$SBET (-2,14 %)

$BMNR (+2,83 %)

$ETH (-1,04 %)

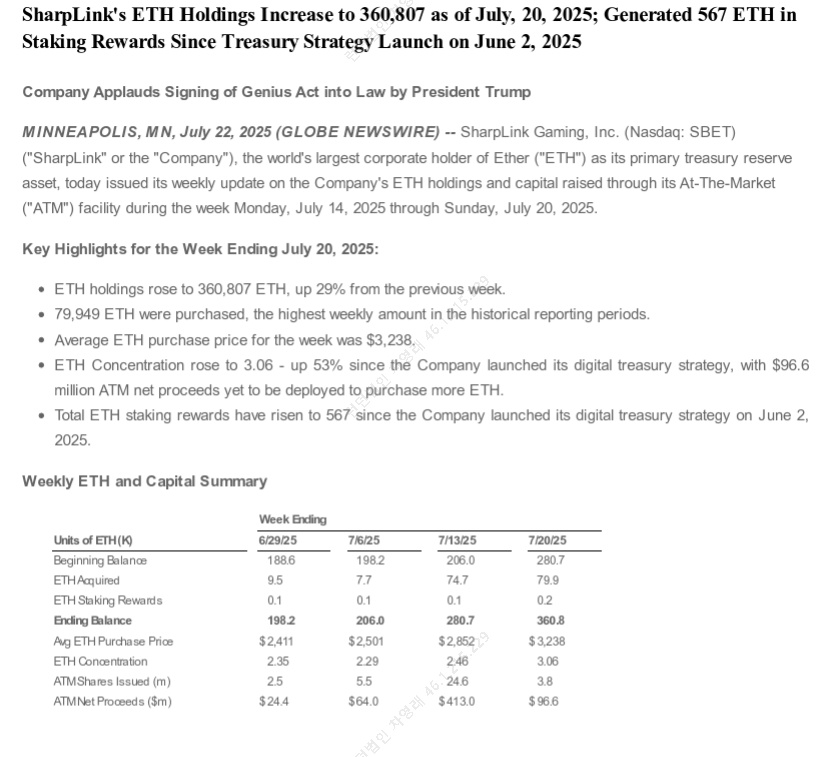

SharpLink Gaming Inc. ($SBET (-2,14 %) ) reported its Ether holdings reached 360,807 ETH as of July 20, 2025, marking a 29% increase from the previous week. The company purchased 79,949 ETH during the week at an average price of $3,238, representing the highest weekly acquisition amount since it began tracking the metric.

The Minneapolis-based company launched its digital treasury strategy on June 2, 2025, and has generated 567 ETH in staking rewards since inception. SharpLink’s ETH concentration ratio rose to 3.06, up 53% since the strategy launch, with $96.6 million in At-The-Market facility proceeds remaining to be deployed for additional ETH purchases.

The company issued 3.8 million shares through its ATM facility during the week ending July 20, generating $96.6 million in net proceeds. This follows previous weekly issuances of 2.5 million, 5.5 million, and 24.6 million shares in prior reporting periods.

"We continue to strategically leverage our ATM facility to build our ETH treasury in pursuit of our long-term growth objectives," stated Joseph Lubin, SharpLink Chairman and Co-Founder of Ethereum.

SharpLink expressed support for the signing of the Genius Act into law, legislation that establishes a regulatory framework for digital assets and smart contract protocols in the United States. The company claims to be the world’s largest publicly traded company to adopt Ether as its primary treasury reserve asset.

The information is based on the company’s weekly update issued July 22, 2025.