Consensus opinion: "With the S&P 500, I only invest in the USA. That's far too risky for me as I'm only invested in one country."

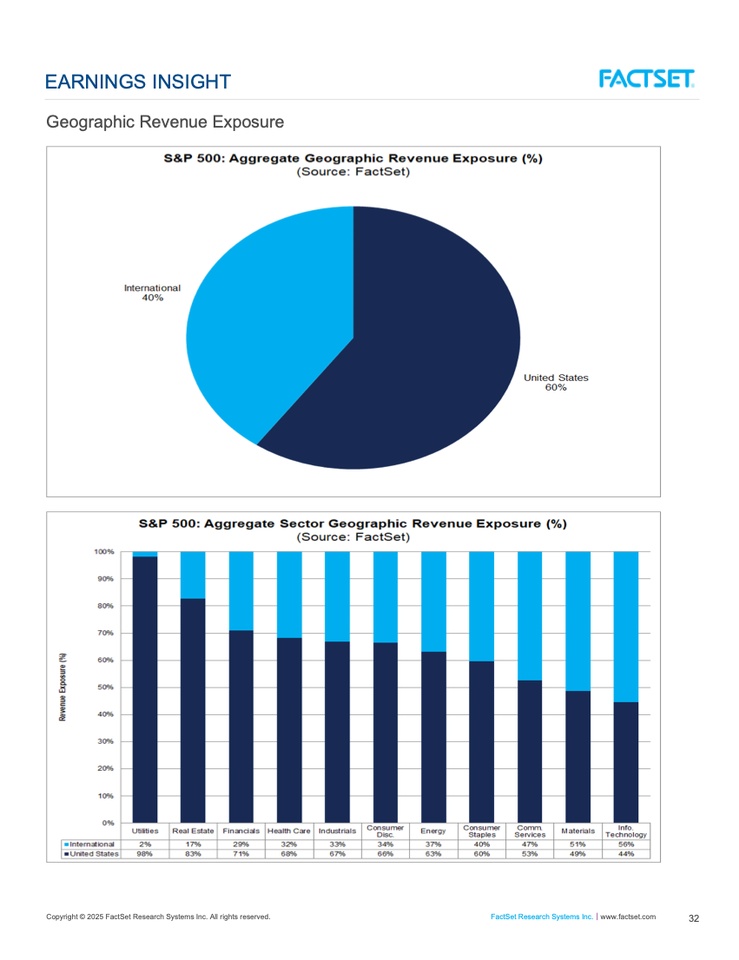

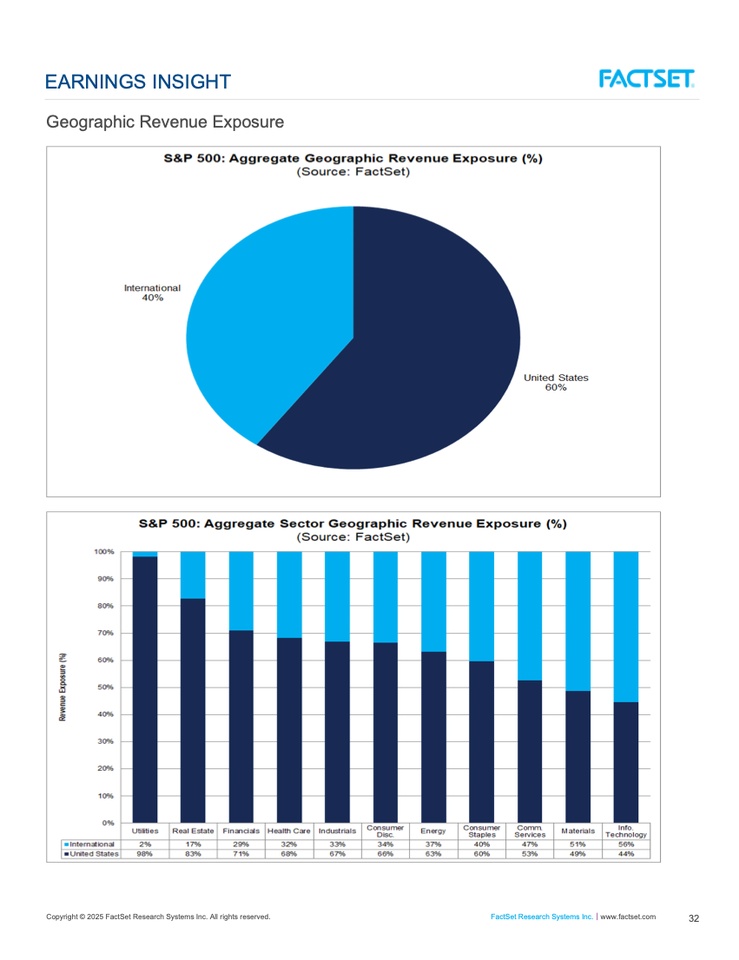

In truth: 40% of the turnover of companies in the S&P 500 comes from abroad.

Consensus opinion: "With the S&P 500, I only invest in the USA. That's far too risky for me as I'm only invested in one country."

In truth: 40% of the turnover of companies in the S&P 500 comes from abroad.