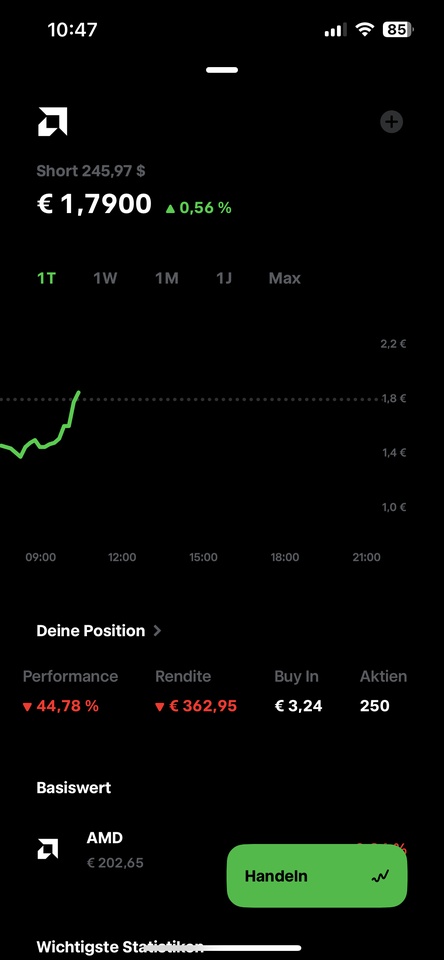

A few days ago I made the mistake of buying a short on AMD.

Today the plan could work out, but my short is already very close to being knocked out.

DE000VD0EHW0 $null (+49,29 %) I have this in my portfolio and am currently down around 40%. The KO is at 245 $. My fear is that, although the day could go as I have drawn it, the KO could be triggered between 15:30 and 16:00 due to the volatility. That's why I'm thinking of selling this bond at a loss of around €350 (to secure the tax advantage🤪) and switching to a bond with a k.o. distance is above $260. I would have chosen the following bill for this purpose.

DE000UQ0T1A5 $null (+58,85 %) the leverage would be minimally lower, the spread is narrow and the knockout at just under $260. This would allow me to get through the volatile phase at the start of trading more safely and, if I am slightly mistaken, I could certainly hold the bond for a few more days, as the correction should actually already be taking place... And I would also have a lower tax burden on the subsequent profits because I would sell the first bill at a loss.

Where is the error in thinking? What do you think?

Exceptionally at Trade Republic, because someone wanted to empty the loss pot 🙈