German investors who bet on the capital market achieved decent returns last year. This is the result of an of the portfolios of 330,000 users of the Getquin platformplatform, which is exclusively available to Handelsblatt. According to this, the average return was between 24 and 30 percent, depending on the size of the portfolio.

Many of these investors are pursuing unnecessarily risky strategies. This is because they invest a relatively large proportion of their money in individual shares. In contrast, exchange-traded ETFs, which often track broad indices, account for a smaller proportion.

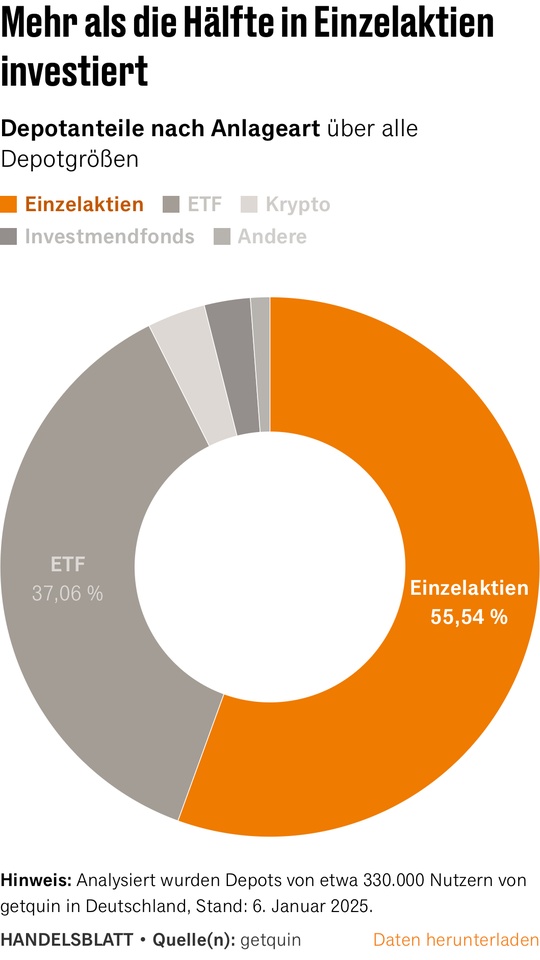

It is striking how much money Getquin users have invested in individual company shares. On average, the average share of individual shares is 55 percent of the investment capital. In contrast, the average ETF share is only 37 percent.

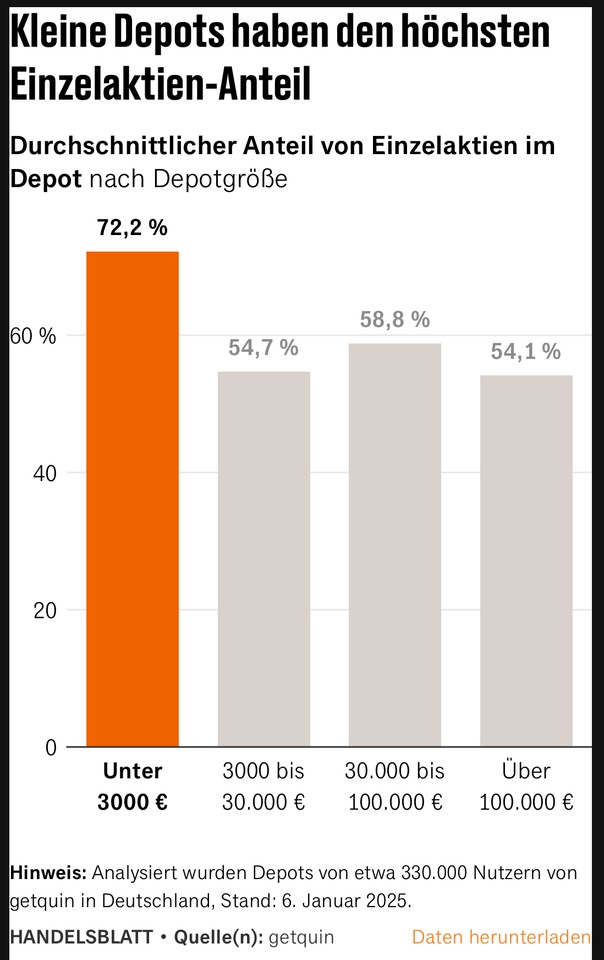

When looking at the individual portfolio groups, it is interesting to note that most individual shares are held in small portfolios. However, even in the over EUR 100,000 portfolio group, investors have invested more than half of their money in individual stocks.

