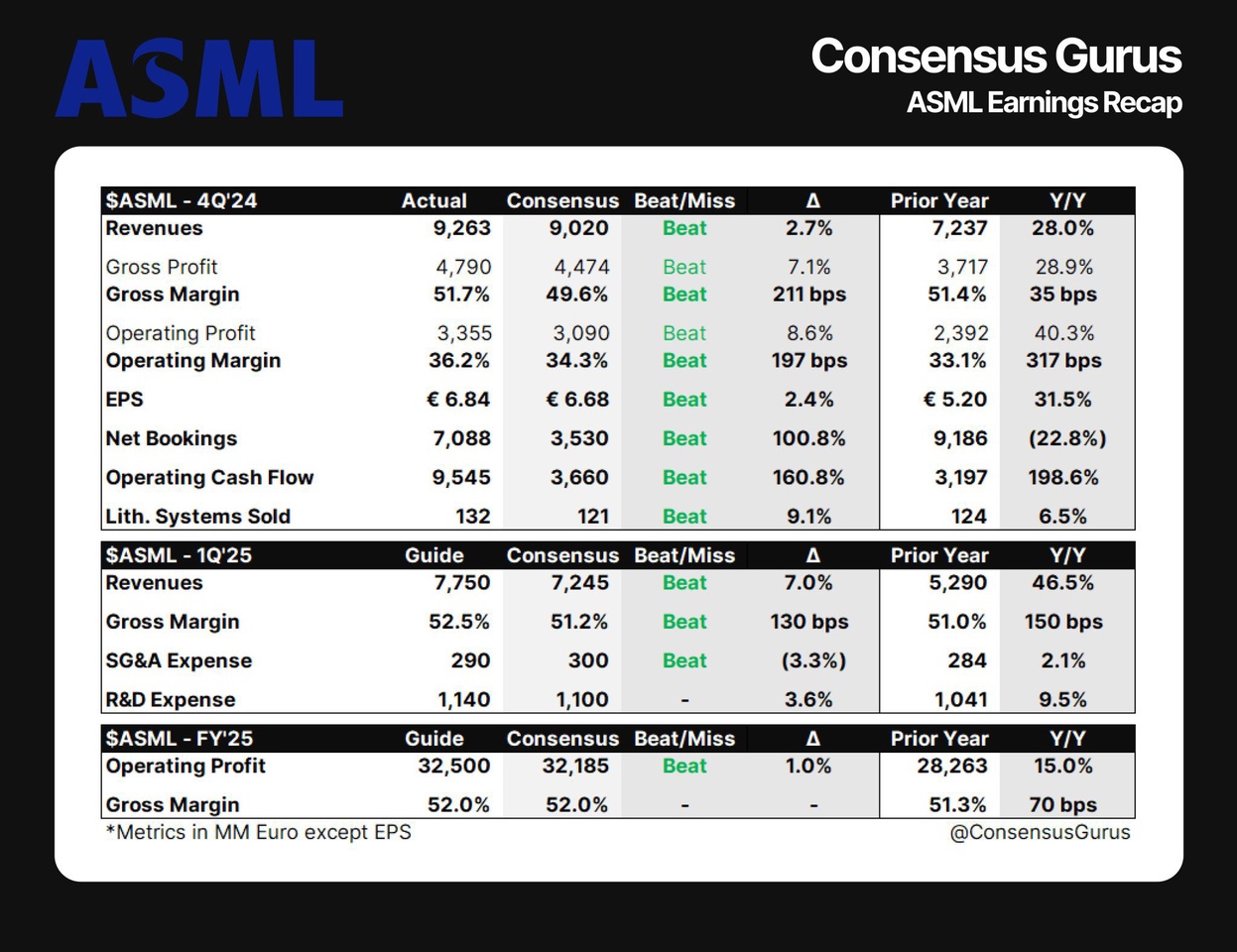

- EPS: €6.84 (Est. €6.68) ; UP +31.5% YoY

- Revenue: €9.26B (Est. €9.02B) ; UP +28% YoY

- Net Bookings: €7.09B (Est. €3.53B)

- Lithography Systems Sold: 132 (Est. 121) ; UP +6.5% YoY

- Gross Margin: 51.7% (Est. 49.6%) ; +35 bps YoY

Q1’25 Guidance

- Revenue: €7.75B (Est. €7.25B) ; UP +46.5% YoY

- Gross Margin: 52.5% (Est. 51.2%) ; +150 bps YoY

- SG&A Expense: €290M (Est. €300M) ; UP +2.1% YoY

- R&D Expense: €1.14B (Est. €1.10B) ; UP +9.5% YoY

FY’25 Outlook

- Operating Profit: €32.50B (Est. €32.19B) ; UP +15% YoY

- Gross Margin: 51%-53% (Est. 52.0%) ; +70 bps YoY

- Net Sales: €30B-€35B (Est. €32.19B)

Other Key Q4 Metrics:

- Gross Profit: €4.79B (Est. €4.47B) ; UP +28.9% YoY

- Operating Profit: €3.36B (Est. €3.09B) ; UP +40.3% YoY

- Operating Margin: 36.2% (Est. 34.3%) ; +317 bps YoY

- Operating Cash Flow: €9.55B (Est. €3.66B) ; UP +198.6% YoY

- Backlog stands at €36 billion, and remain confident in their outlook for 2025.

CEO Christophe Fouquet’s Commentary:

- “Our fourth-quarter was a record in terms of revenue, driven by additional upgrades and first revenue recognition of two High NA EUV systems. 2024 overall was another record year, with total net sales of €28.3 billion and gross margin of 51.3%.

Looking ahead, we see Q1 ’25 net sales in the range of €7.5 billion to €8.0 billion, gross margin between 52% and 53%, and full-year sales of €30 billion to €35 billion. AI remains a key growth driver for our industry, though it creates shifting market dynamics among our customers. We’re confident our lithography leadership will continue to serve as a critical enabler for advanced semiconductor roadmaps.”

Additional Highlights:

$NVDA (-2,42 %)

$AMD (-3,55 %)

$AVGO (-4,11 %) , $QCOM (-1,22 %)

$TSM (+0,17 %)

$INTC (-1,69 %) , $TXN (+0,17 %) , $MU (+2,03 %)

- Returned €3.0B to shareholders in 2024 via dividends and share buybacks

- EUV system sales: €8.3B in 2024 (44 EUV systems recognized); down -9% YoY

- Metrology & Inspection systems sales: €646M; up +20% YoY

- Installed Base Management (service + upgrades): €6.5B; up +16% YoY

- China accounted for 27% of Q4 revenue; expected to normalize to ~20% of revenue in 2025

- Proposed total 2024 dividend of €6.40/share, +4.9% vs. 2023