Hot PPI – Time to Call the Tariffs Off

Markets opened weak today after a shocking producer-price report. The new data showed inflation is picking up, with a 0.9% increase — much stronger than expected, and the largest monthly rise in over three years. Stocks jumped yesterday after solid CPI data, but as I emphasized the other day: someone has to eat the tariffs. And as long as it isn’t the consumer, it’s the corporations. Deere and Caterpillar are two behemoths in the machinery industry, and both are noting a heavy impact from the tariffs. They’re bracing for way more to come. These aren’t good signs. Even worse: the market keeps ignoring them.

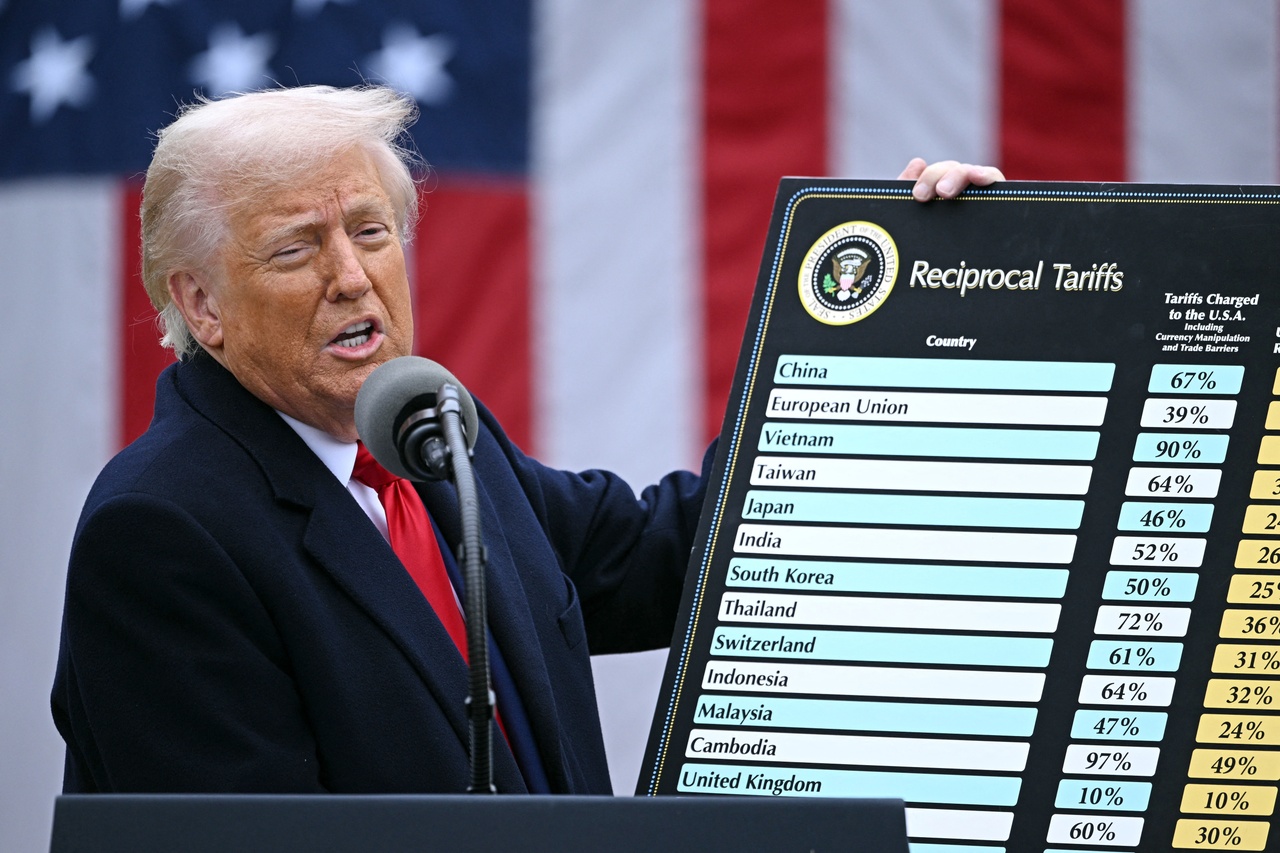

Trump can run around as excited as he wants and fire the bearers of bad news. But eventually, he will need to face the fact that his love child – enormous tariffs – causes inflation. Does he really think that companies will keep eating most of the impact? He can’t be that clueless.

For the markets, this news is a double-negative. Not only is inflation picking up, which puts strain on the economy, but if this is the beginning of the materialization of the tariffs, then the Fed has a very good excuse not to lower rates in September. The market is currently pricing in three rate cuts this year. But if inflation keeps ramping up, that’s nothing more than delusional dreaming. In fact, several regional Fed presidents have already voiced concerns about the negative signal rate cuts would send right now — in this dire economic situation.

All of that points to disaster, but it won’t come to that. Stay with me here:

This could age very badly. I predict we will see increased tariff impact over the coming months, leading to a significant drawdown in the stock market. I don’t know what is driving the markets right now — maybe it’s AI or maybe it’s pure hubris. But there is no case in world history where tariffs haven’t taken a toll on the economy. That point is going to come soon. The president will face a difficult decision: chicken out or crash the economy.

And when I say decision, I mean he only has one choice. But before he eventually tucks his tail, markets will tumble. Trading at all-time highs while being in the buildup of an economic crisis is never a good position.

However, I embrace the idea of a market crash: 10%, 20%, 30%? The more, the better. My horizon is long-term, my stocks are already undervalued, and crashes create massive opportunities. Personally, I consider a crash a win-win situation: Trump would have to walk back his nonsense, and investors could load up on great companies.