High-yield bonds, also known as high-yield bonds or junk bonds, are fixed-interest securities issued by companies or governments with a low credit rating. Due to the increased risk of default, they offer investors higher interest rates than bonds from issuers with better credit ratings. To minimize the risk, you could invest in high-yield bond ETFs. [IE00B4PY7Y77] $IHYU (+0,4 %)

Characteristics of high-yield bondsTo compensate investors for the higher risk, these bonds offer above-average interest rates of approx. 6% per year at -> $IHYU (+0,4 %) Corporate Bond ETF

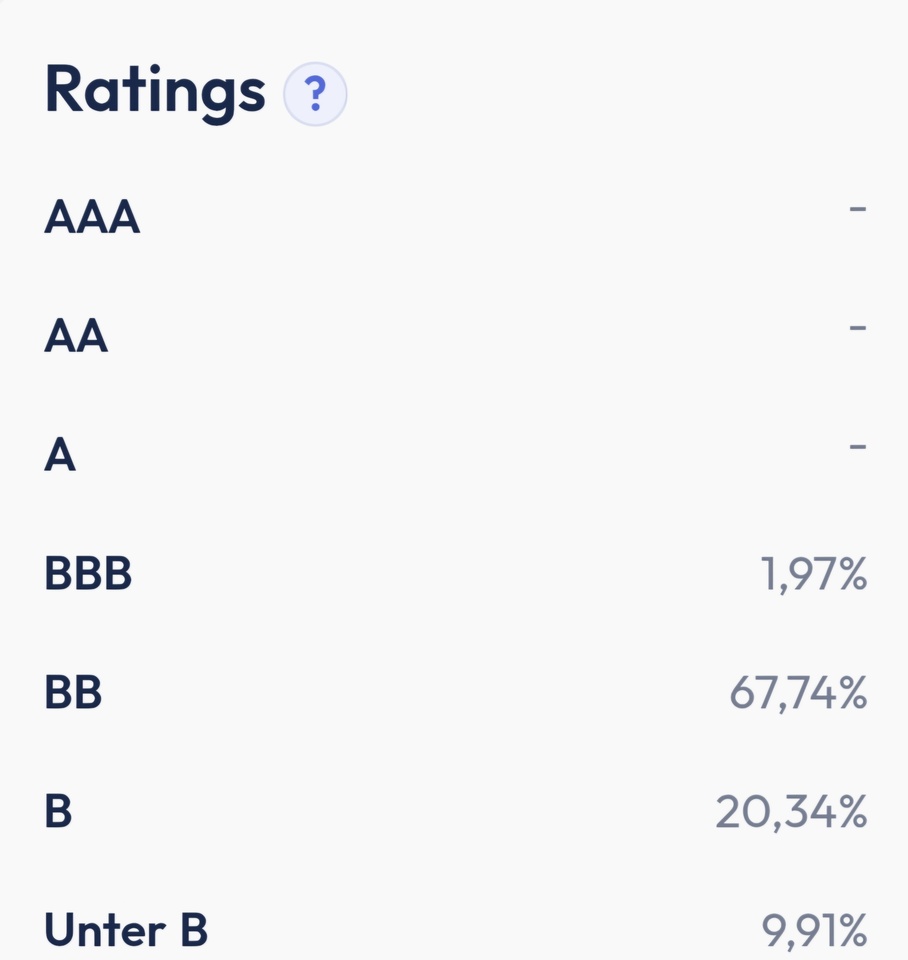

Low rating: Rating agencies classify the issuers of such bonds below investment grade, which indicates an increased probability of default. Examples of such companies are Thyssenkrupp, Renault, Nokia and Deutsche Bank.

