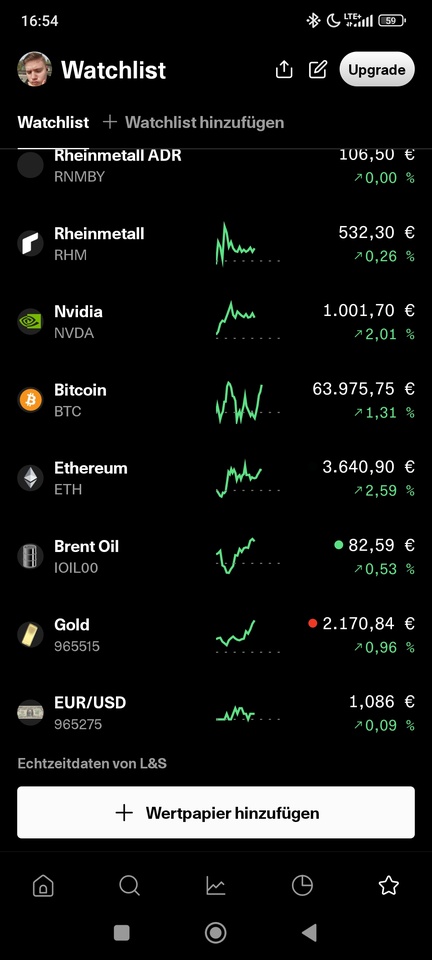

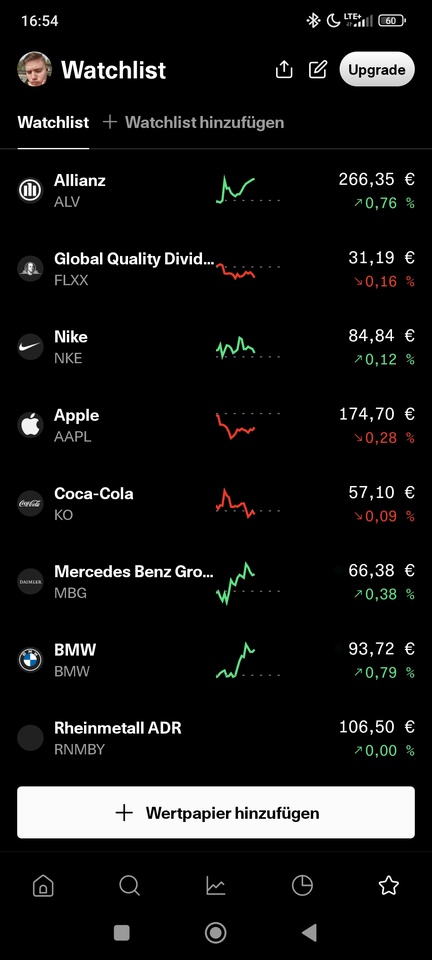

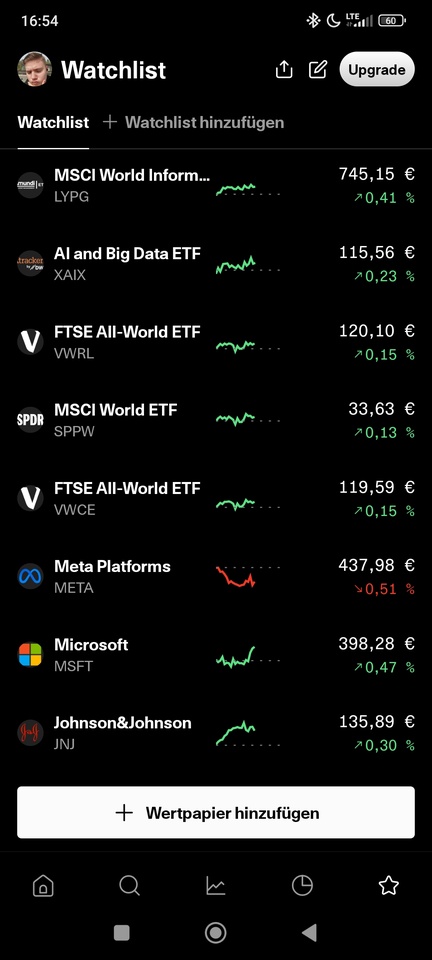

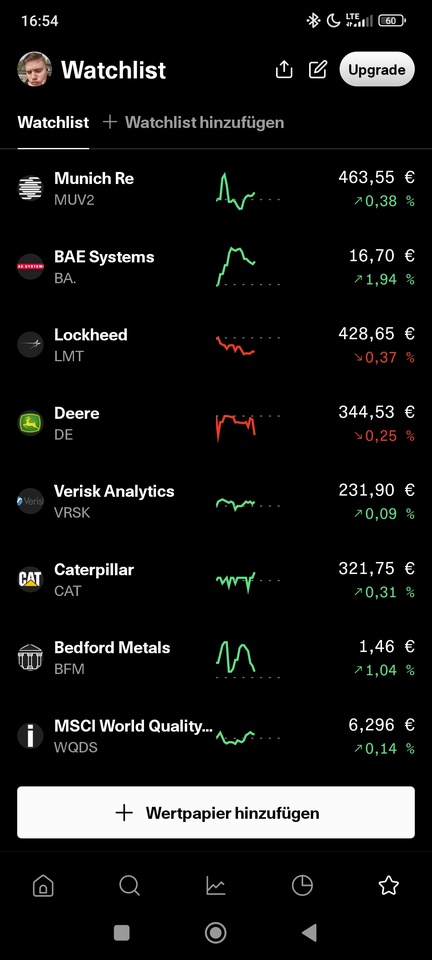

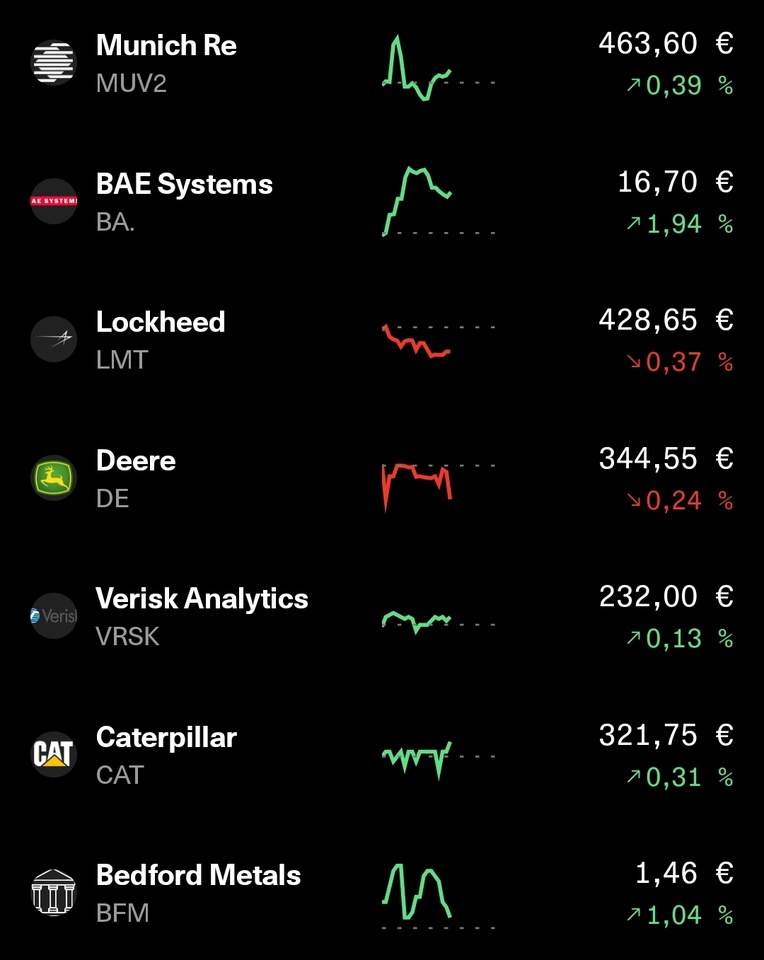

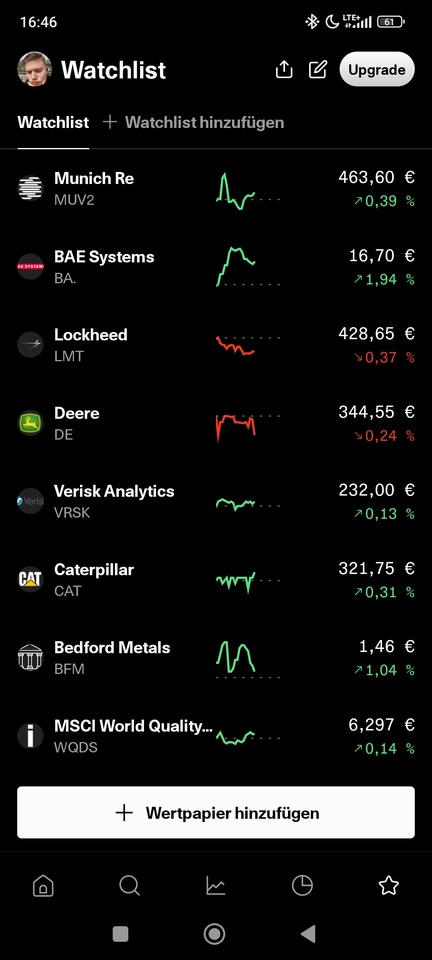

Watchlist feedback

Hello everyone, I'm a 15 year old beginner and would like some opinions on my watchlist, i.e. whether I should definitely remove or add anything etc. I have also invested in the following stocks at the moment: $PRAW (4x) $RHM (+2,55 %) (0,199x) $MBG (-1,7 %) (2x) Please feel free to give me feedback. Thanks in advance!