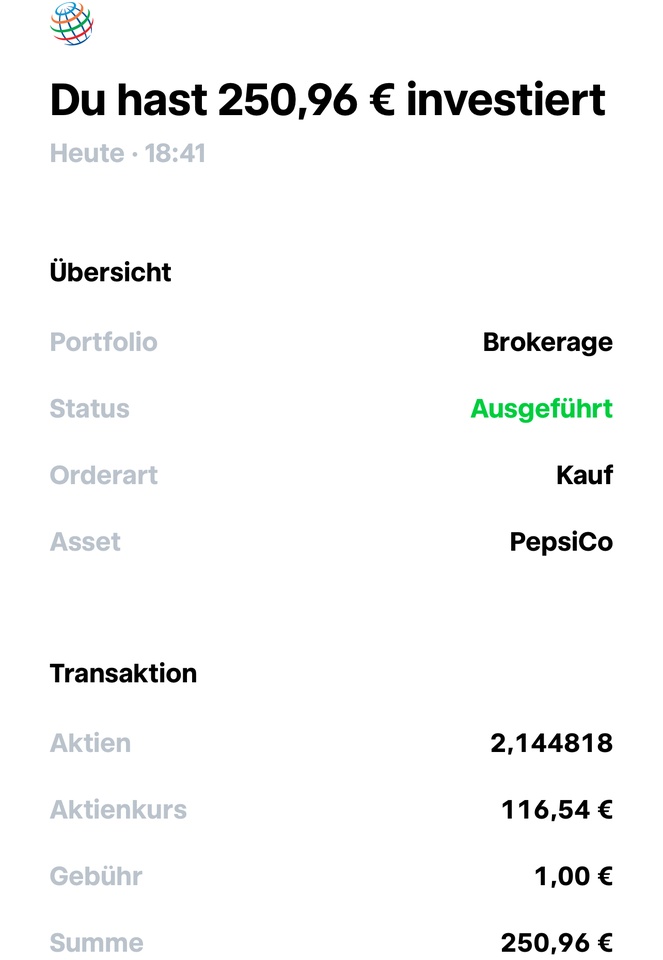

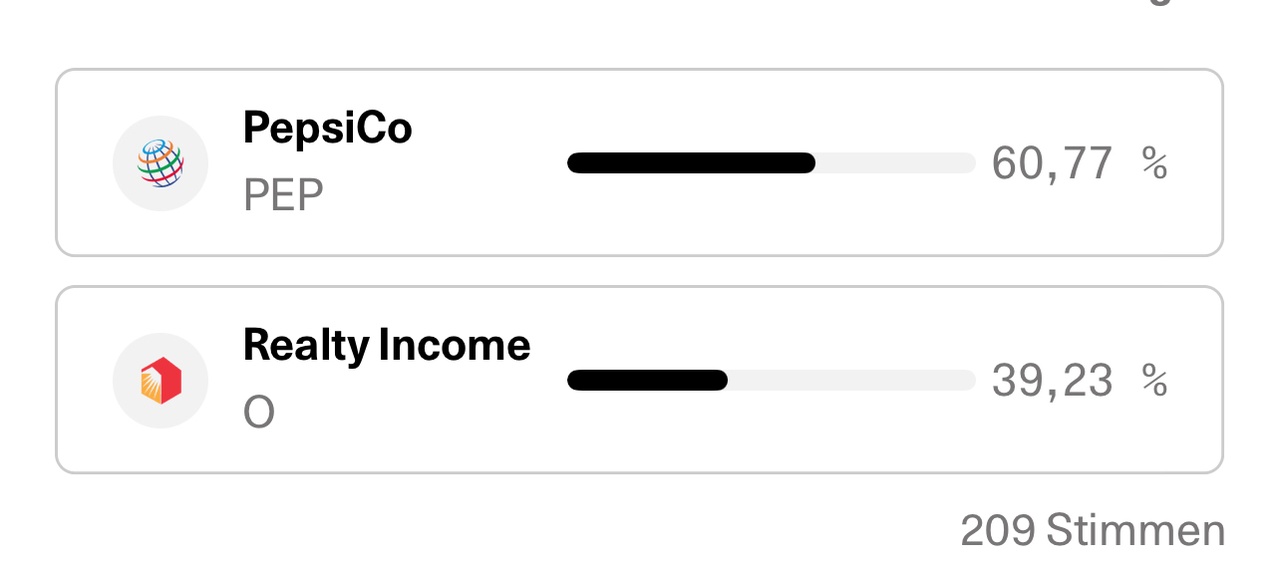

took part in my survey earlier this evening. There were $PEP (+0,31 %) or $O (+1,62 %) with an investment amount of €250 were available. The majority had voted for $PEP (+0,31 %) voted in favor. My average share price is now €136.40. Why did you vote in favor of $PEP (+0,31 %) in the vote? The share price performance over the last few months does not look very confident. Just under 40% were in favor of $O (+1,62 %) ! Why would you rather add to this position?