Dear Community,

here we go - get ready for massive updates in the next few weeks.

Today we are launching the first major feature:

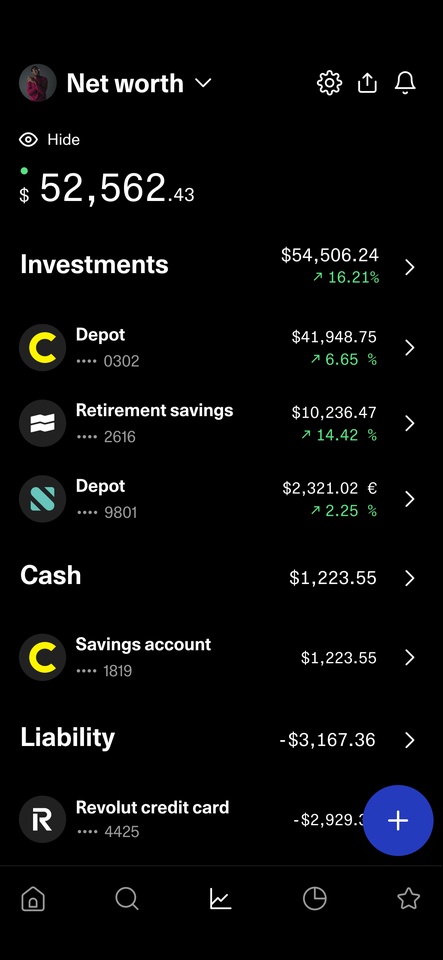

From now on, you can link all your net assets to getquin - including bank balances and liabilities.

This gives you everything in one overview - automatically and in real time.

The automatic link is currently only available for users in Germany. However, everything can be entered manually worldwide.

To use the feature, you need app version 2.152 or higher. iOS is already live, Android will follow later today.

PS: You can access the new overview pages directly from the dashboard. The investment page will remain the default, so your usual user experience will not change.

As always, please share your experiences with the new functions.