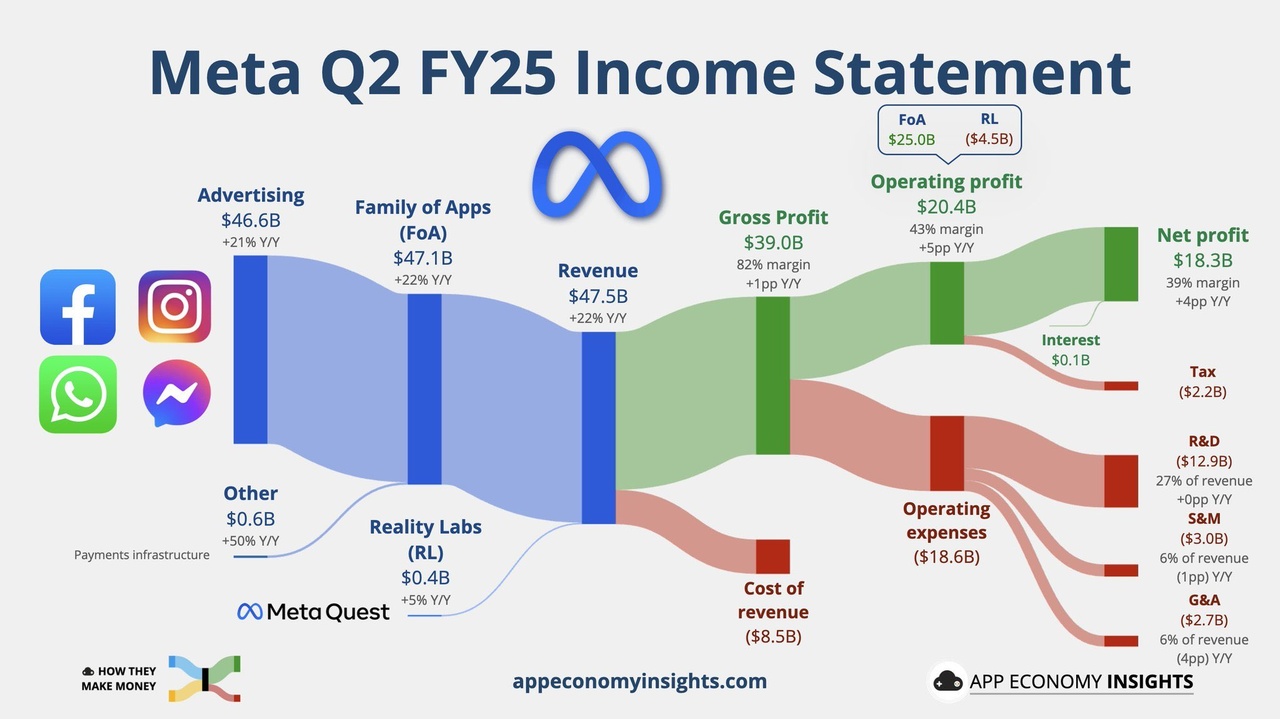

- Sales: USD 47.52 billion (estimated USD 44.83 billion) ✅ ; increase of +22 % compared to the previous year

- Earnings per share: USD 7.14 (estimated USD 5.89) ✅ ; increase of +38% compared to the previous year

- Operating result: USD 20.44 billion (estimated USD 17.24 billion) ✅ ; increase of +38% compared to the previous year

- Capital expenditure in FY25: USD 66-72 billion (previously: USD 64-72 billion; estimate: USD 67.8 billion)

Q2 segment::

