The year 2024 came to an end. It is therefore worth taking a look at the leading stocks that put in an outstanding performance in 2024. The focus is on stocks that tended to belong to the second tier at the start of 2024. These are also companies with exciting stories that could ensure that the respective share continues to perform strongly in 2025.

AppLovin: Leader in mobile advertising and app marketing

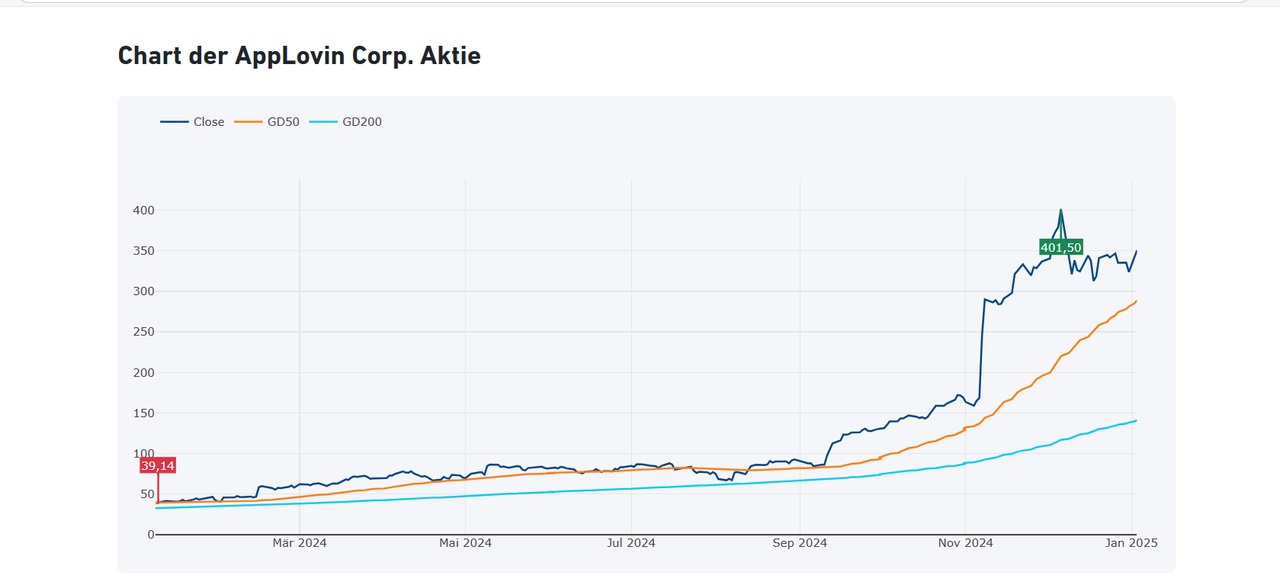

AppLovin (APP) is a leading company in the field of mobile marketing and advertising ("mobile advertising"). It offers a platform for app developers that enables them to monetize their applications efficiently and increase their reach. The company provides technologies that enable targeted advertising and the analysis of user behavior. The AppLovin Growth platform product is particularly well known and helps developers to maximize the monetization of their apps through data-driven marketing and tailored advertising strategies. The big story playing out in the market is probably that AppLovin has established itself as an innovator in the "mobile advertising" space. Through acquisitions, such as the takeover of Adjust (a mobile analytics company), AppLovin has further strengthened its market position. The mobile marketing market is growing rapidly as more and more companies rely on mobile platforms to reach their customers. AppLovin is using this development to further expand its tools and develop new partnerships that improve the reach and effectiveness of its platform. The share performance in 2024 was tremendous. The share price shot up by over 700 %. The market capitalization amounts to a good USD 112.5 billion. This means that AppLovin is probably no longer a second-tier company.