Handelsblatt evaluated the portfolios of the 1,000 investors with the highest investment amounts who had reported fewer than 250 positions to the SEC as of June 30, 2025. This is intended to exclude providers of particularly broadly diversified ETF funds.

The tech sector continues to dominate the portfolios as the most important industry. At 21.8%, the share rose again to its highest level since the end of 2024. The financial sector follows in second place with 14.5%. The healthcare sector and real estate shares have lost much of their importance. Both were represented in the portfolios at the end of July with just under 5% less weighting.

Many professional investors took shares in Microsoft $MSFT (+1,59 %) Amazon $AMZN (+1,45 %) , Alphabet $GOOGL (-1,08 %) and Nvidia $NVDA (+2,37 %) into their portfolios or increased their weighting. Tesla $TSLA (+2,37 %) also made strong gains. A quarter of institutional investors had Elon Musk's company in their portfolios at the end of July.

Of the major tech stocks, only Apple $AAPL (-0,01 %) clearly shows weaknesses. The average share of the iPhone manufacturer in the professional portfolios fell by almost 20 percent to 5.3 percent.

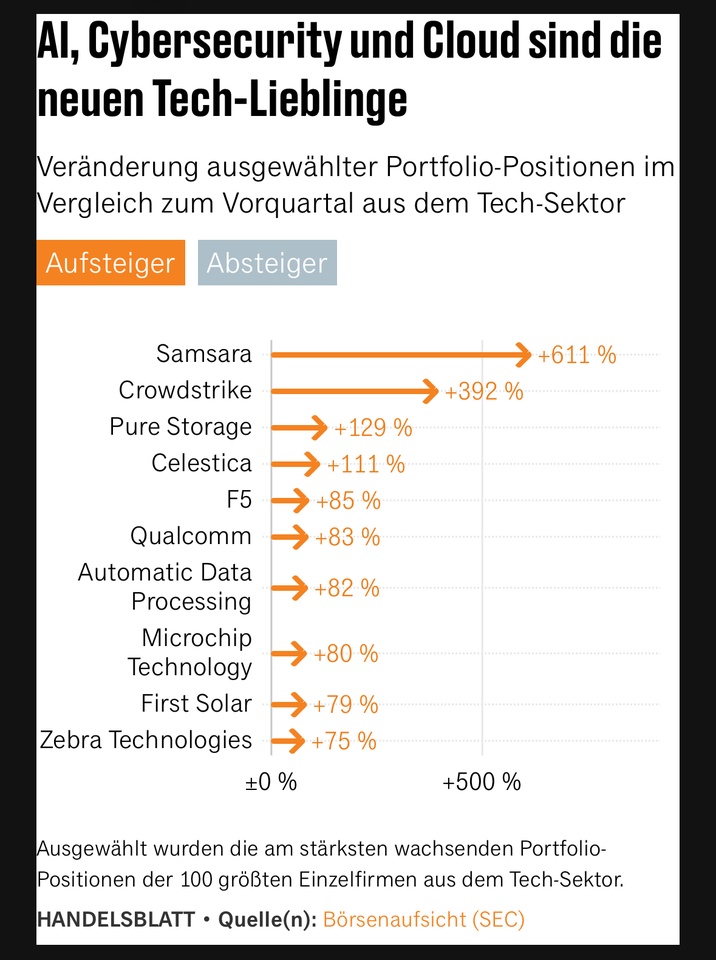

Smaller software companies have also moved the portfolios. Handelsblatt has calculated the fastest-growing portfolio positions among the 100 largest tech companies.

According to the report, the most hotly traded tech climber at the moment is Samsara $IOT which produces networked solutions for industrial means of production, including networking and tracking trucks. The number of shares in the Californian company in the portfolios increased sevenfold in the second quarter. The cybersecurity provider Crowdstrike $CRWD (+2,85 %) from Texas also made strong gains.

The most important investments outside of tech companies

Alongside the tech giants, the list of the most important companies is headed by Visa $V (-0,23 %) and Broadcom $AVGO (+1,51 %) followed by Johnson & Johnson $JNJ (-1,89 %) and Mastercard $MA (-1,06 %) and Eli Lilly $LLY (-1,56 %)

New among the 20 most important investments after the Mag Seven is the accounting software provider Intuit $INTU (-0,03 %).

Source: Text (excerpt) and graphics: Handelsblatt, 25.08.2025