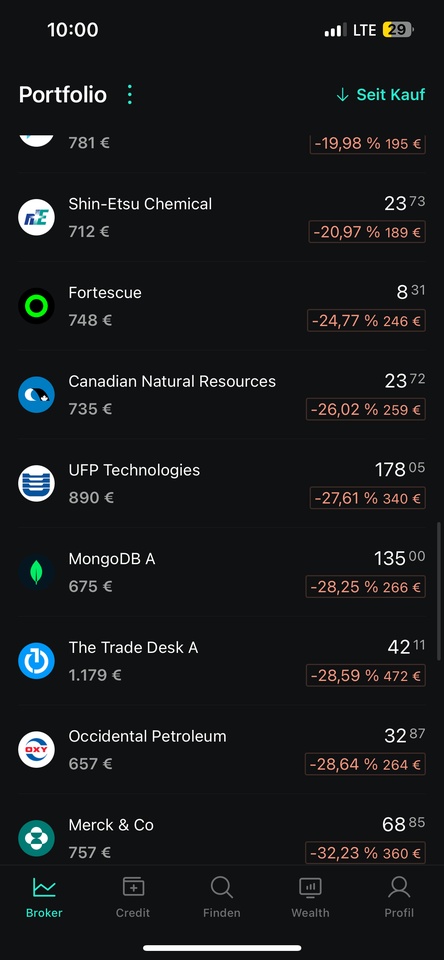

Hello dear community,

I still have some cash to invest and would like to add 3 of the following shares from the list.

Which one would you choose?

at the top is still $6367 (+1,72 %) (daikin)

MANY thanks for your opinions schonmal💪🏼🙏🏼

VG

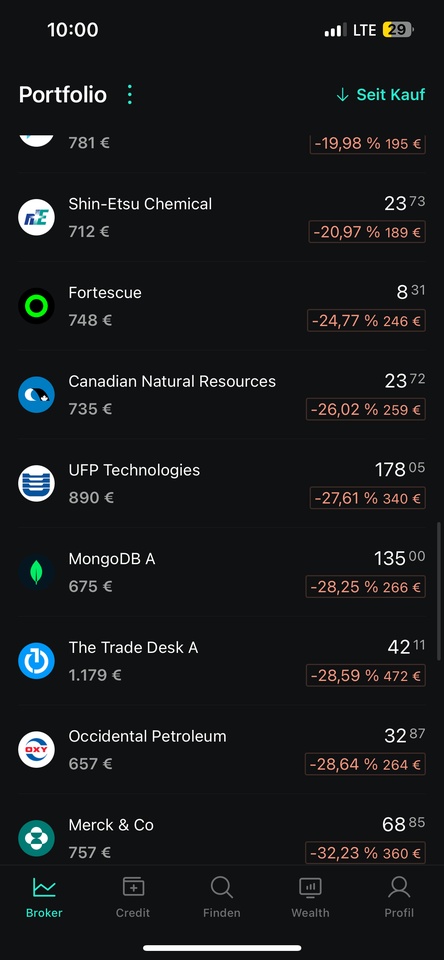

Hello dear community,

I still have some cash to invest and would like to add 3 of the following shares from the list.

Which one would you choose?

at the top is still $6367 (+1,72 %) (daikin)

MANY thanks for your opinions schonmal💪🏼🙏🏼

VG