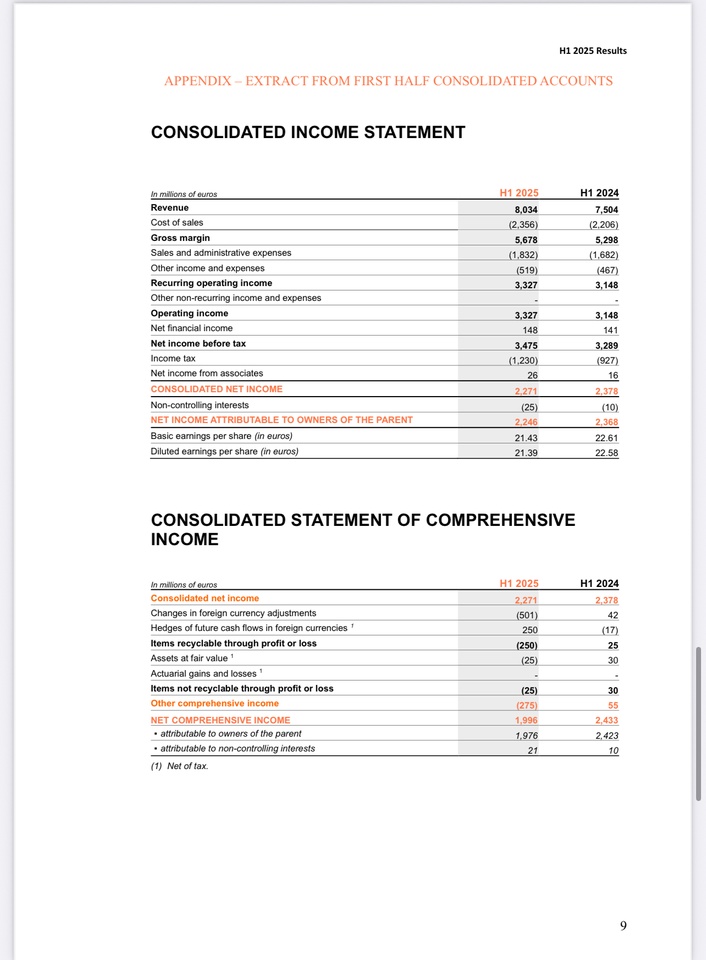

- H1 sales: €8.03 billion → +8% at constant exchange rates compared to H1 2024 (previous year: €7.50 billion)

- Sales Q2 alone: €3.91 billion → +9% in the comparative period

- Recurring operating income: €3.33 bn (+6% YoY), margin now 41.4% vs. 42% in the previous year

- Net profit (Group share): €2.246 billion (-5% unadjusted), adjusted +6% to €2.5 billion compared to previous year

- Free cash flow: €1.85 bn (+4% YoY) with operating CF of €2.73 bn (€0.32 bn investments)

Comparison with analyst estimates:

- Sales growth of +9% was slightly below the consensus of around +10%

- Profit growth of +6% (adjusted) was roughly in line with expectations

- The operating margin fell from 42% to 41.4%, which surprised several market participants

Why did the share price still fall by almost 5%?

Slight margin pressure - the margin decline despite sales growth was interpreted as a warning signal, especially for a luxury stock with an otherwise over 42% margin.

Dampening signals from China - growth in Asia (ex-Japan) stagnated at +1-3%, China remains fragile

High expectations - Investors expected consistent top margins; even small deviations were viewed negatively.

Economic environment - Uncertainty due to geopolitical situation, weakness in the European luxury market and trade tensions increased nervousness

I personally see the slight fall in the share price as a buying opportunity $RMS (-1,66 %)