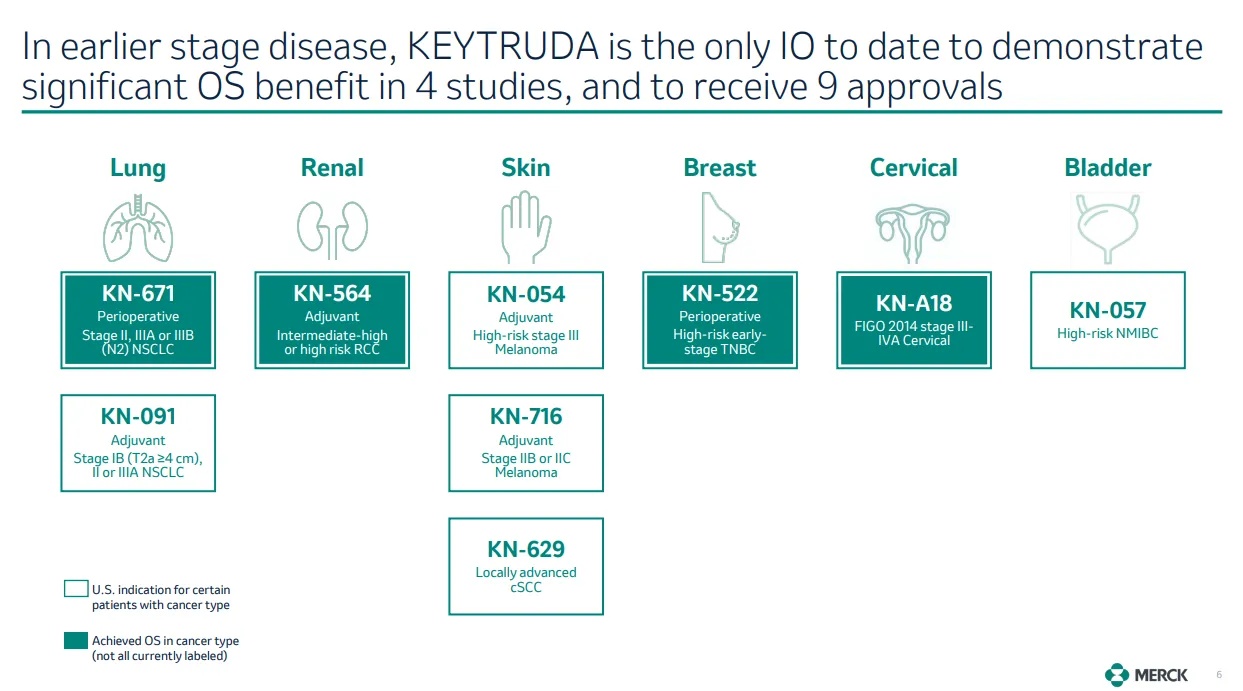

- Keytruda: Anti–PD-1 therapy; GOAT-tier in oncology.

- Gardasil: HPV vaccine line with growing international traction.

- Animal Health: Low-key cash cow (pun intended) doing $5.5B+.

- Pipeline bets: Immunology, Cardio, and Vaccines.

Merck’s moat was exclusivity. Now it’s pivoting to:

- Combo therapies (extend Keytruda’s lifecycle)

- New indications (get more FDA labels on Keytruda)

- Next-gen biologics & AI-aided R&D

They’re buying growth, too—$11B for Prometheus Biosciences in 2023.

Competitors: Biosimilar Bros Incoming

Big Dogs:

- Bristol Myers ($BMY) – Opdivo is chasing similar cancer types.

- Pfizer ($PFE) – Inorganically hunting post-COVID cash.

- Roche ($RHHBY) – Another OG oncology player with deep biosimilar know-how.

New Age:

- BeiGene, Novartis Sandoz, Samsung Bioepis – Hungry biosimilar makers that smell blood post-2028.

📉 Biosimilars typically take 30–40% market share in year 1 and cut prices by 25–50%. That’s ugly math for Merck.

Growth KPIs: From Leader to Lagger?

- 2024 Keytruda rev: $29.5B → expected $41B by 2027 (pre-cliff).

- Patent cliff hit in 2028 = potential 60% revenue drop by 2032 in bear case.

- Merck’s scenario modeling:

- Best Case: No expiry → $48B in Keytruda rev → $130/share value.

- Base Case (–40% rev): $107/share value. Still a 14% upside.

- Bear Case (–70%): $92/share = fair value near today’s price.

💰 ⑤ Financials Snapshot:

- Gross Margin: ~74% (great, but typical for big pharma)

- Operating Margin: 33% (dropping as R&D ramps)

- EPS Growth: +6% CAGR…but forecasted dip post-2028.

- Balance Sheet: $12B cash vs. ~$22B total debt

- Dividend Yield: 2.8% and growing (15 years straight)

Merck isn’t broke—but it’ll feel a cold wind when Keytruda drops off.

Valuation Check:

- P/E (FWD): 10.5x (vs. peers like $LLY at 36x or $BMY at 8x)

- PEG: ~1.2x (depending on which EPS trajectory you believe)

- Analyst PT range: $92–$125

Merck is trading like it’s already past the patent cliff. That’s… intriguing.

Catalysts & Risks:

Catalysts:

- New FDA approvals for Keytruda combo therapies

- Expansion into non-oncology (autoimmune via Prometheus)

- Surprise acquisition? 💥

Risks:

- Failure to replace Keytruda’s revenue hole

- Slower uptake of new therapies

- Inflationary pressures on R&D or CapEx

👀 Watchlist trigger: If biosimilar lawsuits or FDA delay biosimilar entry to 2029–30? Stock rerates fast.

Conviction Close: King-Maker or Cliff-Diver?

This is the Keytruda cliff trade. Period.

You’re either betting Merck successfully reinvents itself before impact, or that the market has over-punished a company still printing billions.

💥 My move? I’m stalking a buy zone sub-$90 as EPS dips begin. A few successful indication wins or a timely biosimilar delay, and boom — we’re cooking.

Valuation asymmetry = opportunity.

Let me know what you’re seeing on $MRK 👇

Are you buying the cliff… or waiting for the wreckage?

An interesting blog for the a further analysis: https://jimmysjournal.substack.com/p/merck-and-co-mrk-and-keytrudas-patent