Dividends are an important part of the investment strategy for many investors. But while some swear by regular payouts, others take a critical view of dividends. In this article, we take a closer look at the pros and cons of dividends.

✅ Advantages of dividends

📈 Passive income

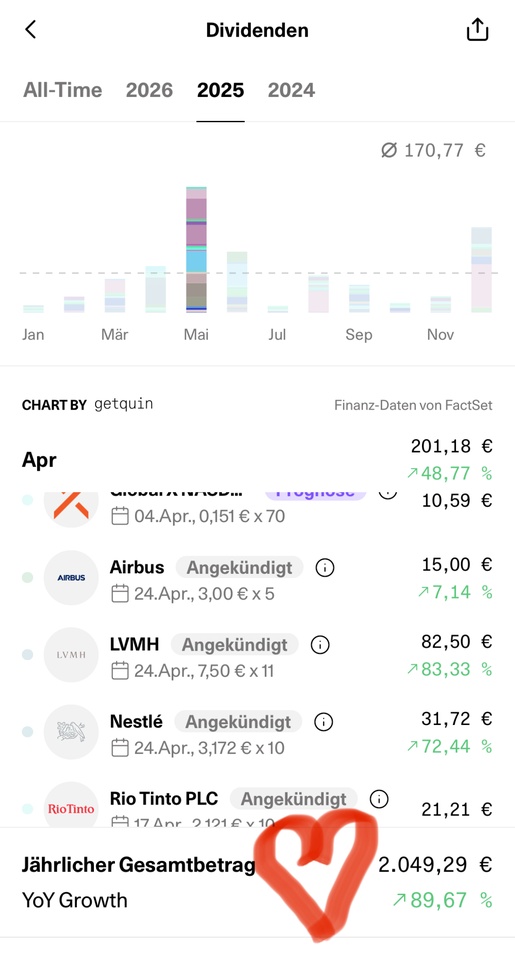

Dividends provide regular income without having to sell shares. They are particularly attractive for long-term investors or as a supplement to a pension.

🏛 Stable companies

Many companies with a long dividend history (e.g. Coca-Cola, Johnson & Johnson) are established, profitable companies with solid business models.

🔄 Reinvestment & compound interest effect

By reinvesting dividends (e.g. via a savings plan), capital can grow exponentially in the long term.

📉 Protection in times of crisis

Dividend stocks are often less volatile than pure growth stocks and offer a certain degree of stability in the portfolio.

❌ Disadvantages of dividends

🚀 Slower growth

Companies that pay high dividends often invest less in their growth. Tech stocks such as Amazon or Tesla do not pay dividends, but are growing rapidly.

💰 Tax burden

In Germany, dividends are subject to withholding tax (26.375% incl. solidarity surcharge, church tax if applicable), which reduces the net yield.

🔻 No guarantee on distributions

Dividends are not guaranteed! Companies can reduce or cancel them if it is economically necessary (e.g. in times of crisis).

📊 Focus on incorrect key figures

Some investors are dazzled by high dividend yields without paying attention to the financial stability of the company. An excessively high payout ratio can be a warning signal.

🔎 Conclusion

Dividends offer stability and passive income, but are not a panacea. A good strategy can be a mix of dividend and growth stocks, depending on your personal investment objective. Anyone investing in dividend stocks should not only be guided by the yield, but should also check the quality of the company and the sustainability of the distributions.

💬 How do you feel about dividends? Do you rely on distributions or do you prefer pure growth?

$NOVO B (-1,99 %)

$PEP (-1,31 %)

$AGNC (-1,13 %)

$HAUTO (+1,02 %)

$KO (+0,38 %)

#etfs

#dividend

#dividende

#cashflow

#aktien

How do you feel about annual returns?