For us investors, investing has become easier in recent years and many things have become simpler in terms of tax, even if they are not cheaper. In the best case scenario, the custodian bank or broker takes care of calculating and paying the taxes. As it is sometimes not so easy to make a rational decision and the "compound interest" effect should not be ignored, here is a short report. I hope it helps some of you with your decision.

The question of whether to invest in a distributing or an accumulating fund or ETF alone should give us a basic understanding of the tax treatment.

What has changed as a result of the Investment Tax Act

When the Investment Tax Act (2018) came into force, a number of things changed and even simplified matters for fund managers and investors. Since then, not only units in domestic and foreign funds are to be treated equally for tax purposes, but also accumulating and distributing funds.

Treatment of domestic and foreign ETFs and funds

Before 2018, the withholding tax for foreign funds was credited against the final withholding tax. For example, if I invested in a share from the USA, the USA was considered the source state - i.e. the country where the taxes were levied. Each state set its own tax rate.

Thanks to double taxation agreements, the withholding tax was limited to 15 percent. However, investors had to pay directly and in advance. Depending on the country in which the share was issued, the withholding tax could amount to more than 15 percent (for example, 30 percent in the USA). Investors were often only able to reclaim the difference retrospectively.

In the case of funds and ETFs, the respective capital management company takes care of refunding the excess withholding tax paid. Investors were still required to make a declaration in their tax return.

Domestic funds are now treated in the same way as foreign funds. Since 2018, 15 percent corporation tax has been levied at fund level. This means that the fund management company pays this directly from the fund assets, which means that dividend payments, for example, are lower than before.

To compensate for this, the law provides for relief for investors. Depending on the composition of the fund, they can expect a partial exemption. Partial exemption means that a certain percentage of the distributions is tax-free. For funds with an equity component of more than 50 percent, the partial exemption is 30 percent. This means that only 70 percent of the distributions are taxed.

The partial exemption also applies to foreign funds. Investors no longer have to declare the withholding tax in their tax return; the data is automatically sent to the tax office.

Treatment of accumulating and distributing ETFs and funds:

The new Investment Tax Act means that accumulating and distributing funds are now treated equally for tax purposes. Before 2018, distributions were taxed immediately after payment and capital gains were only taxed when they were sold.

This resulted in a tax deferral effect. Although German accumulating funds had to report income equivalent to distributions and pay tax accordingly, foreign funds and ETFs did not have to do so. It was again up to the investors to declare this income in their tax returns.

As these accumulating funds reinvest distributions directly, no tax payments were triggered. Until they were sold, investors could benefit from non-tax-reduced compound interest, while investors in distributing funds could only reinvest the amounts for which tax had already been deducted.

The new law was intended to abolish the tax deferral effect. With the introduction of an advance lump sum, which we will look at in more detail below, a lump sum is paid annually on capital gains.

Accumulating versus distributing ETFs and funds

Distributing funds

With distributing funds, equity and bond income such as dividends and interest are paid out on an ongoing basis. As a rule, the fund value is then reduced by the amount distributed. Depending on the fund rules, income is therefore transferred to my clearing account on a monthly, quarterly or annual basis and the invested assets decrease at the same time. I can then transfer the income to my current account or reinvest it in the fund. The latter may incur transaction costs.

No matter what you choose: The distributions must be taxed.

Accumulating funds

In the case of accumulating or reinvesting funds, income from shares and bonds is not paid out but reinvested. The fund company buys back shares on a pro rata basis. Investors therefore do not receive any extra payouts and no taxes are payable on the distributions. Compared to the distributing fund, which otherwise pursues the same investment strategy, my fund units tend to be worth more with the accumulating fund, as the entire basket of shares is worth more. If, on the other hand, I want to reinvest the distributed taxed amounts in the fund, I own more fund units, each of which is worth less.

This comparison illustrates once again where the tax deferral could arise before 2018. By reinvesting the distributions within the funds, the tax could be saved. Although a higher tax amount was then incurred on sale, the compound interest effect of accumulating funds was previously higher than for distributing funds, whose income could only be reinvested after tax.

