📅 KW 16 / Status: April 14, 2025

Apple starts the week in an exciting position: while the share price is still below the moving averages, there is an increasing amount of positive fundamental data that could cause movement in the coming days.

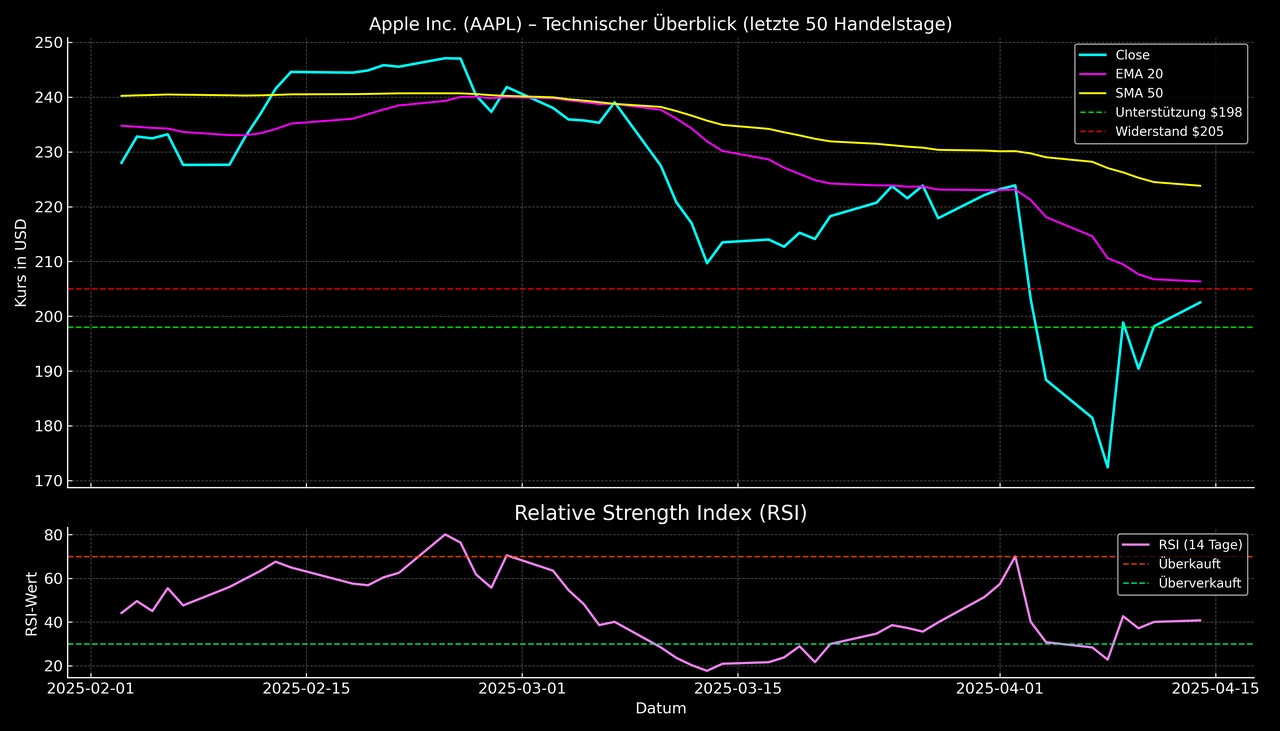

📊 Current market data

- Price (closing price): $201.56

- EMA20: $206.35

- SMA50: $223.82

- RSI (14): 65 (near overbought)

- 52W High/Low: $260.10 / $164.08

➡️ The price is currently below EMA20 & SMA50 - Short-term weakness dominates.

➡️ RSI indicates an overbought zone, which may indicate consolidation.

🔼 Resistance levels

- $205: Decisive zone for short-term breakouts

- $210: Psychological mark - possible target with positive momentum

- $223.82 (SMA50): Dominant medium-term resistance

🔽 Support zones

- $198: Short-term support, important for trend continuation

- $195 - $190: Next lower pullback zone with increasing weakness

🕒 Intraday momentum (April 14, 2025)

- Last 5 minutes: -0.05 %

- Last hour: -0.68 %

- Last 4 hours: -1.61 %

- ➡️ Technically speaking: slightly downward intraday trend

📰 News situation - Fundamental impulses

1. tariff exemptions strengthen tech sector

Apple benefits from temporary exemptions from US trade tariffs on key components.

➡️ Market impact: Positive margin fantasy and institutional confidence

2. supply chain issues remain a factor of uncertainty

According to media reports, there are delays in semiconductors and displays in particular.

➡️ Risk: Shortages could delay product cycles and increase costs

3. expected product announcements in spring

Rumors about new iPhones, AI features in iOS and new Mac models with M4 chips are circulating.

➡️ Potential: Positive surprises could trigger share price momentum

📈 Weekly outlook & valuation

- Expected Range: $198 - $205

- Breakout scenario: above $205 → target zone $210

- In the medium term, the SMA50 at $223.82 remains the central "cap"

- Fundamental sentiment: Positive with uncertainties

📣 Conclusion

AAPL is at a technical crossroads: only a sustained rise above $205 would neutralize the short-term downtrend.

The fundamental news situation is predominantly bullish, but patience is required on the charts. Traders should keep a close eye on key levels ($198/$205/$210).