moin moin,

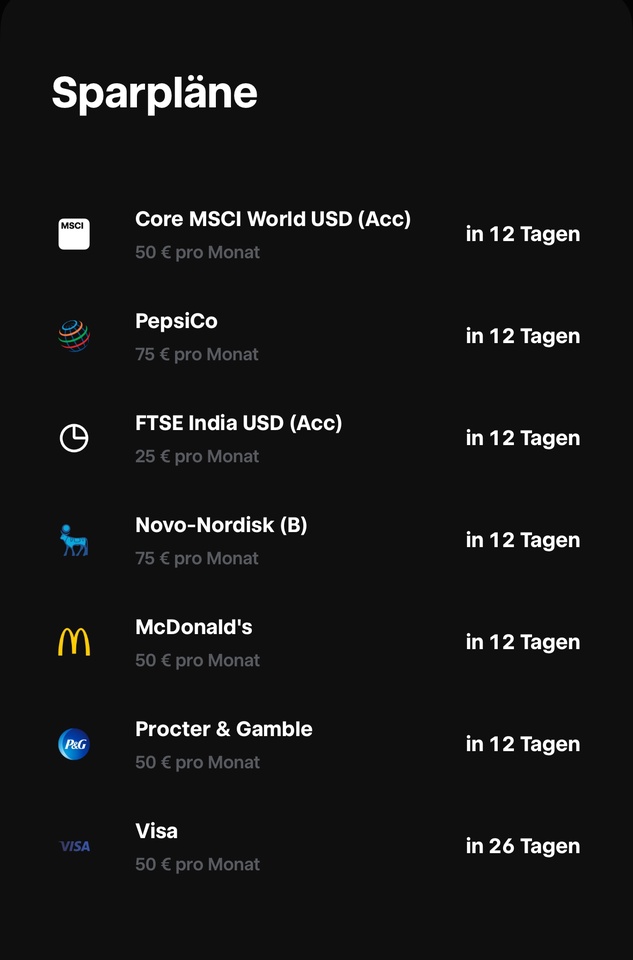

since both $PEP (+3,06 %) as well as $NOVO B (-3,44 %) are weakening somewhat at the moment, I am taking the opportunity to adjust my savings plans. My $IWDA (-3,61 %) will only receive €50 per month in future, $PEP (+3,06 %) and $NOVO B (-3,44 %) 75€ instead of 50€.

This will allow me to further expand my dividend strategy and increase the proportion of individual shares in my portfolio.

As I have now finished my training and will receive my full salary for the first time in mid-March, my savings plans will be adjusted again at the beginning of March and more will be added.

I would be grateful for a few suggestions for this - I am mainly looking for dividend stocks, but we can also talk about one or two growth stocks.

One consideration at the moment is my $KO (+0,18 %) position, which is up just under 11%, into $PEP (+3,06 %) to take advantage of the weak phase (and the higher dividend :) ) of PepsiCo.

I am also considering selling my $1211 (-4,45 %) sell my position with a 33% profit and switch to $CMCSA (-3,65 %) and reallocate. The same applies here - higher dividend and extremely favorably valued, and I would also have the communications/entertainment sector in my portfolio.

Please write me your opinion on this.

Thanks in advance :)