In order to establish equal treatment here, the Investment Tax Act introduced the advance lump sum. However, as we will see, this only partially eliminates the problem. In the following, we will take a look at why this is the case, what interest has to do with it and how the tax-free allowance plays a role here.

The advance lump sum

In this section, we will look at some formulas and calculations. It is important to know that investors do not have to calculate and pay the taxes themselves. The custodian bank takes care of this and pays the tax amount directly from the investor's settlement account to the tax office.

Nevertheless, it can be useful to look into the calculation of the advance lump sum. On the one hand, it helps with the choice of the respective fund or ETF type, on the other hand, it is always good to know what has been calculated and how - banks can also miscalculate. However, we have yet to meet an investor who has actually calculated this for themselves.

The key figures

The custodian bank requires four key figures to calculate the advance lump sum and the resulting taxes to be paid. Before 2018, investors had to provide 33 different details in their tax return. Now the following information is sufficient:

- Amount of distributions,

- Fund value at the beginning of the year

- Fund value at the end of the year

- Type of fund

The basic terms

Before we start calculating, let's clarify a few basic terms to help us understand the advance lump sum and its effects.

The prime rate: This is published by the Deutsche Bundesbank at the beginning of each year for the current year. It is based on the long-term yield achievable on public-sector bonds. Using the interest rate structure data for German government securities with annual coupon payments and a remaining term of 15 years, a was calculated and published for 2023.

The base yield: To calculate the base yield, the fund value at the beginning of the year is multiplied by 70 percent of the base interest rate. This is a fictitious calculation. Multiplying this by the prime rate calculates the "safe" return that can theoretically be generated by a low-risk investment. The 30 percent reduction is intended to offset the costs at fund level.

The formula is therefore as follows: Base yield = fund value at the start of the year x base interest rate x 0.7

The base yield is the maximum taxable amount. This means that if the price growth of the fund at the end of the year is higher than the base yield, only the base yield is used. If the price growth is below the basic income and no distributions have been made, the lower value is used. The base yield can never be less than zero.

The advance lump sum: This forms the basis for the taxation of income growth of funds and is calculated as follows:

Advance lump sum = basic income - distributions

The basic income is reduced by the distributions, as these are taxed separately. In the case of accumulating funds, they are generally zero. If the price appreciation at the end of the year is below the basic income, the price gain is recognized.

If there is a negative result when calculating the advance lump sum, this is set at zero.

Taxes: A final withholding tax is calculated on distributions and the advance lump sum. This means that income from capital gains is taxed at a flat rate and then no longer has to be included in the income tax return - it is settled with this tax rate, so to speak.

The final withholding tax is made up of capital gains tax (25 percent), the solidarity contribution (5.5 percent) and, if applicable, church tax (8 to 9 percent). Excluding church tax, it amounts to 26.375 percent.

Example calculation 1: Funds with low total income growth

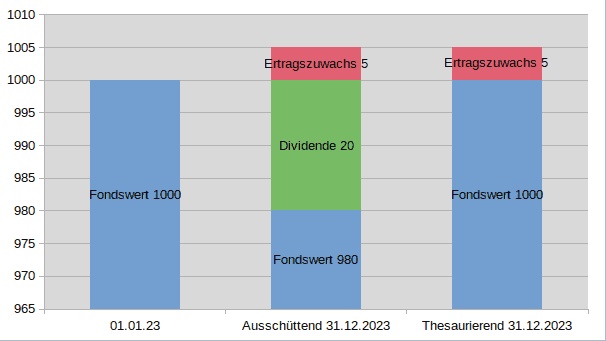

In this section, we look at how the advance lump sum and the taxes payable are calculated using a specific example. We have illustrated the scenario in the following diagram:

We compare a distributing fund with an accumulating fund. The fund value for both is EUR 1000 on 01.01.2023. At the end of 2023, both funds have a total return of EUR 1,005. The distributing fund will still pay out a dividend of EUR 20, which will reduce the fund value to EUR 980. Compared to the start of the year, both funds have recorded an increase in income of EUR 5.

