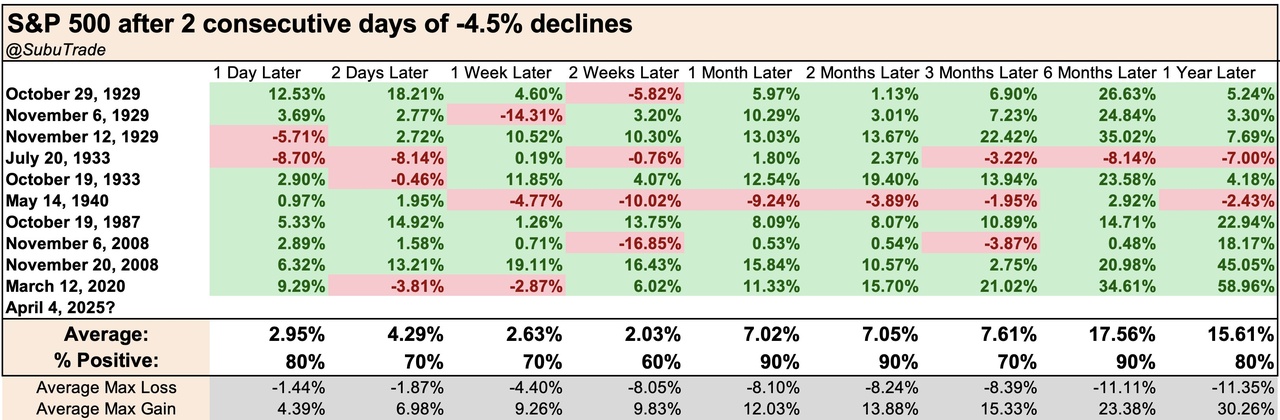

The S&P 500 $CSPX (+0,41 %) has now lost more than 4.5% on two consecutive days, the Nasdaq 100 $CSNDX (-0,05 %) even more.

- The last time this happened was in March 2020 and during the COVID-19 crisis

- Even worse: only the 5th time since 1987 and the 11th time in the last almost 100 years

So we are living through historic times.

You know what that means: it's time to BUY - now, in the coming days, weeks and months, even if the S&P 500 loses even more from its last all-time high.

Are you buying too?