German Getquin users particularly like to invest in tech companies, many of them from the USA. It is therefore not surprising that US companies frequently appear among the 20 most popular individual stocks.

Many investors prefer shares from their home country. This phenomenon is known as "home bias". This apparently selective perception in favor of the domestic financial market explains why Allianz $ALV (-0,14 %) , SAP $SAP, BASF $BAS (+1,69 %) , Munich Re $MUV2 (-0,6 %) and Deutsche Telekom $DTE (+0,67 %) are five German companies. Siemens $SIE (-0,45 %) and Mercedes Benz $MBG (-1,31 %) are in the next five places.

Andreas Hackethal is not surprised that Getquin investors overweight both the domestic market and the tech sector. The finance professor from Goethe University Frankfurt's own portfolio studies produced similar results: Investors bought many individual stocks and more often than average from the domestic market. In this way, they tried to beat the market. Hackethal criticizes the "poor diversification" of Getquin usersand says: "Having so many individual stocks is an unnecessarily risky strategy."

In relation to the tech sector, this approach is particularly problematic: Because many ETFs already include the big tech companies anyway - including the funds that are most popular with Getquin investors: Replicas of the world equity indices MSCI World and FTSE All World as well as the US S&P 500. There is also one ETF in the top 10 that focuses on technology companies. In this respect, investors have bought a double tech overweight via individual shares and ETFs.

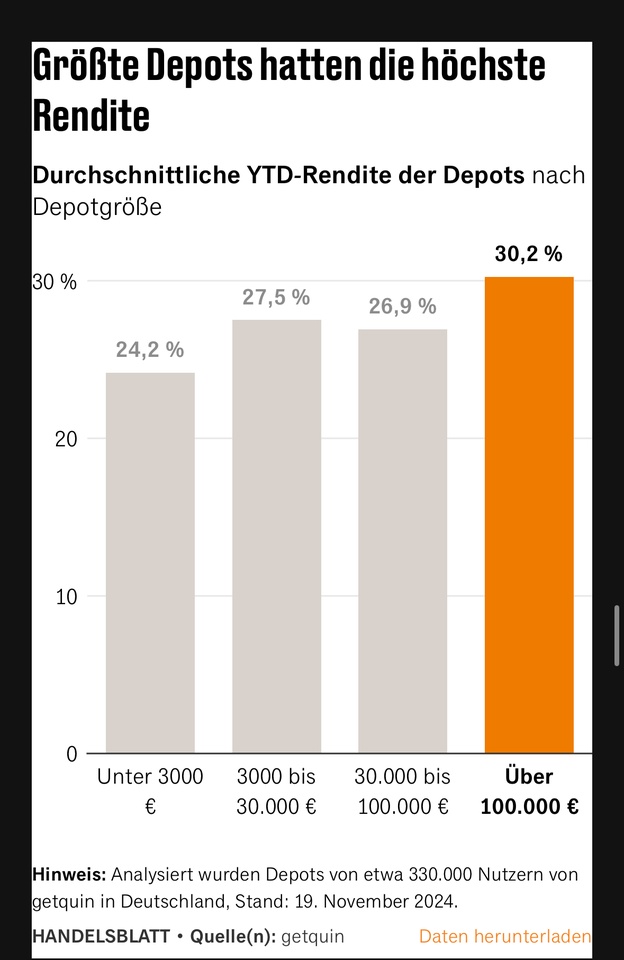

How have the portfolios of Getquin users developed? The strategies look successful over the past year: All custody account groups made gains in 2024, says Steil. The largest portfolios achieved the highest average return.

In the longer term, however, the picture is not so rosy. In 2022, for example, "most of the smaller portfolios made losses", notes Steil. Larger portfolios, on the other hand, show "consistently good figures" over the years, according to the analysis.

