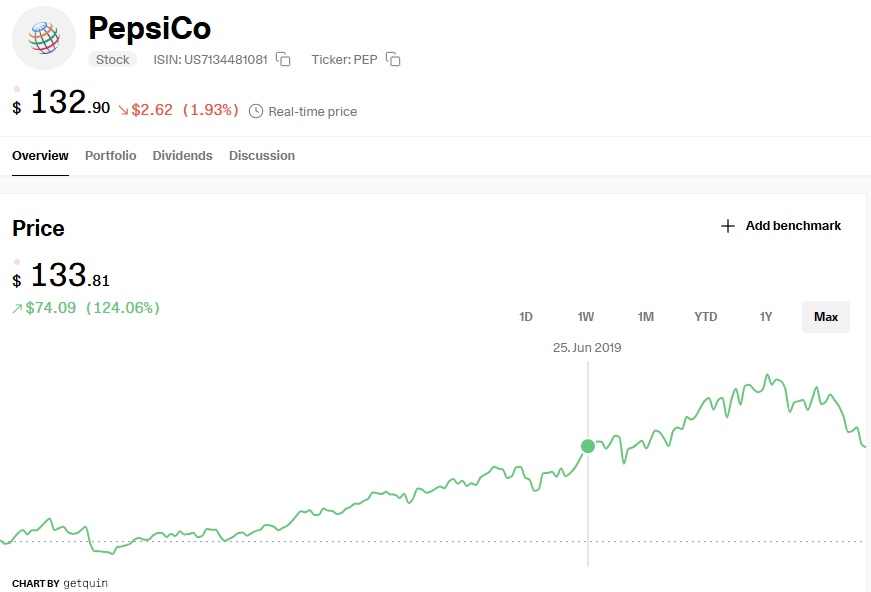

$PEP (-1,16 %) currently trading at May/June 2019 levels

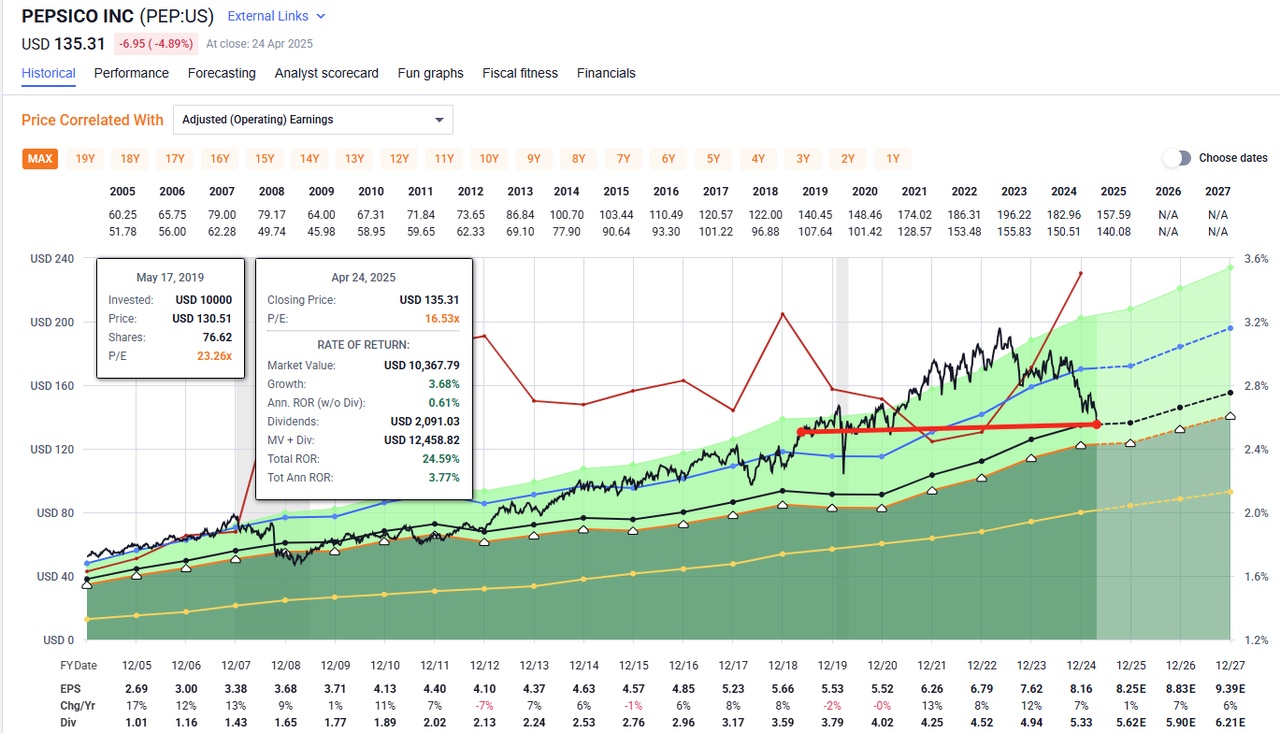

You can now buy it around 16x P/E, compared to 23x P/E in 2019.

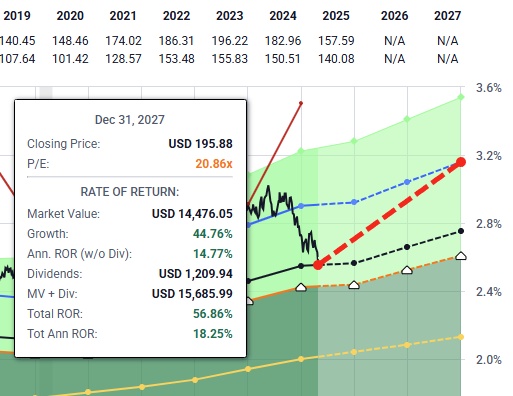

Back to normal P/E of 21 by 2027 would be 195$ almost 50% ROR.

If it goes sideways to fair value of 15x for a while, you still get 4% dividend.

What do you guys think?