The calculation is as follows:

Basic yield = 1000 euros x 2.55% x 0.7 = 17.85 euros

Advance lump sum

Distributing = 17.85 euros - 20 euros = - 2.15 euros = 0 euros

Accumulating = 5 euro - 0 euro = 5 euro

Taxes

Distributing = 0 euro x 26.375% x 0.7 + 20 euro x 26.375% x 0.7 = 3.69 euro

Accumulating = 5 euros x 26.375% x 0.7 + 0 euros x 26.375% x 0.7 = 0.92 euros

What can we conclude now?

In the case of the distributing fund, the advance lump sum is zero, so it is not taxable. However, there is also the taxation of the dividend, which is set at 70 percent due to the partial exemption. Accordingly, EUR 3.69 will be debited from my clearing account at the beginning of 2024.

In the case of the accumulating fund, the advance lump sum amounts to the increase in income of EUR. This is because the basic income is higher and no distributions are deducted. In this case, it is not the notional profit potential that is taxed, but the actual income. And the taxes payable on this amount to 0.92 euros.

As an investor in distributing funds, I initially have to pay more tax due to the dividend payment. On the other hand, less tax is payable when the fund is sold at a later date, as the increase in income is generally lower.

Ultimately, the tax burden should be the same for both types of fund.

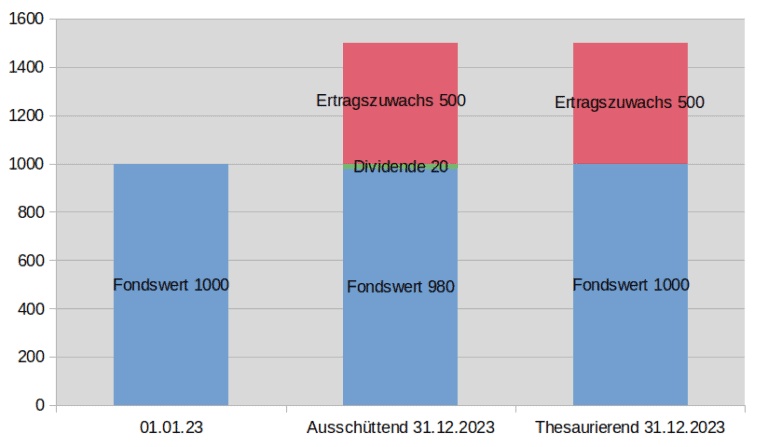

Example calculation 2: Fund with high total income growth

We are again comparing a distributing fund with an accumulating fund. The fund value for both is 1000 euros on 01.01.2023. Both funds have a total return of EUR 1,500 at the end of 2023. The distributing fund will still pay out a dividend of EUR 20, which will reduce the fund value to EUR 980. Compared to the start of the year, both funds have recorded an increase in income of EUR 500.

The calculation is as follows:

Basic yield = 1000 euros x 2.55% x 0.7 = 17.85 euros

Advance lump sum

Distributing = 17.85 euros - 20 euros = - 2.15 euros = 0 euros

Accumulating = 17.85 euros - 0 euros = 17.85 euros

Taxes

Distributing = 0 euro x 26.375% x 0.7 + 20 euro x 26.375% x 0.7 = 3.69 euro

Accumulating = 17.85 euros x 26.375% x 0.7 + 0 euros x 26.375% x 0.7 = 3.3 euros

What can we conclude now?

The tax payments are similarly high for both fund types. This is because the basic income is used for calculating the accumulation fund and this is almost as high as the dividend of the distributing fund.

In the event of a subsequent sale, the difference should even out again.