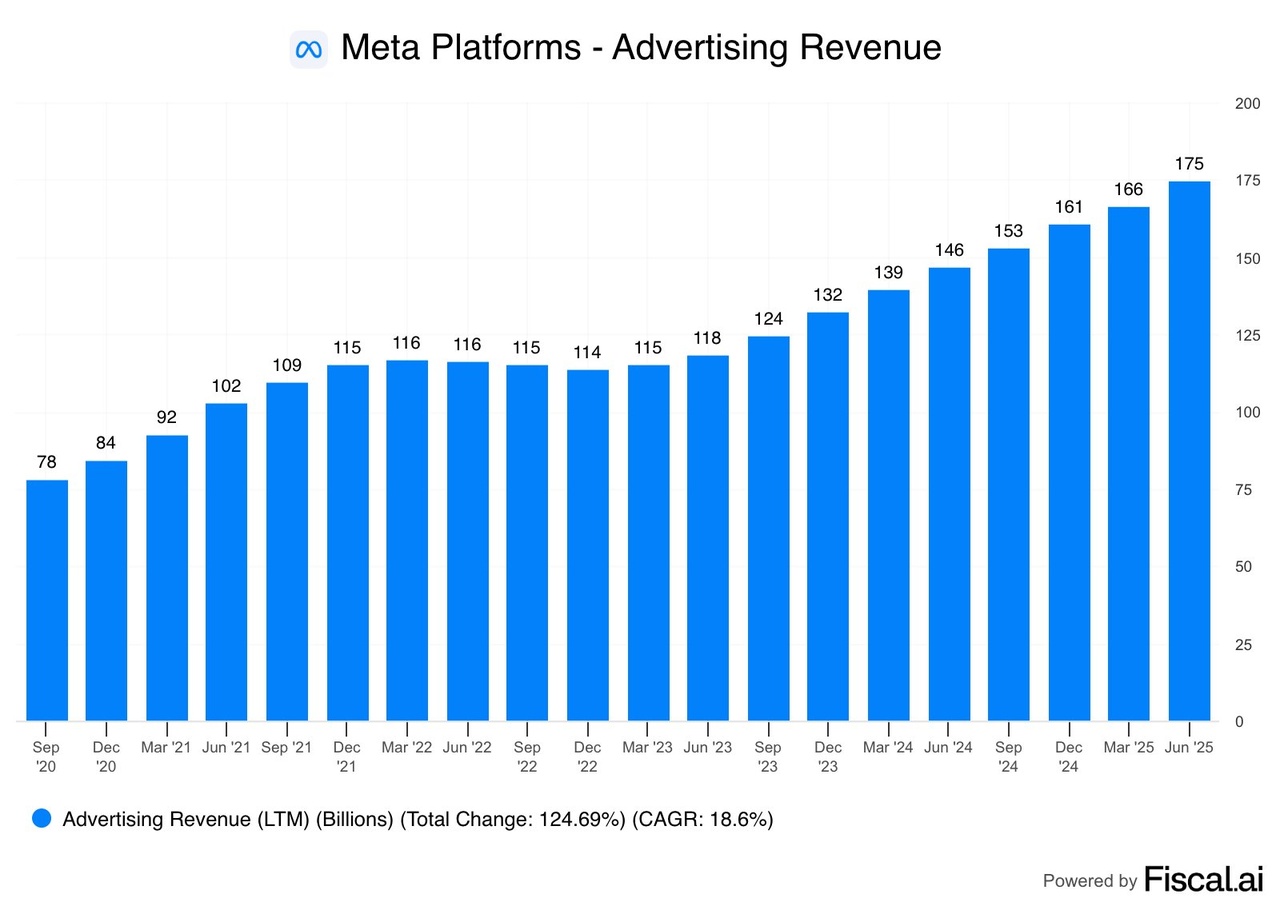

- Advertising revenue: USD 46.56 billion (estimated USD 44.07 billion) ✅

- Revenue of the app family: USD 47.15 billion (estimated USD 44.40 billion) ✅

- Operating result of the app family: USD 24.97 billion (estimated USD 22.16 billion) ✅

- Revenue of Reality Labs: USD 370 million (estimated USD 386 million) ❌

- Operating loss of Reality Labs: (USD 4.53 billion) (estimated loss USD 4.86 billion) ✅

Other metrics:

- Daily active persons (DAP): 3.48 billion; up 6% year-on-year

- Ad impressions: Increase of +11 % compared to the previous year

- Average price per ad: +9 % compared to the previous year

- Number of employees: 75,945; increase of 7 % compared to the previous year

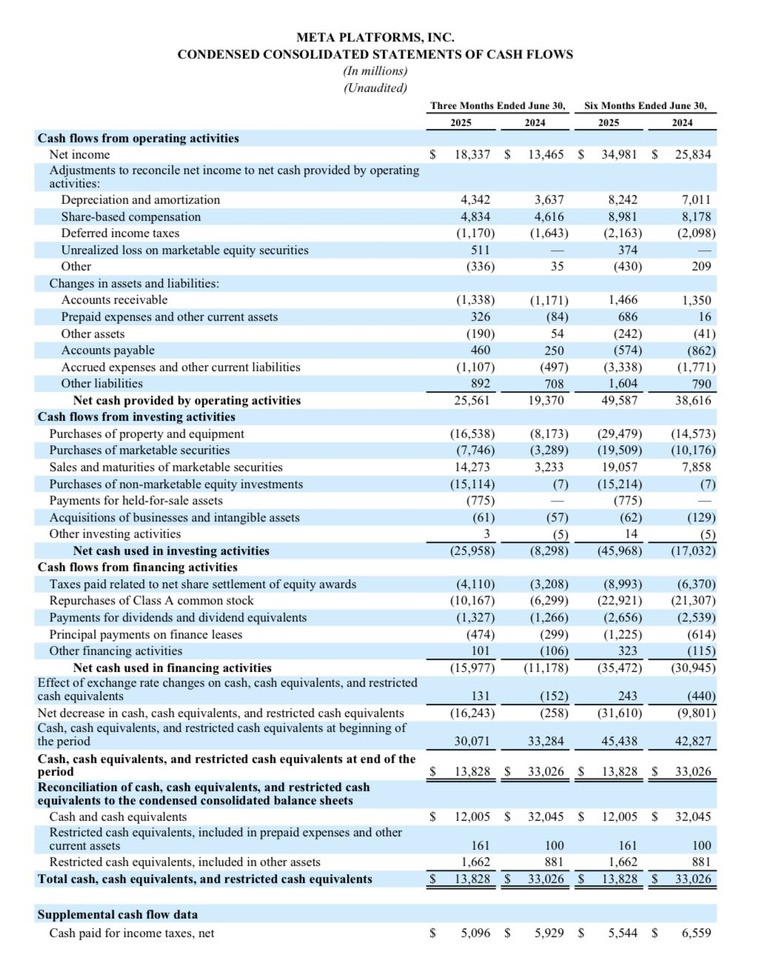

- Capital expenditure: USD 17.01 billion

- Free cash flow: USD 8.55 billion

- Share buy-backs: USD 9.76 billion

- Dividends and equivalents: USD 1.33 billion

- Cash and cash equivalents: USD 47.07 billion

Comments:

➡️ "We had a strong quarter both commercially and socially." - CEO Mark Zuckerberg

➡️"I'm looking forward to building a personal superintelligence for everyone in the world."

➡️ Expense guidance for the financial year reduced; expected to grow 20-24% year-on-year

➡️ Cost growth in FY26 expected to be higher due to infrastructure and remuneration

➡️ Capital expenditure for FY2026 expected to increase again to support scaling of AI

➡️ Regulatory risks in the EU could significantly impact sales this year