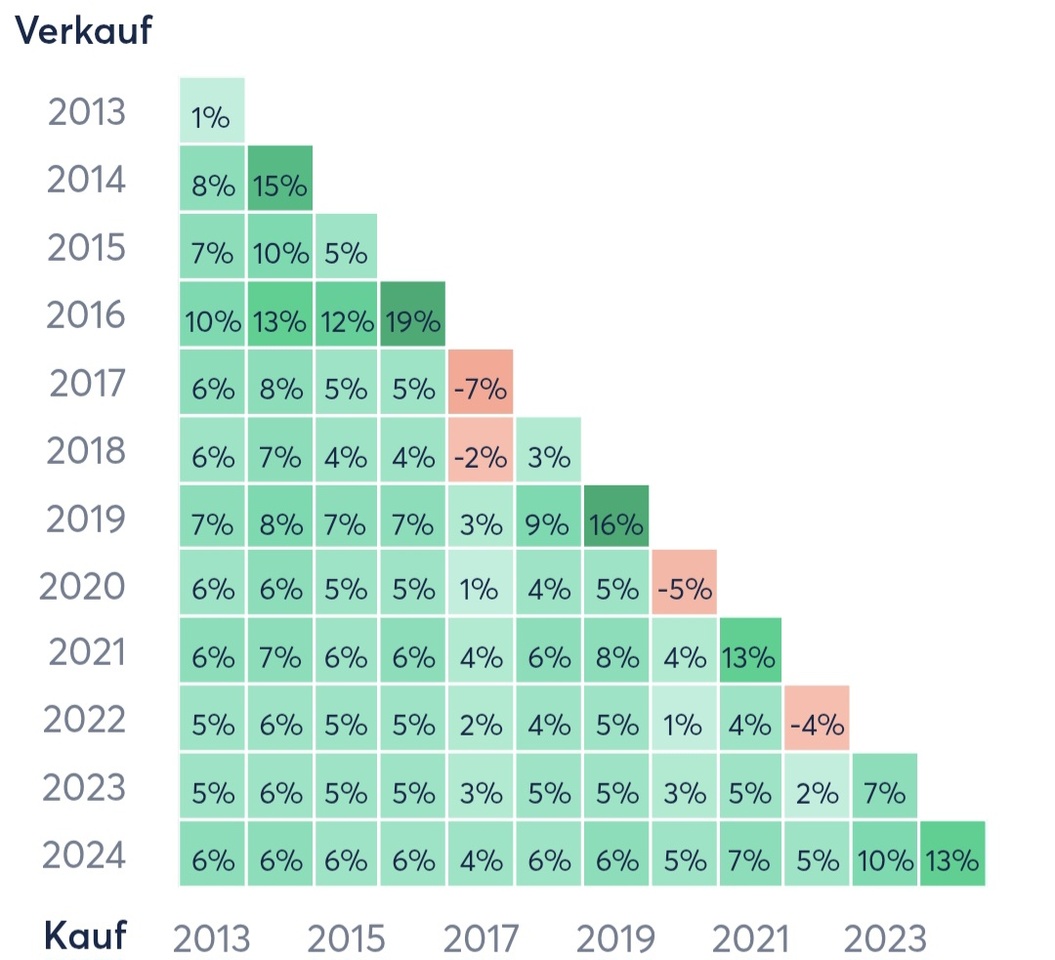

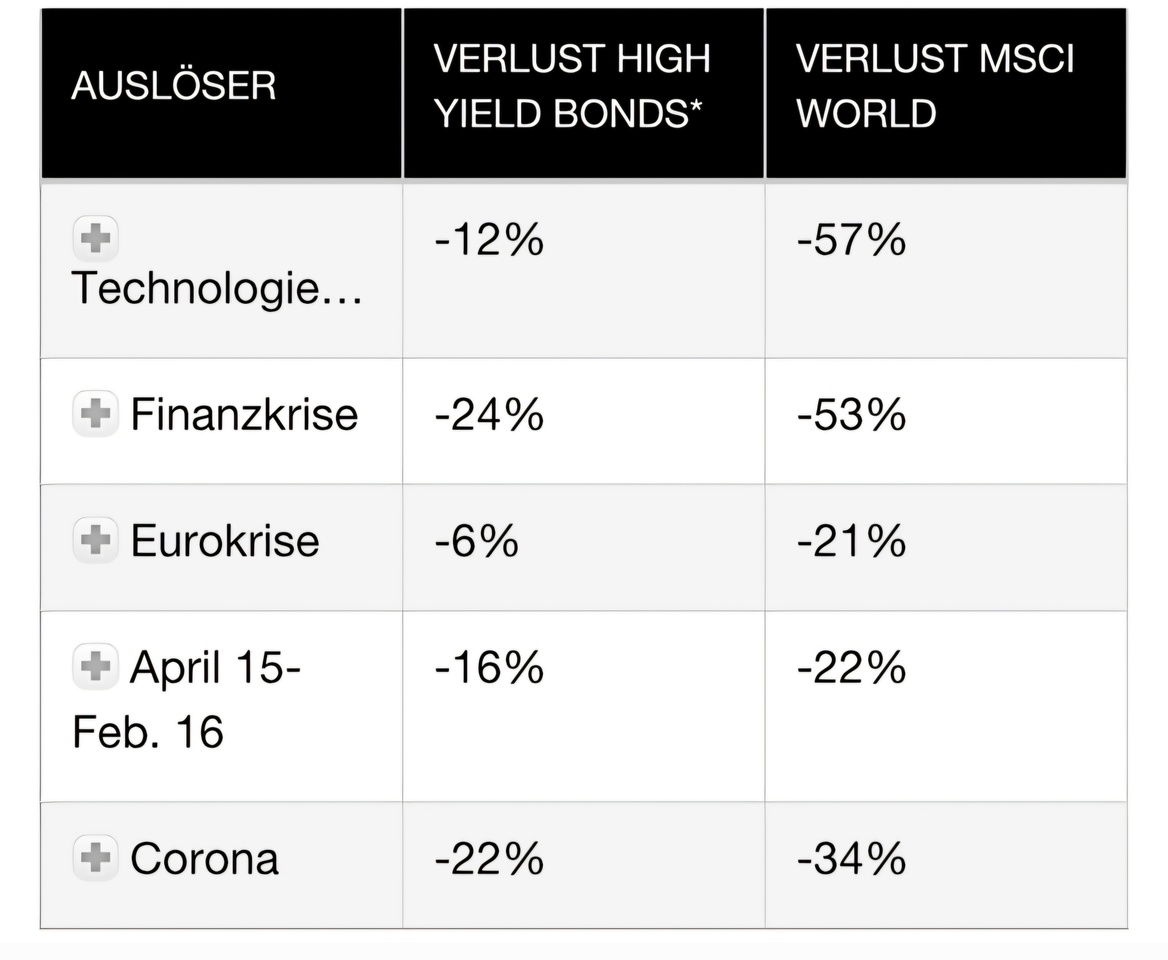

Price volatilityHigh yield bond prices can fluctuate more, especially in times of economic uncertainty. However, they fall lower than the MSCIWorld $IWDA (+0,64 %) and recover quickly . As a result, corporate high yield bonds offer a better risk/return ratio than the MSCI World.

Opportunities and risks

Opportunities: In phases of economic recovery, high-yield bonds

high-yield bonds can offer attractive returns. They can also help to diversify a portfolio, as their performance does not always correlate with that of equities or government bonds.

Risks: In addition to the increased default risk, factors such as interest rate changes, currency fluctuations and low liquidity can have a negative impact on performance. In economic downturns, the probability of payment defaults also increases.

Suitability for investors

Overall, high-yield bonds are risky investments. Although they are safer than shares, they are considerably more volatile than euro government bonds from countries with top credit ratings such as "Germany". High-yield bonds therefore belong on the risky side when putting together a portfolio. Anyone who swaps high-yield bonds for euro government bonds in order to increase the yield of their portfolio also significantly increases the risk and usually lowers the risk/return ratio.

Conclusion

High-yield bonds can be an interesting addition for investors who are looking for higher returns and are prepared to accept a higher risk in return. However, careful analysis and evaluation of individual risk tolerance are essential in order to make well-founded investment decisions.

What do you think of high-yield bond ETFs? ℹ️

I'm thinking of investing a good sum this year to take advantage of my tax-free allowance, diversify and build up assets via a savings plan.

IE00B4PY7Y77 $IHYU (+0,4 %)