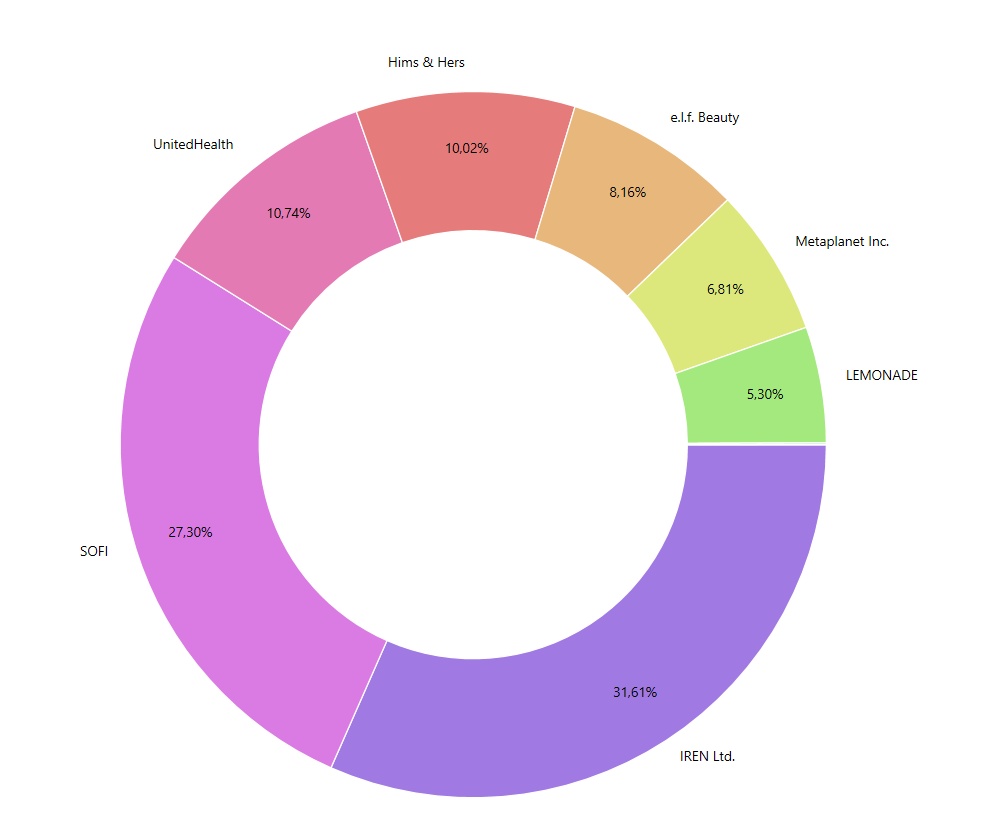

$IREN (-9,15 %)

$SOFI (-10,55 %)

$HIMS (-8,47 %)

$LMND (-10,89 %)

$UNH (-5,78 %)

$3350 (-2,4 %)

$ELF (-13,74 %)

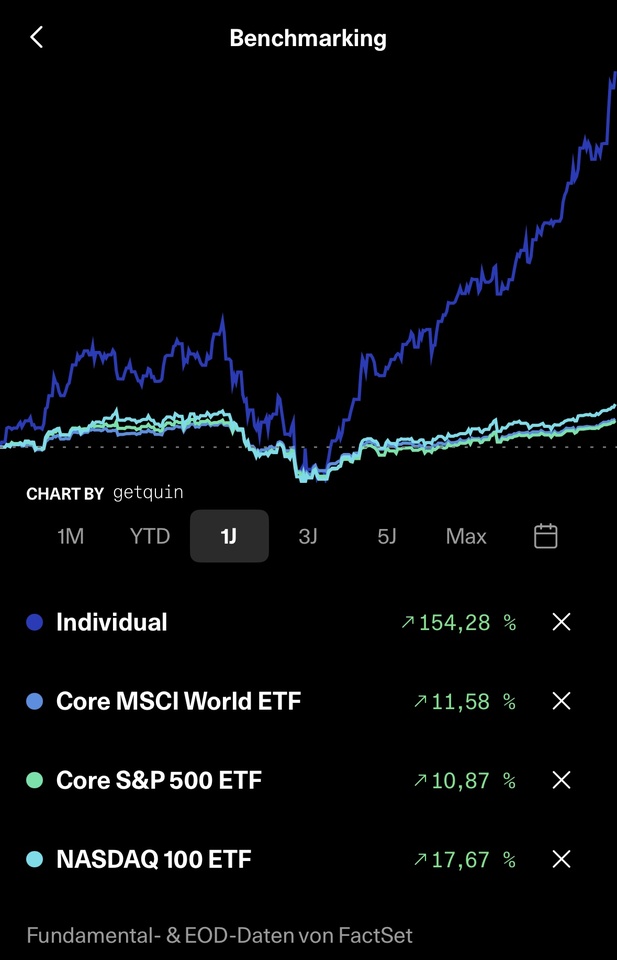

Many would probably not have expected things to go so well after the weak start to the year.

But it shows me personally that my research, my confidence in my company selection and what I saw in the selected companies has paid off.

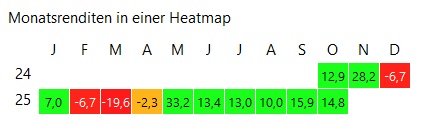

Not only once was I down more than 50% on the companies listed, but I constantly bought more and remained true to my selection, as nothing had changed in my opinion.

Yes, the portfolio is very focused and overweight, but I still believe that the positions will largely continue to outperform the market in the future.

And yes, you need strong nerves, I won't deny that, and you have to question your selection regularly, so it helps a lot if you take notes on why you bought the companies.

Believe in your convictions ✌️