The reason is clear: in the largest portfolios, the proportion of individual shares in cryptocurrencies, which also fluctuate greatly in value, is relatively low. The ETF ratio is correspondingly high at just under 40 percent. Investors with larger portfolios therefore invest their capital in a more diversified manner. Olaf Stotz, Professor of Asset Management at the private university Frankfurt School of Finance & Management, explains this as follows: investors would be more rational with larger assets.

Experts generally do not think much of a strategy that tries to achieve higher returns with individual shares than by betting on the broad market. "Buying individual shares is a very bad bet," warns Niels Nauhauser, capital market expert at the consumer advice center in Baden-Württemberg.

Researcher Hackethal confirms this: On average, "investors left three percent return per year if they try to beat the market with certain strategies. The researcher has calculated: Investing in individual shares is "twice or three times as risky" as investing in the MSCI World.

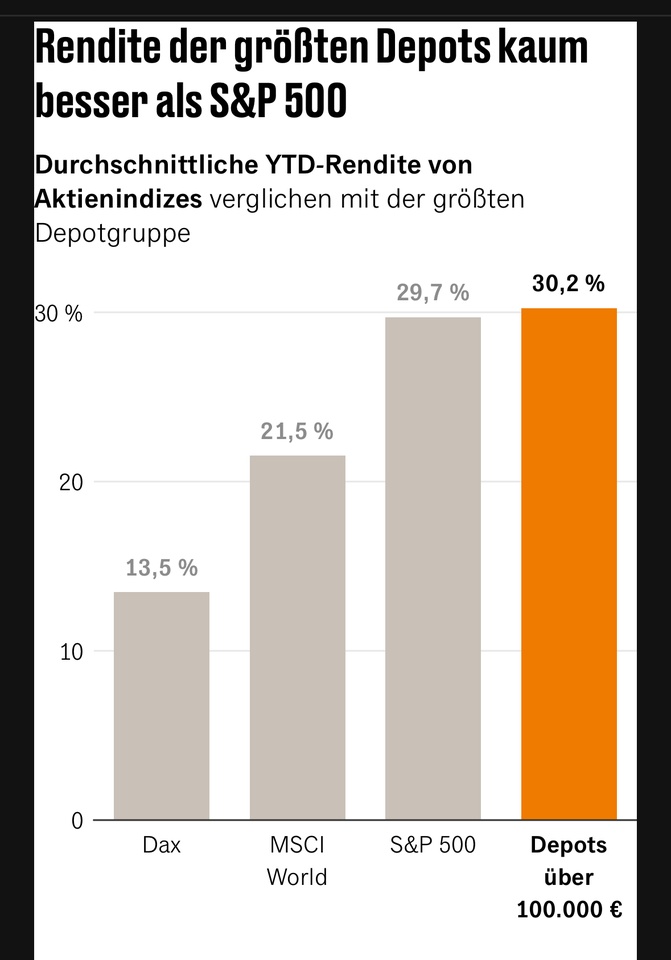

The return on even the largest Getquin portfolios was only 0.5 percentage points higher than the broad US S&P 500 index last year.

With a corresponding index ETF, investors would have achieved almost the same return, but would have spread the risk of portfolio losses much more widely - across all 500 shares in the index.

For Hackethal, there are therefore no rational reasons for an individual share strategy. Why do many people still invest in this way? Hackethal says: "They want to feel a kick. They overestimate themselves. And they want to make money as quickly as possible." All of this is particularly true of younger and male investors.

However, a look at stock market history teaches the opposite: For long-term wealth accumulation, it is important to be patient and realistic, Hackethal emphasizes. Nobody should expect a return of 20 percent or more in the long term.

With an ETF on the global share index MSCI World, an investor could have accumulated 100,000 euros over the past 20 years with a monthly investment of 250 euros. The average annual return was 6.8 percent. With a savings rate of 200 euros per month, this mark would have been broken after 21 years on average.

This is not a rapid increase in wealth, as promised by windy finfluencers with reference to hype stocks such as Nvidia or cryptocurrencies. On the other hand, an investor with such an ETF strategy is taking significantly less risk.

Read the full article here: handelsblatt:%20Diese%20Daten%20zeigen,%20wie%20riskant%20viele%20Deutsche%20investieren%20-%20https%3A//hbapp.handelsblatt.com/cmsid/100094935.html

Source / graphics: Handelsblatt, 17.02.25