$PH (+0.14%) +13%

I took a closer look at Parker Hannifin shares over the last few hours and found almost no good reasons to sell. Except of course for the ubiquitous overvaluation of US stocks...

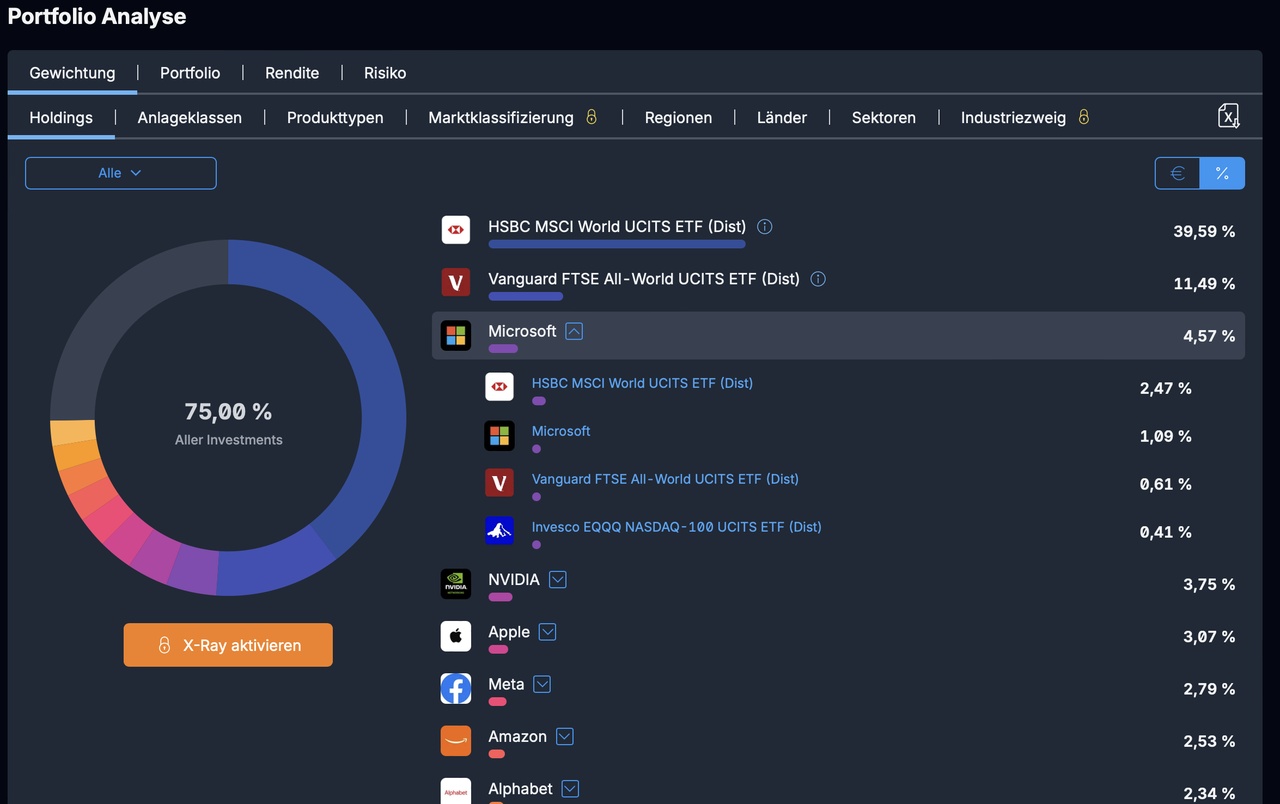

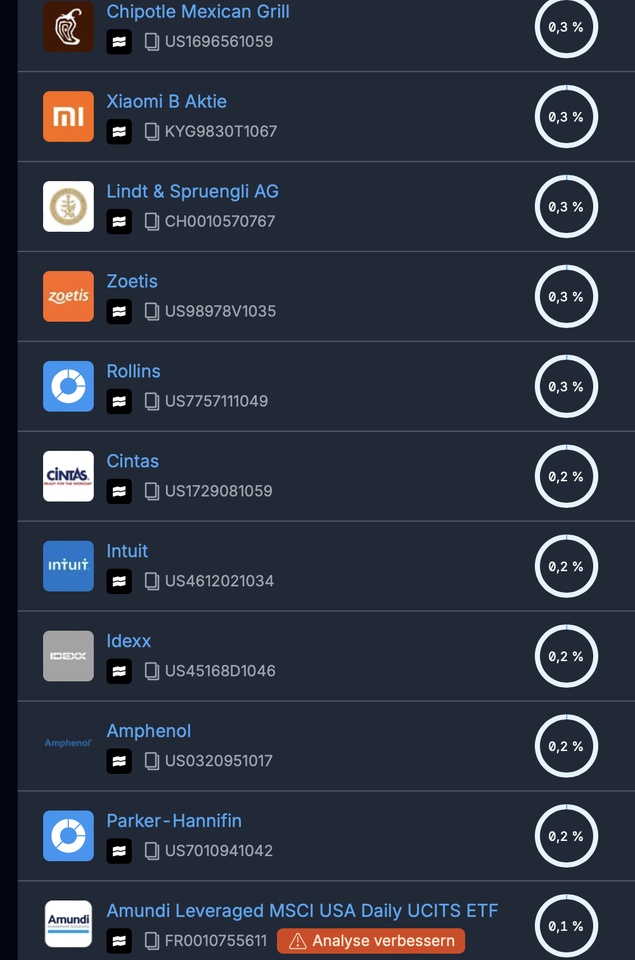

I started with this share because it is the smallest position in my portfolio and therefore doesn't make sense simply because of its size.