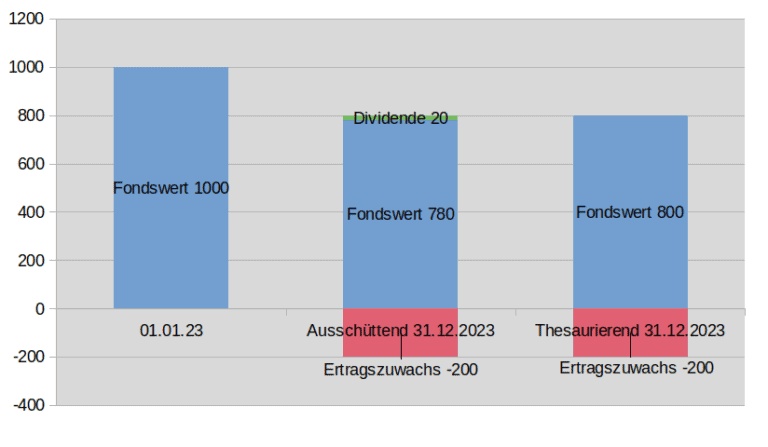

Example 3: Fund with a total return loss

We are again comparing a distributing fund with an accumulating fund. The fund value for both is 1000 euros on 01.01.2023. Both funds have a total return of EUR 800 at the end of 2023. The distributing fund will still pay out a dividend of EUR 20, which will reduce the fund value to EUR 780. Compared to the start of the year, both funds recorded a loss of income of EUR -200.

The calculation is as follows:

Basic yield = 1000 euros x 2.55% x 0.7 = 17.85 euros

Advance lump sum

Distributing = 17.85 euros - 20 euros = - 2.15 euros = 0 euros

Accumulating = -200 Euro - 0 Euro = -200 Euro = 0 Euro

Taxes

Distributing = 0 euro x 26.375% x 0.7 + 20 euro x 26.375% x 0.7 = 3.69 euro

Accumulating = 0 euro x 26.375% x 0.7 + 0 euro x 26.375% x 0.7 = 0 euro

What can we conclude now?

In the case of the accumulating fund, there are no taxes at all this time. Due to the loss of income, the advance lump sum is zero. With the distributing fund, on the other hand, the dividend payments are taxed again.

What is important for investors

Although the tax burden should be the same, there are two effects that make the matter somewhat more complicated: interest and the saver's allowance.

The base yield as the basis for calculating the advance lump sum is calculated using the base interest rate that the Deutsche Bundesbank publishes every year. In 2021 and 2022, this interest rate was negative. For accumulating funds, the taxes on the advance lump sum were therefore zero. As a result, tax deferral effects occurred here again. The actual and untaxed income once again benefited from the full compound interest effect.

However, even with an interest rate of 2.55% for 2023, the taxes incurred are always lower for accumulating funds than for distributing funds. There is also a certain tax deferral effect here.

So should you always give preference to accumulation funds? No.

The second component that plays a role in the decision for one of the fund types is the saver's allowance. Every year, recipients of capital income have a tax-free allowance. In 2023, 2024 and now 2025, this allowance is 1,000 euros per person (2,000 euros for married couples). If the fund from the example above is my only investment, I can claim the tax-free allowance here and save a higher amount with the distributing fund than with the accumulating fund.

However, this only applies to smaller assets. For large sums of assets, the tax-free amounts are fully utilized for both types of fund and the effect disappears again.

A distributing fund can still make sense if I want to generate an ongoing income with my assets. I then don't have to constantly sell units and incur transaction costs. However, I should bear in mind that distributions are not guaranteed.

For all the calculators among you who have not yet received a statement for 2024, but still want to know what advance lump sum is due, the base interest rate on 02.01.2024 was 2.29%. 70 percent of the besis interest yield results in 1.603%.

$TDIV (+0,39 %)

$VUSA (+0,17 %)

$IWDA (+0,22 %)

$FWRG (+0,27 %)

$VWRL (+0,18 %)

$CSPX (+0,19 %)

#etfs

#etf

#etfkosten

#steuer

#steuern

#vorabpauschale

#thesaurierer

#ausschütter

#thesausierend

#fonds