Dear ETF friends,

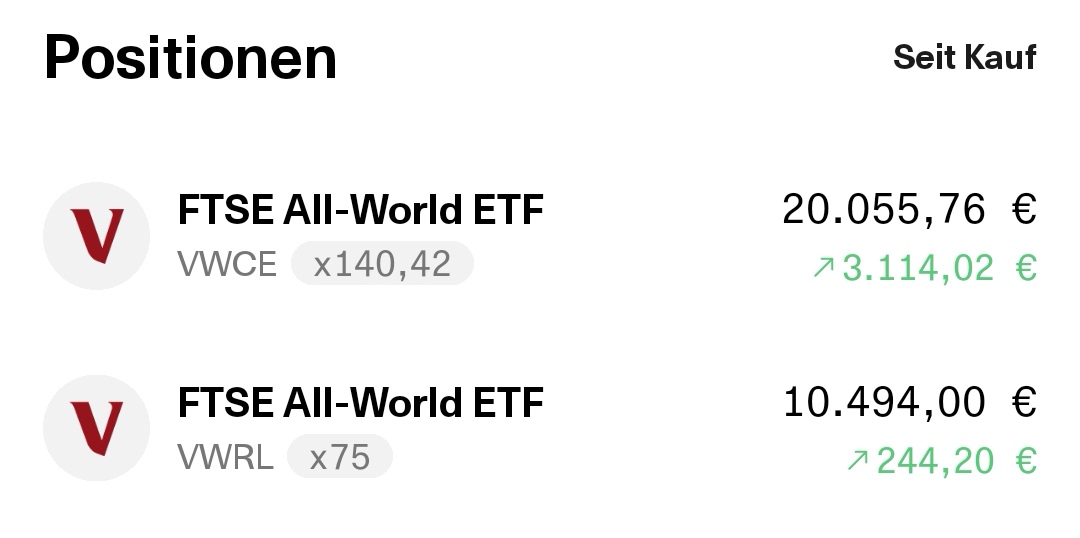

I need your expert opinion. At first I had started to save the $VWCE (+1,12 %) and thought an accumulating variant would be easiest. But now I have often heard dissenting voices and had also put some cash into the $VWRL (+1,01 %) I had also put some cash into it. Briefly about me: I am 37 and therefore still have time until I retire, I spend a lot of time with my portfolio anyway and would therefore have no problem reinvesting dividends independently with the paying-out variant.

Pros / cons? Please no other suggestions. One of the two should definitely stay and serve as a private pension. The $VWCE (+1,12 %) has the much better entry price for me. My exemption order has already been more than exhausted. So maybe you could leave the other one and just stop saving in it? I would be grateful for any tips from you.

Many thanks 🤗