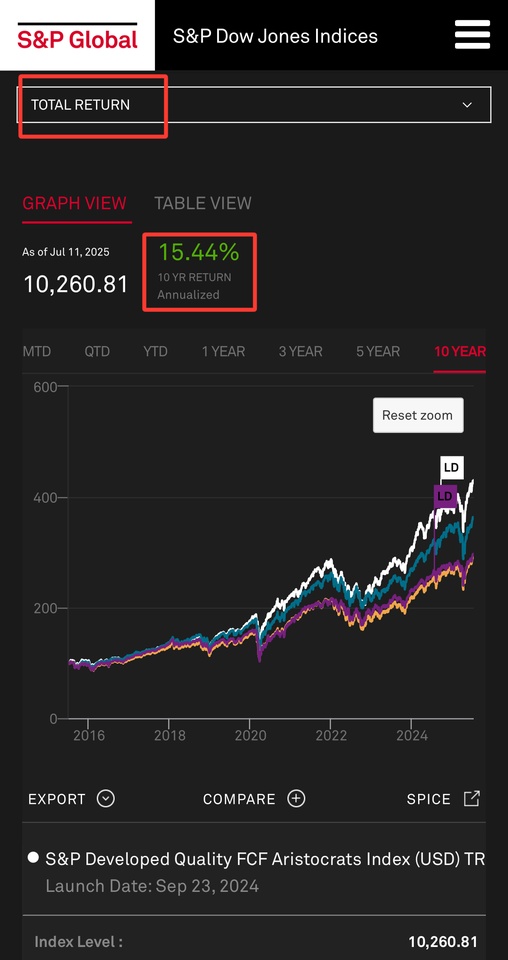

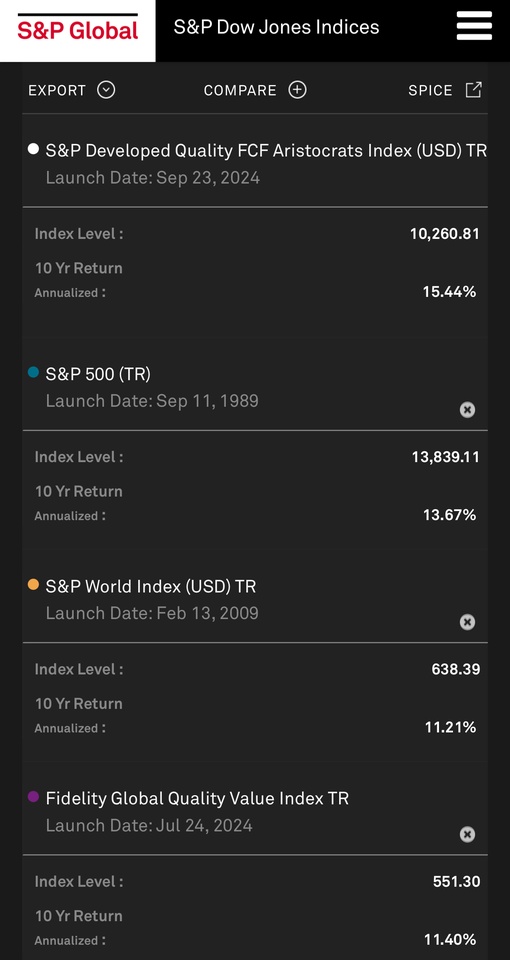

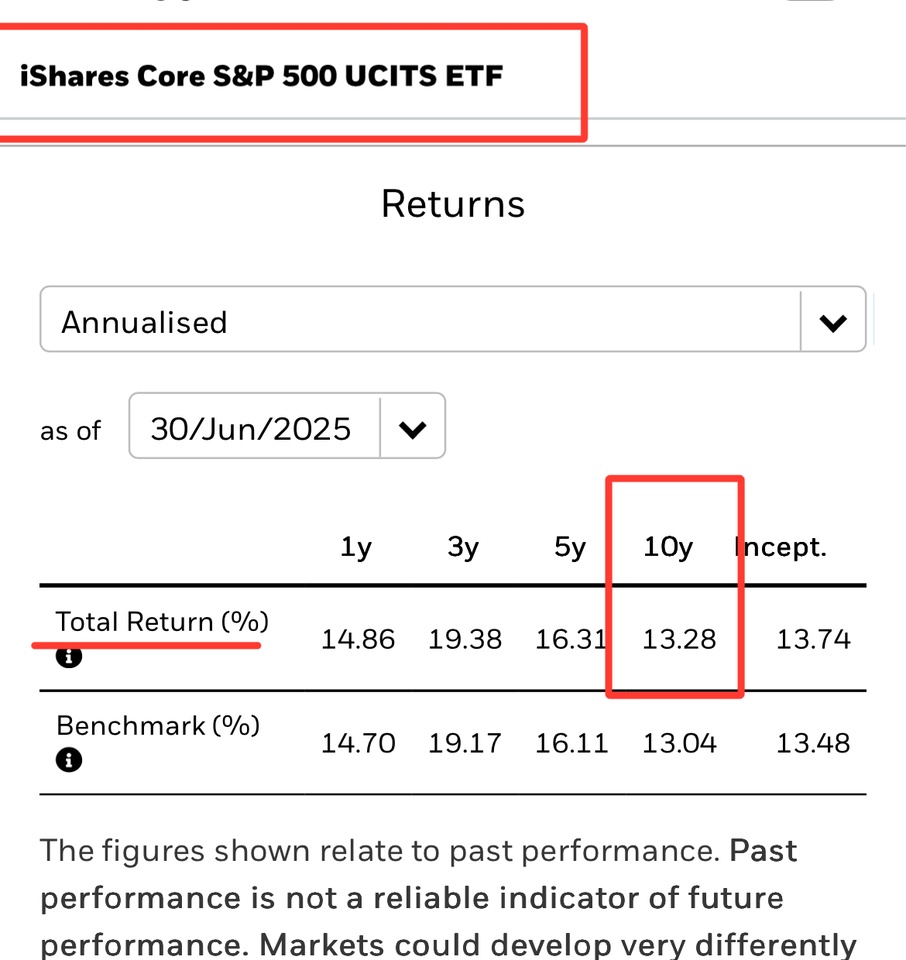

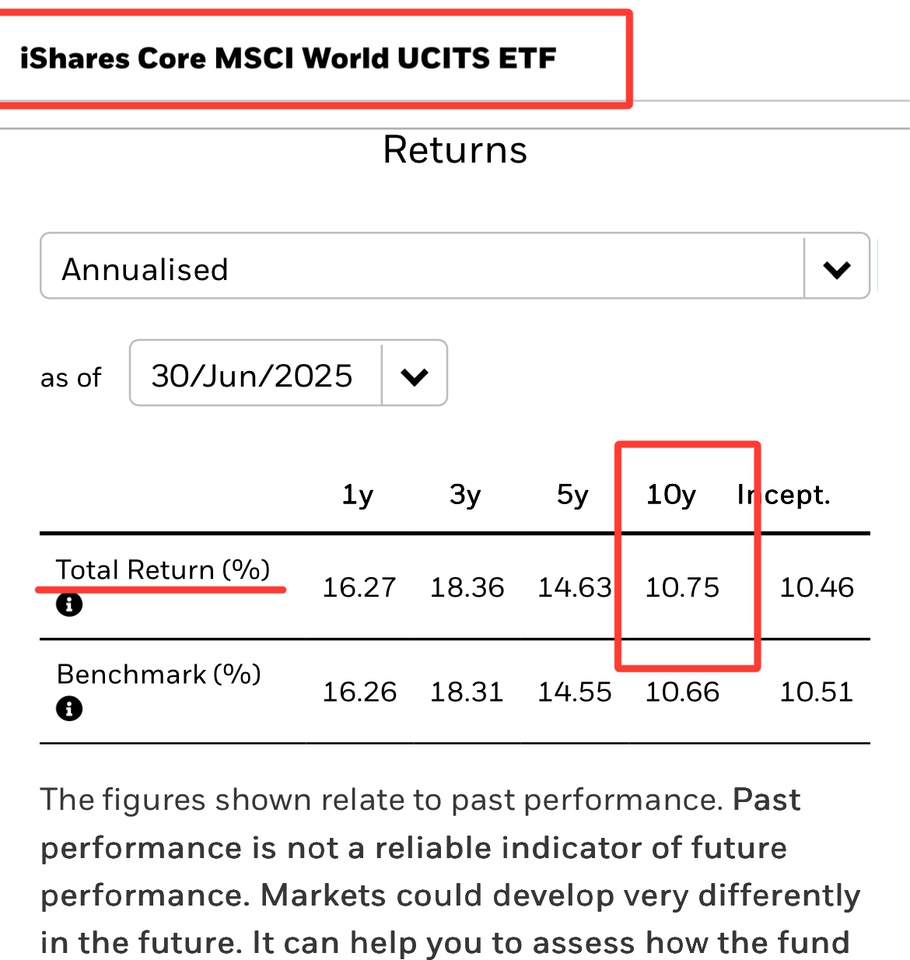

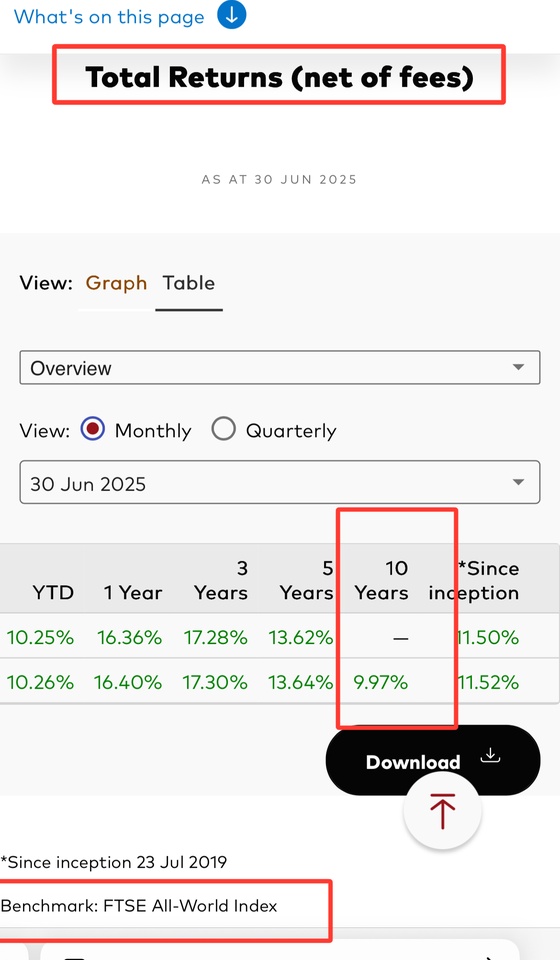

I took a few interesting screenshots comparing $QDEV (+0,4 %) with other popular indexes $IWDA (+0,21 %) , $CSPX (+0,1 %) , $FGEQ (+0,36 %) and $VWRL (+0,61 %)

It is about the annualized 10-year total return (price + dividends)

World Quality Aristocrats: ≈15%

MSCI World: ≈11%

S&P500: ≈13%

FTSE All-World: ≈10%

Fidelity: ≈11%