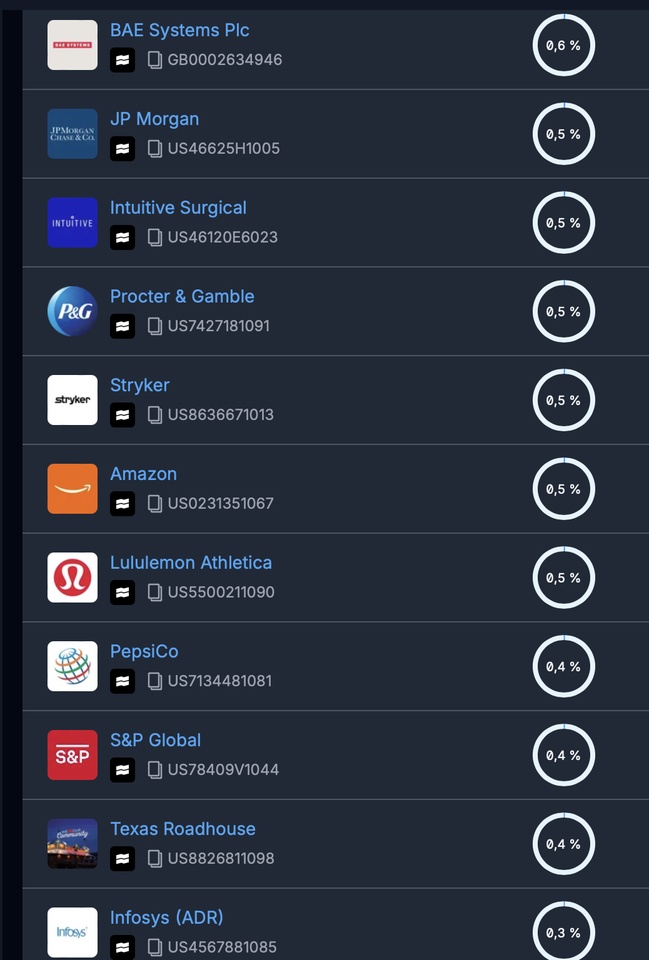

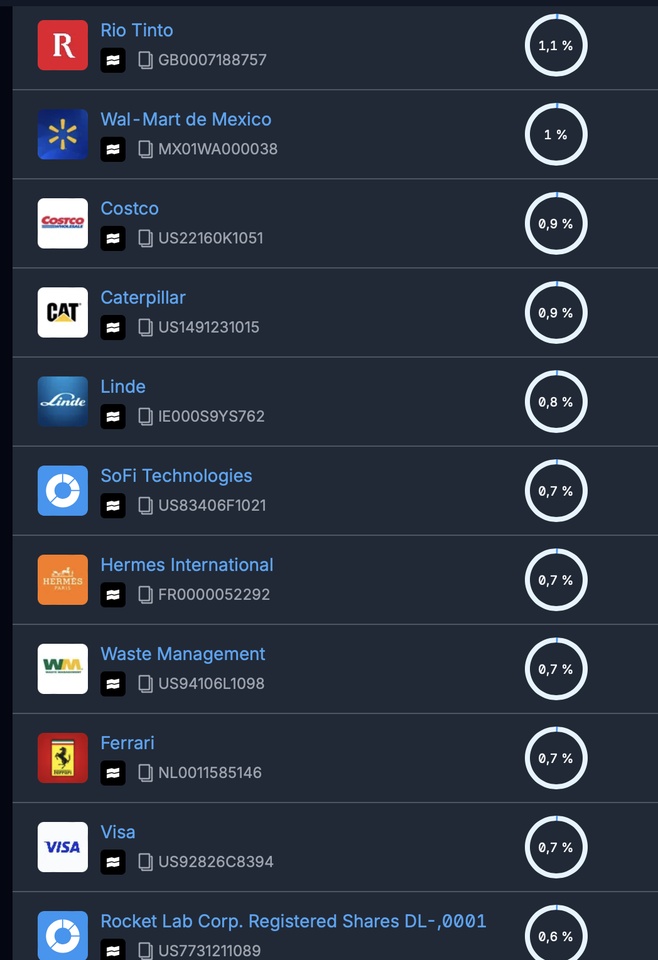

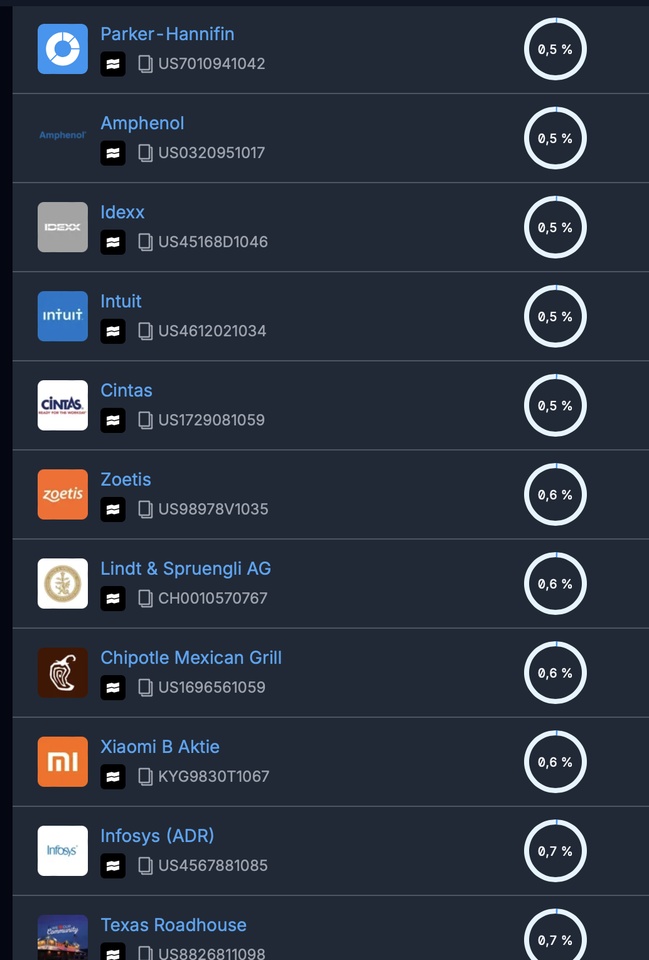

In the chart, my smallest stock positions in ascending order of position size:

Now I have found out the following:

The stock is currently trading at around $723.

As of Q1, Parker has $9,370 million in debt and about $408 million in cash and cash equivalents.

If you now subtract the have from the should and divide it by the number of shares, around 128.44 million, I arrive at a net debt per share of around $69.8.

Worse than in the previous year.

In combination with the high valuation, I think I should take my approx. 13% quick book profit and reallocate.