The Siemens $SIE (-0,45 %) AGM last week marked the start of the dividend season.

And Siemens is a reliable dividend payer with regular increases and an attractive yield of currently 2.7%.

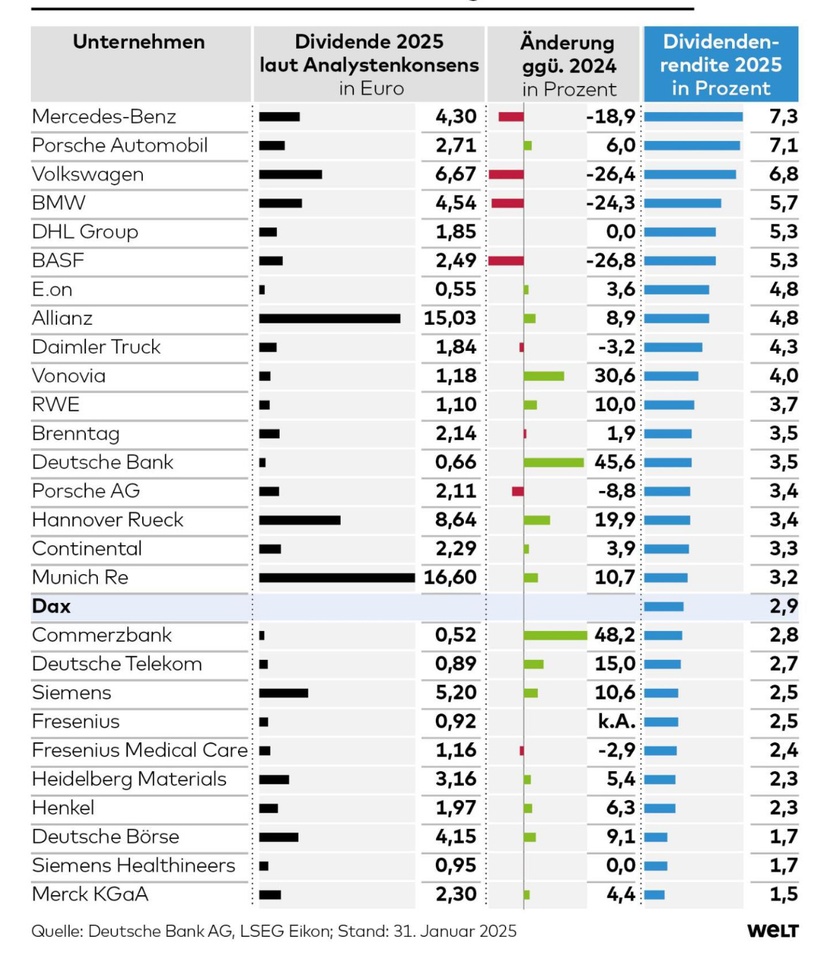

Not all companies are such reliable dividend payers, e.g. $BAS (+1,69 %) will probably pay less in 2025 than in 2024.

Further reductions are to be expected from German car manufacturers. Nevertheless, it can be assumed that they will pay out the most despite the cuts. However, experts rightly warn that a high dividend yield alone is not a sign of quality.

Infographic: WELT